100+ Years of Combined Tax Resolution Experience.

100+ Years of Combined Tax Resolution Experience.

Many Americans are concerned about having the IRS audit their income tax returns. Of course, filing your tax return on time doesn’t mean that you are safe from an IRS audit or from the IRS coming after you. In fact, the IRS can look into your return long after you filed it.

While it’s important to get your return in by the federal due date, the truth is that no taxpayer in the United States is completely immune from an IRS audit — regardless of whether you’re randomly selected for an audit or have more serious tax issues, such as making mistakes on a tax return (or worse).

If your tax return does raise red flags with the IRS, you might be subject to an audit. Every taxpayer must report all of their taxable income, as well as pay the taxes that come with it. If you purposely fail to do so, you can be fined or even face jail time.

Fortunately, understanding how and when the IRS can audit you can help you be better prepared should this situation arise.

Table of Contents

What Are the IRS Audit Time Limits?

Can the IRS audit you after five years? What about 10 years? Usually, there is a time limit on how long the IRS has to collect back taxes you owe. The federal statute of limitations usually runs for three years — however, the IRS can request an extension on this period. When the statute of limitations expires, the IRS can no longer run the audit. You can decline to extend the audit, in which case the agent will have to make a decision based on their current findings. However, these audit periods can be extended by up to six years or even to no time limit at all.

If the IRS decides to audit you, it will typically do so over two years. The length of the audit depends on the following:

- The complexity of your tax issues

- Whether you submit all of the information the IRS needs on time

- Whether you decide to appeal the audit findings from the IRS

If you choose to contest the IRS agent’s findings, it’s wise to have legal counsel from a tax lawyer who will assist you in the dispute process. If you need a tax lawyer specializing in IRS audits and defense, contact our experienced and trusted team of tax lawyers.

1. The Three-Year Audit

Based on the federal statute of limitations, the IRS can conduct an audit typically up to three years after filing your tax return. This statute of limitations means that if, for example, you filed your federal tax return on the federal due date of April 15, the IRS can audit this return until April 15, three years later.

There are a few points to keep in mind about due dates:

- If you file early (before April 15), the statute of limitations still runs three years after the federal due date, not the tax filing date.

- If you apply for and receive an extension on your tax return from the IRS, the statute of limitations will run from the new filing date – which can be six months after the original due date.

- If you filed late anddid not have a filing extension, the statute of limitations starts running three years from the latefiling date.

- Even if you file your return a day before the end of the three-year statute of limitations expires, the IRS still has three more years.

While the IRS usually only has up to three years to collect back taxes owed, there are some exceptions. In these cases, the IRS can conduct a tax audit up to six years after the filing date — or longer if you never filed or are subject to civil tax fraud, examination or investigation.

Reaching out to a tax attorney at Polston Tax and having us handle your tax audit can simplify the process for you and ensure the correct handling of every step.

2. The Six-Year Audit

Extending the statute occurs in some cases. The reasons for extending an audit aren’t always for fraud. Sometimes, it’s because of unreported income. The IRS has up to six years to conduct an audit on back taxes that you owe in the following circumstances:

- Understating taxable income: In your tax return, you understate your gross income by 25% or more.

- Basis overstatements: The IRS determines that certain items on your tax return have the same result as a 25%+ understatement of your gross income.

For example, you sell your house for $6.5 million and claim that you originally invested half of that amount, $3.25 million, in the property. You only invested $2 million in that property (your basis). Your basis overstatement results in you only paying taxes on $3.25 million of profit gain when you should have paid taxes on $4.5 million.

- Foreign income, including gifts and assets: The IRS can conduct an audit up to six years after you file your tax return if you omit $5,000 or more of foreign income from your return. This income also includes inheritances and interest in overseas or offshore accounts.

Additionally, the IRS has a number of forms you need to fill out related to foreign income, gifts, assets and inheritances. The IRS will extend the statute if you don’t fill them out.

Request a free consultation with a dedicated tax attorney who can help you avoid an audit or navigate the process when you face one.

Having the statute of limitations extended on your tax return by an additional three years is far from ideal, but there is an even worse situation that you can be in.

3. No Time Limit Audit

In very exceptional circumstances, there will be no tax audit time limit on how far back the IRS can collect back taxes owed – meaning that the statute of limitations will not be applicable. This is a situation every taxpayer wants to avoid at all costs.

In the following circumstances, no statute of limitations may apply:

- If you do not file a tax return at all: Moreover, if you file a return but don’t sign it, no statute of limitations may apply since the IRS would not consider it a valid tax return. Until you file the tax return for a particular year, the IRS has unlimited time to complete the audit. Once your file your return, the statute of limitations begins.

- If you file a fraudulent return: This fraud includes tax evasion by not fully reporting your income, using a fake Social Security number, falsely claiming deductions or claiming your business expenses as personal expenses. In the case of fraud, the IRS agent has the right to get to the bottom of the crime — therefore, the agent can go back as far as necessary.

Filing a fraudulent tax return is a serious felony violation. A taxpayer who files a fraudulent tax return can be imprisoned for up to three years, fined up to $100,000 – or both.

What’s the Longest IRS Audit Time Limit?

After assessing your tax liability, the IRS has 10 years to collect. This is known as the Collection Statute Expiration Date (CSED).

There have been cases where the collection statute has been renewed for well beyond 10 years, so it is important that you keep the following items on hand:

- All of your tax records (both electronic and hard copies)

- Proof of when your return was mailed or filed

- Pertinent receipts as they relate to the basis of assets

Proper record-keeping can help you resolve your IRS dispute and reach a better outcome for your case. When you reach out to us at Polston Tax, we can offer you the tax audit representation you need.

What Can Initiate an IRS Audit?

In most cases, an IRS audit is random. Some people, such as those who are self-employed or have prior liabilities, are more susceptible to continuous audits than others. Yes, the IRS can audit you for several years in a row. However, if they have audited you on the same issue and you have won the dispute, they will be limited to how many times they can audit you.

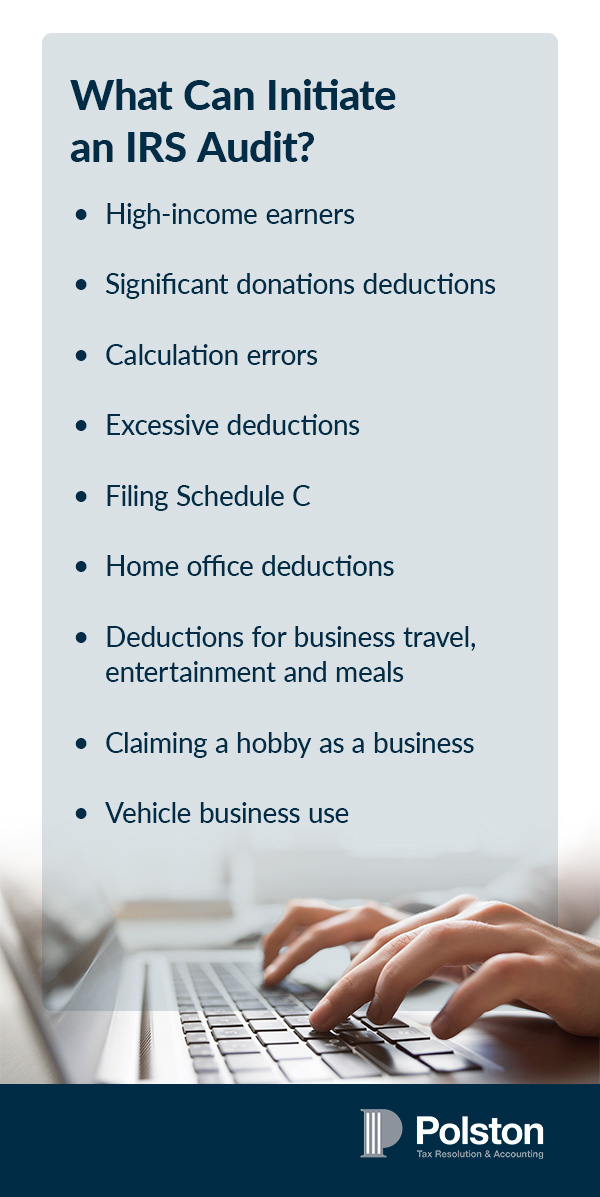

Several factors can trigger the IRS to conduct an audit on your tax returns:

- High-income earners: People who earn $10 million or above are more likely to be audited than lower-income earners. The exam rate for these high-income earners is 8.16%. Those earning between $1 million and $10 million have an exam rate of 2.53%. Below these income levels, the exam rate is less than 1%.

- Significant donations deductions: When you write a check to donate to a charity, it’s easy for the IRS to trace. Determining the value is more challenging when you donate an item. You have to estimate the item’s value, which can bring about an audit. If you donate an item worth $500 or more, it’s wise to have a professional appraiser determine its value.

- Calculation errors: If the IRS finds an error in your calculations, regardless if it favors the IRS or not, the IRS may audit you.

- Excessive deductions: People within similar tax brackets tend to have similar deductions, and the IRS is well aware of this. If you have significant deductions that seem outside of the norm, this may trigger an audit. As long as you have all the necessary supporting documents and information, don’t hesitate to make the deductions.

- Filing Schedule C: Taxpayers use Schedule C to report income and loss from business operations or if they are sole proprietors. These self-employed taxpayers are more likely to be subjected to an audit, especially if they operate mainly in cash. This is because self-employed individuals are solely responsible for reporting their incomes, leaving room for more mistakes.

- Home office deductions: The IRS regulations for home office deductions are fairly strict. You must use the space exclusively for conducting business, and it must be the principal place where you conduct business. This deduction is only available to self-employed taxpayers.

- Deductions for business travel, entertainment and meals: If you make any of these deductions, keep all of your receipts. Taxpayers can abuse these deductions, so the IRS thoroughly scrutinizes them.

- Claiming a hobby as a business: The IRS clearly distinguishes whether your endeavor is a hobby or a business. You must conduct it as a business to qualify for deductions and maintain accurate records. You must also prove that the time and money you’ve spent on this business is to make it profitable.

- Vehicle business use: If you claim to use your vehicle for your business 100 percent of the time, make sure that you have solid documentation to support your deductions. If you use it entirely for business purposes, you can deduct the entire cost of ownership and operations. However, if you only use it for business a portion of the time, you can only deduct the cost that applies to business use.

How Does the IRS Conduct an Audit?

The IRS will typically carry out an audit in person as an interview or via mail.

If the interview is in person, the IRS will first contact you via mail with contact information and instructions. Afterward, they will set up an interview with you at a local IRS office, your home, your place of business or your accountant’s office. In the event of an interview, it’s wise always to have counsel with you.

If your audit is via mail, the IRS will request additional information regarding items on your tax return. These items may be income, expenses or deductions. If there are too many records to mail, you can request to conduct the audit in person.

During your audit, the IRS agent may ask you to provide a list of various records, including recipes, bills and legal papers. As technology has become increasingly common, they will also accept electronic documents produced by some tax software. As a self-employed taxpayer, the law requires that you keep all the records you use to prepare your tax return for at least three years.

How a Tax Attorney Can Help With Audits

If the IRS notifies you of an audit, your first step should be reaching out to a tax attorney. An experienced tax attorney can help you prepare for this intense inspection of your tax documentation and answer questions the auditor may have. When you hire a tax attorney from Polston Tax, you can expect the following benefits.

A Tax Attorney Has More Qualifications Than a CPA

Though you may be tempted to hire a CPA or accountant to help you prepare for an audit, these professionals may not know how to defend clients in a tax audit situation. On the other hand, a tax attorney has the knowledge and experience needed to prepare for and navigate an audit, along with the ability to defend you and negotiate on your behalf.

When you have a tax attorney, you’ll have a partner who can interpret tax law in your best interest, protecting your assets.

A Tax Attorney Can Bring Clarity and Interpretation

An audit can be overwhelming, especially with the terminology and procedures that the IRS uses. If you receive a letter from the IRS, you may need clarification, which is common. A tax attorney can clearly explain the steps in the audit procedure and what the IRS agent will need from you.

As tax attorneys, we are also skilled at picking up when the IRS digs deeper into your tax return to look for criminal intent. Using our discernment, we can advise you accordingly.

A Tax Attorney Can Reduce Your Tax Liability and Penalties

When you’re facing an audit, your risk of the IRS finding errors in your tax return increases. If this occurs, the IRS could subject you to hefty interest and penalties. In extreme cases, you may need to pay tens of thousands of dollars – you may even face jail time.

On top of additional interest, the penalties you may face include:

- Civil penalties: You could face a civil penalty if there are errors in your tax return. If there are significant errors, you could face a penalty as high as 20% of the amount you underpaid.

- Civil fraud penalties: You could face a civil fraud penalty if you underpay your taxes due to fraud. In this case, you could face a penalty of 75% of the amount you underpaid.

- Criminal penalties: This is the most serious penalty you could face, as this penalty is typically a result of fraud or tax evasion. In this case, you could face significant fines and jail time.

Your tax attorney can negotiate on your behalf to reduce the liability during the process — you don’t have to wait until the IRS has made its decision to begin defending your case. At Polston Tax, we review the options available during the audit and advise you accordingly.

Why You Should Work With a Polston Tax Attorney

Being audited by the IRS can be scary, especially if you don’t know tax law. You deserve to have your tax rights protected. Speak with a Polston Tax attorney who will provide tax advice and protect you from potentially having thousands of additional tax dollars added to your tax liability. When you partner with Polston Tax, you will be fully supported by a seasoned tax professional with years of tax industry experience.

Licensed to practice in all 50 states as tax attorneys, we have more than 100 tax professionals on staff from all areas of the tax industry, including:

- Tax lawyers

- IRS enrolled agents

- Case managers

- Accountants

- CPA’s

So we are more than well-equipped to handle your tax matters and provide you with the help you need, all under one roof. Contact us today to get your life back in order and resolve your tax problems for good.

Additional Readings

The IRS conducts audits to verify income and expenses claimed on tax returns. For 2020, the IRS audited 509,917 tax returns, which resulted in recommended additional tax of more than $12.9 billion. While your chances of getting audited are low, it is still possible to get selected by the IRS. Sometimes you may be audited simply for having a complicated...

Many Americans are concerned about having the IRS audit their income tax returns. Of course, filing your tax return on time doesn’t mean that you are safe from an IRS audit or from the IRS coming after you. In fact, the IRS can look into your return long after you filed it. While it’s important to get your return in by...

Tax season can be stressful and overwhelming for everyone. Aside from filling out forms, collecting your receipts from the past year and ensuring you’re doing everything correctly, many people fear that they will do something wrong and get audited by the IRS. There is nothing worse than getting all your tax documents together, filing your...

Each year, the IRS processes around 261 million tax returns. From individuals, 90% of these are filed electronically. The IRS expects individuals to file an annual tax return each year. Yet, many don’t file yearly or even haven’t filed for several years. In fact, in 2020, the IRS estimates it was owed over $114 billion in back taxes, penalties,...

Tax Audits are one of the most terrifying things a taxpayer can endure. Most taxpayers don’t know what being audited by the IRS entails and usually don’t know what to do if they are audited. IRS audits can be confusing to most taxpayers as most don’t know what the IRS is looking for when they...