100+ Years of Combined Tax Resolution Experience.

100+ Years of Combined Tax Resolution Experience.

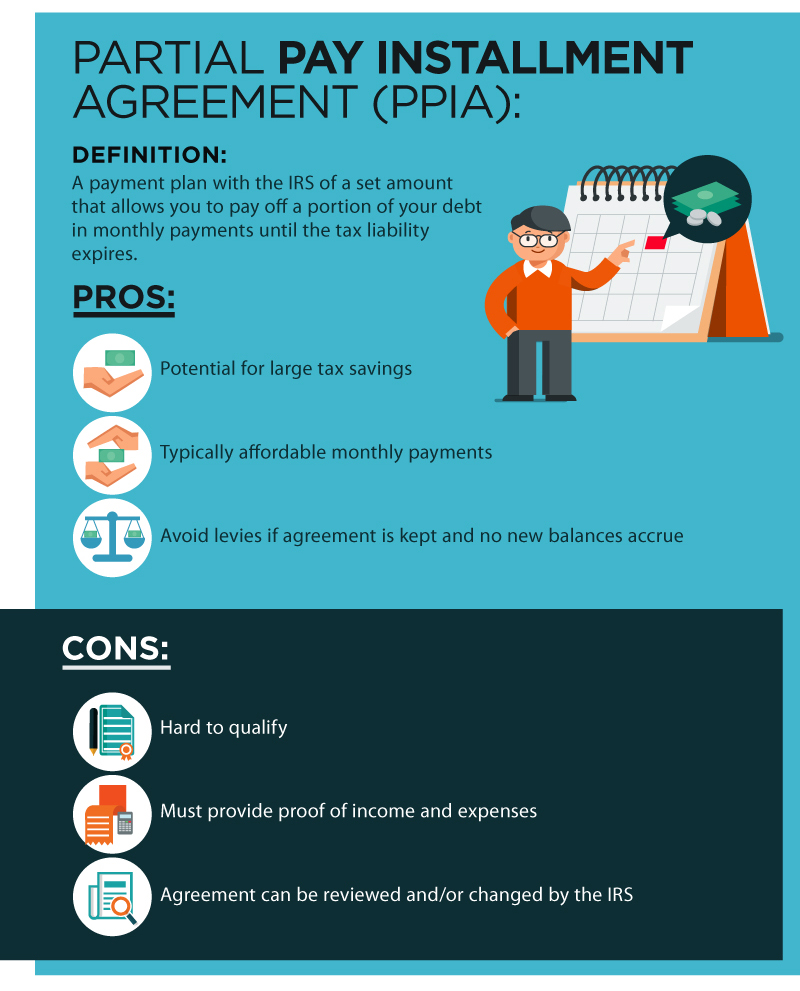

If you owe taxes to the IRS, you may be feeling overwhelmed by the idea of paying off your entire balance at once with a large lump sum payment. While some taxpayers may be required to pay off their entire tax balance at once, there may be other options available to you that can resolve your tax balance for less than you owe. One such tax resolution option is known as a partial payment installment agreement (PPIA).

A PPIA is an IRS tax resolution that allows you to settle your tax balance for less money by making monthly payments for a set period of time. If you think a PPIA may be right for you, here is what you need to know.

Table of Contents

Can You Negotiate Tax Debt With the IRS?

While some taxpayers may be able to pay their tax balances in full with one lump sum, there could be other options available to you that you want to explore.

Each tax resolution comes with varying requirements for paperwork and eligibility. If you owe taxes to the IRS, you may be able to negotiate your tax bill with an experienced tax attorney from Polston Tax at your side. Some of the tax resolutions available to you may include:

- Innocent spouse relief

- Offer in compromise (OIC)

- Full pay installment agreement (FPIA)

- Currently Not Collectible status (CNC)

- Streamlined installment agreement (SLIA)

- Partial pay installment agreement (PPIA)

When you are seeking IRS tax assistance, you deserve an experienced IRS tax attorney on your side. Reaching out to a tax attorney at Polston Tax means we handle negotiations with the IRS, making the process simple for you. With our team acting as your advocate, the situation will be much less stressful.

What Are Partial Payments?

A partial pay installment agreement refers to a type of payment plan with the IRS in which you can pay off part of the taxes you owe via monthly payments until your tax liability expires. With a PPIA, you can pay off your tax balance for less than what you owe and avoid making a large lump payment. A PPIA can prevent further collection action from the IRS, such as seizures or levies.

The IRS only has a certain amount of time to collect on your tax balance after you file your tax return. Once this deadline expires, your tax balance is forgiven. Like an offer in compromise, a PPIA has the potential for large tax savings. The monthly payment you pay will be determined by the amount you owe the IRS and the amount of disposable income you make every month.

If you are struggling to pay off your tax bill, get in touch with us at Polston Tax to learn more about our installment agreement services.

How a PPIA Works

A standard installment agreement involves making minimum monthly payments that allow you to pay off your tax bill within six years. For example, if you owe $18,000, the IRS will expect a monthly payment of at least $250. However, in some cases, the IRS may allow more or less time for an installment agreement.

Those who cannot afford the payments of a standard installment agreement may be eligible to make smaller payments with a PPIA. With the smaller payments, it will take more time to pay off your total tax liability. As a result, your tax bill may not be paid o

Continuing with the above example, if you owe $18,000 and cannot afford a monthly payment of $250, the IRS may accept a payment arrangement of $100. During the six years that follow, you’ll pay $100 each month for a total of $7,200. Your remaining tax bill will expire, and you won’t owe the IRS anything else.

At Polston Tax, we can help you communicate and negotiate with the IRS and get a PPIA you can afford.

A PPIA is a very appealing resolution to taxpayers, as you can save thousands of dollars. To get a PPIA, you should fill out an application and send the IRS a full financial disclosure. Depending on your financial situation, you may need to

agree to an extension of the expiration date or sell some assets.

Who Is Eligible for a PPIA?

To be eligible, you must have all required tax returns filed and must have made any required estimated tax payments. If you have not, the IRS may not negotiate a resolution with you. To qualify for a PPIA, you cannot have:

- OIC: You cannot have an active OIC to be eligible for a PPIA.

- Bankruptcy: You also cannot file for bankruptcy if you want a PPIA.

- Equity: If you have equity in any assets like a home, car or profitable land, the IRS may not grant you a PPIA, as they may ask you to borrow against that asset and pay your tax liability that way.

If you are unsure whether you may be eligible for a PPIA, contact us at Polston Tax. We can review your financial situation and determine whether you may qualify for a PPIA.

Who Should Apply for a PPIA?

If the following factors apply to your situation, you may want to apply for a PPIA:

- You lack assets that can be used to pay off your entire tax liability.

- Your application for an OIC has been rejected.

- You are not eligible for CNC status or hardship.

- You are unable to take out a loan that can allow you to pay your tax balance in full.

- You are unable to afford the monthly payments that can pay off your tax balance prior to the Collection Statute Expiration Date (CSED).

Though there are exceptions, the IRS typically only accepts a PPIA if you lack enough assets to liquidate and enough disposable income each month to make payments via an installment agreement. The IRS may also need to believe you will not earn enough money to pay your taxes in the upcoming years.

How Much Will the IRS Settle for?

The purpose of establishing an installment agreement with the IRS is to settle for less than what you owe. Keep in mind, however, that the IRS will settle only for what the agency believes you can reasonably pay. The IRS will look at the following circumstances when considering whether you qualify for a PPIA and what your monthly payment should be:

- Your ability to pay

- Your current income

- All expenses you’re currently paying

- Your assets and their equity

When trying to get a PPIA approved, the IRS may ask for substantiation for expenses you are claiming or ask for recent bank statements. Assets, income and expenses the IRS may review include:

- Car value

- Home value

- Utility costs

- Childcare costs

- Monthly income

- Mortgage or rent

- Savings accounts

The IRS will inquire into almost all aspects of your finances. They are trying to see if you have more money than you say you do. You or your tax attorney can argue for certain expenses and try to keep the monthly payment amount low.

While you can technically settle with the IRS yourself, the process can be complicated, and you can rest assured the process is handled correctly when you have a reliable tax attorney on your side. If you are concerned about the amount you owe the IRS and navigating negotiations with the federal agency, get in touch with us at Polston Tax.

What Is the PPIA Process?

When applying for a PPIA, there are several steps to the process. First, review your tax debt and verify you actually owe it. If you believe you do not owe these taxes, hire a tax attorney and communicate with the IRS. If you receive a notice from the IRS, call the number listed on the notice to discuss the amount the IRS claims you owe.

If you do owe these taxes, then you will fill out a Collection Information Statement. This will collect all your financial information so the IRS can look at your current finances and see what you can afford. You will then also fill out Form 9465 Installment Agreement Request.

What Is Form 9465?

You can fill out Form 9456 to request a PPIA from the IRS if you are unable to afford the total amount you owe, as listed on an IRS notice or your tax return. Some information you may need to provide on this form includes:

- Your name and Social Security Number (SSN).

- The name and SSN of your spouse if you are making your request for a joint return.

- The total amount you owe according to the notice or tax return.

- Any other balances you owe.

- Your estimate of what you can afford to pay each month.

Make sure you can afford the payment — if you default on the payment agreement, you may have to start the whole process over. If you need further guidance in completing this form or estimating what you can afford to pay each month, reach out to us at Polston Tax.

How Do You Request a PPIA?

You will send the Collection Information Statement and Form 9465 to the IRS, along with your most recent tax return. If you have a tax attorney, you can have them contact the IRS on your behalf to request the PPIA.

The IRS will then contact you or your tax attorney and let you know if they require more information — it can be helpful to collect financial documents that support the information on your forms ahead of time. If the IRS requires more information, the IRS will let you know what they need and give you a deadline. Missing a deadline may cause the specialist to reject your offer. After getting the IRS the requested information, you may need to defend your stance, and it may take time before a decision is made.

How Often Can the IRS Review Your PPIA?

The IRS can review your PPIA every two years and request updated financial information. The IRS is looking to see if your financial situation has improved and if you can afford a higher payment. To avoid defaulting on your PPIA, respond to any requests for your updated financial information in a timely manner. Financial information you may be asked to provide includes your expenses, income and amounts owed, such as your mortgage and car loan payments.

If your financial situation has improved, the IRS may try to raise your monthly payment. You or your tax attorney can try to fight this increase in monthly payments, but it may require providing proof you cannot afford the higher monthly payment. Although you will not have any bank levies or garnishments put against you when your PPIA is approved, liens can be filed against you and your property.

A tax attorney at Polston Tax can help you throughout the PPIA process. Applying for a PPIA can be time-consuming, so team up with us to make the process simpler and easier.

Can the IRS Collect After 10 Years?

The IRS has a limited amount of time to collect your tax balance. This is known as the Collection Statute Expiration Date. Usually, the IRS only has 10 years to collect on a tax balance from the time your tax return is filed. After that, your balance is forgiven. With a PPIA, you pay your monthly amount until the CSED expires. This is when the remaining balance you owe will not be collected.

In some cases, however, the CSED can be extended. After requesting an installment agreement, the initial 10-year CSED may be suspended while your request is pending. If your request is rejected, the collection period is delayed for another 30 days. This will also occur if you default on your payments and the IRS terminates your installment agreement.

How to Pay Off Tax Debt

You have multiple options to pay off your tax debt. You can pay off your tax balance by:

- Using a credit card.

- Filing for bankruptcy.

- Refinancing your home.

- Obtaining a personal loan.

- Applying for an innocent spouse program.

- Applying for an OIC.

- Using savings to pay off tax balance in full.

- Applying for a PPIA.

If you choose to apply for a PPIA, you can do so by mail or by phone. To apply by mail, you will fill out Form 9465, collect your required documents and mail it according to IRS instructions. If you are applying for a PPIA as an individual, you will also submit Form 433-F. If you are applying for a PPIA as a business, you will submit Form 433-B.

What if the IRS Denies Your PPIA Request?

In some cases, the IRS may reject your request for a PPIA. If this occurs, you have the right to appeal this decision. You also have the right to appeal the termination of your installment agreement or modification of your agreement.

If your PPIA request is denied, we recommend partnering with a tax attorney to help you navigate the process of appealing the IRS’s decision and negotiating with the IRS.

How to Negotiate With the IRS

To negotiate successfully with the IRS, hire a tax attorney who is experienced in IRS negotiations. A tax attorney can help you:

- Get tax relief.

- Prepare tax documents.

- Understand complex tax laws.

- Settle disputes and tax balances with the IRS.

A tax attorney can also offer their experience in broader areas, such as business, estate and corporate taxes. To find the right tax attorney for you, look for someone with an accounting background, experience, quality customer service and the services you need.

- Accounting background: You may want to work with an IRS tax attorney with a background in accounting. Many tax attorneys have previous experience as accountants, which provides them with the knowledge needed to understand your financial situation.

- Experience: Confirm the attorney is specifically a tax attorney. This will ensure they have the necessary knowledge and experience you need to resolve your tax balance quickly and efficiently.

- Quality customer service: You want a tax attorney who is communicative and trustworthy. Research the tax professionals online to see what their clients are saying and make sure they offer high-quality customer service to support you throughout the process.

- Services you need: If you want to apply for a PPIA, you want to work with a tax attorney who has experience in securing these installment agreements for clients.

Contact Polston Tax Resolution & Accounting for a PPIA

A PPIA is an IRS tax resolution that lets you settle your taxes owed for less money by making monthly payments over a certain period of time. With a PPIA, you can save money and make tax liability payoff affordable.

If you think a PPIA might be the best resolution for you to pay off your tax liability, you can have a tax attorney assist you in obtaining one. At Polston Tax, our tax attorneys negotiate every day with the IRS to try to get our clients the best tax resolution possible, and we can do that for you.

We have been working with the mission to help taxpayers pay back their back taxes and navigate negotiations with the IRS since 2001. In the years following, we have expanded to multiple offices to serve clients nationwide. Along with tax resolution services, we offer tax and accounting services to meet all of your individual or business needs. With more than 100 tax attorneys, tax preparers, CPAs, case managers and accountants, we can customize a tax resolution strategy that can get you the help you need.

We work hard to make sure you pay as little as possible in taxes, which is how we have saved our clients millions of dollars. Contact us at Polston Tax or schedule a free consultation to learn more about how to pay off your tax debt.

Additional Resources on Installment Agreements

Additional Readings

We’re in an era in which more small businesses are launching like wildfire. Many people find starting a small business of their own as easy as a piece of cake. However, most of the time, what they fail to prioritize are some of the major players involved in smoothly operating their small business. A...

Do you know why most married taxpayers go for filing joint tax returns? It’s actually because of the benefits that it offers. But with joint tax returns, both the filers hold the responsibility for the tax bill or any penalties and interest that arise from it. Both are legally responsible for the entire liability, even...

What if you owe so much in taxes that you can’t see your way out of it? If you owe back taxes, you might not think there is a way you can ever pay things off. And the more those back taxes have accumulated, the deeper the hole. But that doesn’t mean you can’t dig...

Tax Audits are one of the most terrifying things a taxpayer can endure. Most taxpayers don’t know what being audited by the IRS entails and usually don’t know what to do if they are audited. IRS audits can be confusing to most taxpayers as most don’t know what the IRS is looking for when they...

Receiving a letter from the IRS can be intimidating, especially if you’re unsure what the notice is for or what to do next. Fortunately, many notices are nothing to worry about and are purely informative. Below, we look at everything you need to do — and what not to do — after getting a notice from the...

The Internal Revenue Service (IRS) is increasing audits on cannabis businesses — the agency is on a mission to ensure that cannabis businesses adhere to the tax code. Unfortunately, cannabis companies must comply with more strict tax laws than other businesses and can claim fewer deductions. Most business owners don’t realize this or aren’t able to meet the reporting responsibilities on their own. If you own a business in...