100+ Years of Combined Tax Resolution Experience.

100+ Years of Combined Tax Resolution Experience.

The Internal Revenue Service (IRS) has announced the end of a two-year-long automated collection system pause and started issuing a new notice called LT38. LT38 notices inform taxpayers that the IRS has assumed normal operations. It also updates outstanding balances and explains what to do if you agree or disagree with the content. Additionally, the federal agency enacted a tax relief plan to ease the financial burden on individuals and businesses. Thus, it’s helpful to understand what you need to do in the next few months.

This guide discusses the LT38 notice and how to respond. You also learn about the relief program and optional available if you cannot pay your taxes in full.

Table of Contents

Background of the IRS Collection Process

The IRS temporarily suspended all automatic notices, including more than a dozen additional reminder letters, such as balance due and unfiled tax return notices, back in February 2022. This decision resulted from an extensive backlog of unprocessed returns and forms intensified by the effects of the COVID-19 pandemic. During this hiatus, the IRS intentionally reallocated resources and implemented informed strategies to improve their inventory, streamline their process and minimize the burden on individuals and businesses.

IRS Collections Delayed Due to COVID-19

When you decide to tackle your tax problems — hopefully with the help of an experienced tax attorney from Polston Tax — by attempting to settle with the IRS, your monthly disposable income (MDI) is considered when determining how much your payment plan or settlement will be. Because many businesses and bank accounts have been affected by COVID-19, it’s likely that your ability to pay is lower than ever.

This is bad news for the IRS, as they want the most money possible in the repayment of your tax liability. How can they get water from a well that has run dry? Simple answer – they can’t! So why should they try now? Why not wait until the economy starts to recover, and you have more hard-earned money to give them?

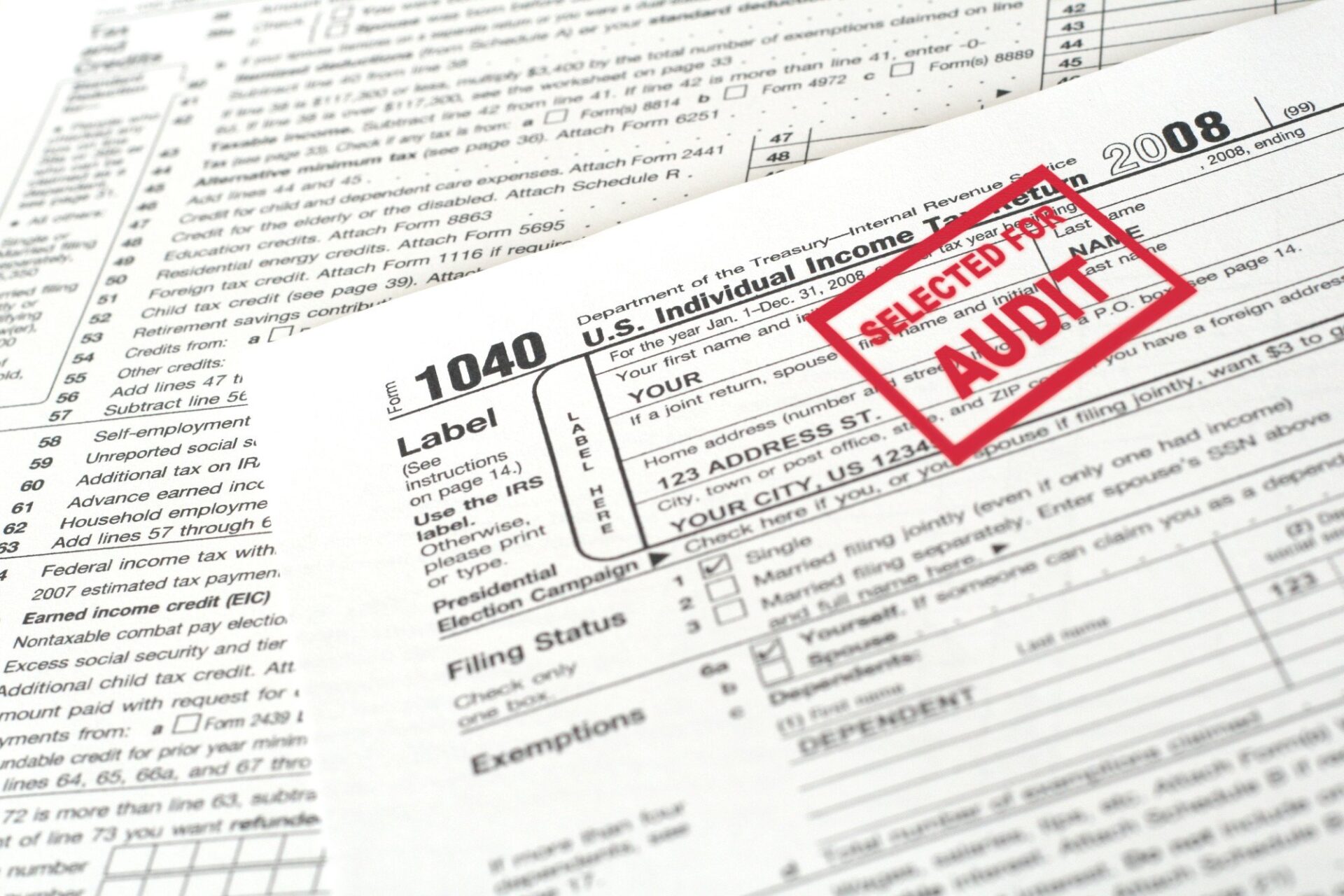

Typically, the IRS collection process timeline varies slightly depending on whether you have taxes owed or an unfiled return.

- Taxes owed: If you have a balance due, the IRS first sends a CP14 or a CP161 notice, followed by a CP59 reminder several weeks later.

- Unfiled return: If you didn’t file a tax return when you should have, the IRS sends a CP80 notice and then a CP501 form.

While initial notices have been distributed over the last two years, the follow-up reminders stopped coming. However, since January 2024, the IRS has been sending out special notices called LT38, alerting taxpayers with tax balances before 2022 to their situation, how it can be resolved and the amount of relief they’re receiving. Regardless of what you receive, the letter should outline your next steps.

What Is IRS Notice LT38?

The IRS sends LT38 notices to remind taxpayers that it’s resuming collection activities for unpaid taxes. The notice details the outstanding tax balance, including the interest and penalties. If you receive this notice, you must file missing tax returns immediately and pay what you owe. If you cannot pay the total amount, pay what you have and arrange a payment plan with the IRS. This strategy can stop or slow down the interest or penalty accrual rate.

You can disregard the LT38 notice if you paid the balance in full within the last 21 days. The reason is that payment on your balance can take 21 days to post. Also, taxpayers with an approved payment plan can continue making payments as agreed. If the IRS has not approved the payment plan, you can pay what you have to reduce your tax balance and the applicable interest and penalties. Taxpayers who disagree with the notice can contact the IRS and provide the supporting paperwork to substantiate their claim.

Do not ignore the LT38 notice if you owe taxes. While it’s a reminder that you owe taxes, failing to comply with the instructions in the notice can result in adverse consequences. The IRS may send further warnings and potentially commence collection actions against you. You will also incur more interest and penalties. It’s best to pay the taxes you owe before the deadline. If you want to learn more about the notice or need help on what to do, you can contact a tax professional.

What Should You Do When You Receive an IRS Collection Notice?

There are a few things you must do when you receive an LT38 notice from the IRS:

1. Review the Notice

Read the notice and understand the content before taking further steps. While there is a deadline for responding, you do not need to rush. The IRS provides sufficient time to allow you to figure things out.

2. File Missing Returns as Needed

If you have a missing tax return, file it as soon as you can. Regardless of what you owe, whether you can pay or whether the IRS made a mistake, you must have a tax return to dispute their findings or negotiate a payment plan.

3. Compare the Documents

Compare the LT38 with your tax return or other records to see if it’s correct. If you notice any error in the IRS’s math, you may contact them and point that out. It’s best to gather your paperwork ready before making the call. Note that the IRS may accept or deny your claims. You can contest if they reject your claim, but you believe you have valid reasons. A tax resolution specialist can help you.

4. Pay or Negotiate a Payment Plan

Follow the payment instructions if you agree with the content of the notice. You can pay online or by paper mail using the payment coupon in the notice. You may negotiate a payment plan if you cannot pay in full. The options available depend on your financial situation. Contacting a tax professional to determine which alternative suits you best would be helpful.

What Should I Do Next?

Now that the IRS is enforcing tax payment collections again, it’s crucial that you devise a plan to address your owed taxes. Although IRS collections are resuming, you have options to manage and resolve your tax balance effectively.

At Polston Tax Resolution & Accounting, we take the stress out of dealing with the IRS and State. Our team of tax professionals, including over 100 accountants, tax attorneys, CPAs, case managers, and financial analysts, has the combined knowledge and experience to help you achieve the financial freedom you deserve. We communicate with the IRS daily, so we know what to expect and how to achieve the best outcome for our clients.

We offer numerous services to help you handle upcoming IRS collections, such as:

- Installment agreements: If your current financial situation inhibits you from making large payments, we can arrange for you to pay your taxes in manageable monthly installments.

- Lien assistance: If the IRS places a tax lien on your property, our tax attorneys will determine the best resolution for your situation.

- Bank levy services: The IRS can issue levies that allow them to legally freeze and extract funds from your account and/or paycheck. We can help you get your levy released through our bank levy services.

- Offers In Compromise services: If you can’t afford to pay back your taxes, you may be eligible for an offer in compromise, enabling you to pay less than your full tax balance.

Taking proactive steps now can prevent further complications and additional penalties. If you need assistance, don’t hesitate to reach out to us for a consultation.

Are You Eligible for Relief?

Although the IRS suspended the reminders, failure-to-pay penalties and interest continued to accrue. The IRS enacted a $1 billion relief plan for over 4.7 million taxpayers, businesses, estates, trusts and tax-exempt entities to reduce taxpayer pressure. Relief rolls out automatically, and eligible recipients will not be required to take any action. If you already took care of your failure-to-pay penalties, you’ll receive a refund or credit.

So, who can expect to receive this relief? Well, this plan is directed at those who have accrued late payment penalties for tax years 2020 and 2021, for whom the IRS didn’t send automated reminders. These recipients were actively involved in the collection process or were issued a balance between February 2022 and December 2023. Similarly, taxpayers who can count on relief must have filed specific 1040, 1120, 1041 or 990-T forms for an assessed tax of less than $100,000. The IRS offers options for those who don’t fit this criteria.

What Are Your Options When You Receive IRS Collection Notices?

Parties not included in the relief plan must repay their liabilities in full. If you’ve been affected by the pause on the IRS automated collection system but aren’t eligible for relief, it’s wise to get on top of it quickly. Fortunately, our team at Polston Tax can help you deal with your unpaid taxes, ensuring you avoid additional penalties and consequences. We can help you take advantage of various repayment options, including:

- Short-term payment extension

- Installment agreements

- Hardship or currently not collectible (CNC) status

- Offer in compromise

- Financially verified installment agreement

Why Trust Us?

We have offered excellent tax consultancy services for over 20 years. This has allowed us to gain experience in the industry, handling complex cases for individuals and businesses. We have a team of knowledgeable professionals dedicated to providing supportive services. We listen attentively and develop solutions that suit your needs.

Our award-winning team comprises tax attorneys, accountants, financial analysts, case managers and enrolled agents. We have the resources and skills to provide end-to-end services. We can guide you through the entire process, from the initial case evaluation to tax preparation, consulting and representation.

We aim to form lasting relationships and help you navigate tax-related challenges. We will take the load off your shoulders, giving you peace of mind. View our community engagements to learn more about our culture and values.

Polston Tax Is Ready to Help

At Polston Tax, we strive to be a partner you can trust to have your back when things get tough. Our team of skilled tax professionals works with the IRS every day, giving them a unique perspective and deep understanding of complex ideas like IRS collection statute of limitations and filing procedures. We use this knowledge to offer a comprehensive end-to-end tax service that eliminates your worry and sets you up for success.

Call Polston Tax Resolution & Accounting at (844) 841-9847, or reach out online for a consultation.

Additional Readings

Paying taxes is an essential responsibility of every citizen, but in some cases, you may lack the funds to pay your taxes. If you face this stressful situation, you should know what to do. Failing to pay your taxes can have severe consequences, such as penalties, interest charges and even legal action. To help, we’ll...

Receiving a letter from the IRS can be a bit alarming for anyone. Once tax season has come and gone, the IRS starts sending out letters and notices to taxpayers. If you’ve received mail from the IRS, don’t panic. Typically, there’s no need to worry. They may just be reminding you of the balance due...

Have you accumulated a large tax liability and it feels like you have no way out? You may have received a notification stating that the IRS will place a levy on your bank account to collect on a tax balance. There is a way to resolve your tax liability and get a fresh start. That’s...

Nevada sales and use tax laws require businesses to collect and remit sales tax when they meet specified criteria. Where the business owner does not collect sales tax, the buyer must pay use tax to the Nevada Department of Taxation. It’s vital to know which products or services are taxable and the rules on exemptions. Additionally, learning...

A 1099-C form is used for reporting debt cancellation as income to the Internal Revenue Service (IRS) and the individual or entity receiving the canceled debt. It is crucial for tax reporting and compliance. Key aspects of this form include information that affects an individual’s annual tax return and when to file or send it...