Our Advanced Tax Planning Services

Our knowledgeable team can provide a broad range of services for advanced tax planning. We can help you identify opportunities like using installment sales or tax credits.

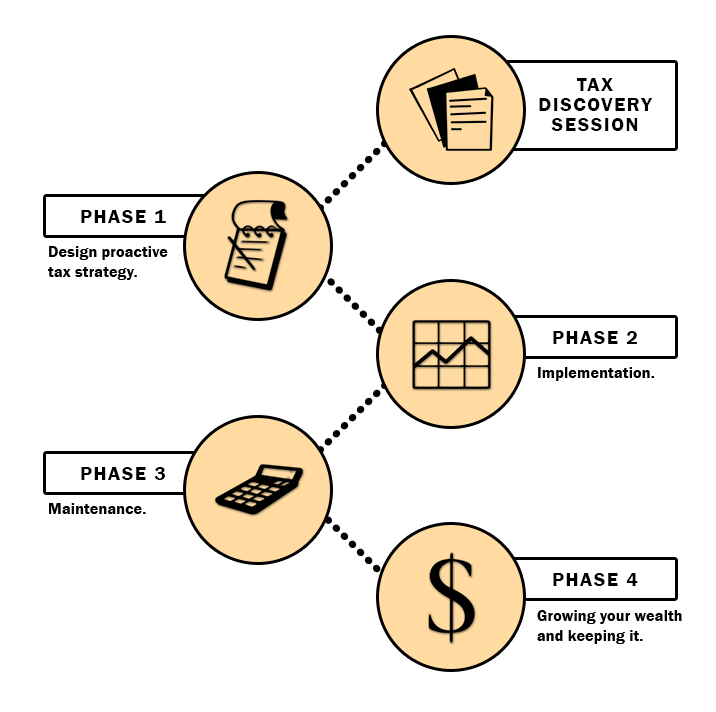

Let us help you create a custom plan personalized to your requirements and enable you to save as much as possible when you pay your taxes. We’ll help you explore all your options for tax payments and identify any advantages that might work for your business. You can trust our team to identify any opportunities that may be available to you and optimize them to your benefit.

As we work with the IRS every day, we have wide-ranging knowledge for how to manage key operational requirements. We know what to expect from the IRS and which strategies are most successful. From beginning to end, we’ll work tirelessly on your case as your trusted advocate. We assign a skilled team to be behind you throughout the process, providing legal expertise, accounting insights, case management and other critical services as required.