Tax season can be stressful and overwhelming for everyone. Aside from filling out forms, collecting your receipts from the past year and ensuring you’re doing everything correctly, many people fear that they will do something wrong and get audited by the IRS. There is nothing worse than getting all your tax documents together, filing your tax return and months later finding out you are now being audited by the IRS.

The risk of you being audited is quite low, as less than 1% of tax returns are flagged for audit by the IRS each year. But if you’re like most people, you want to make the chances of you being audited as low as possible. We’ll show you how to avoid getting audited and make your future tax process is much easier.

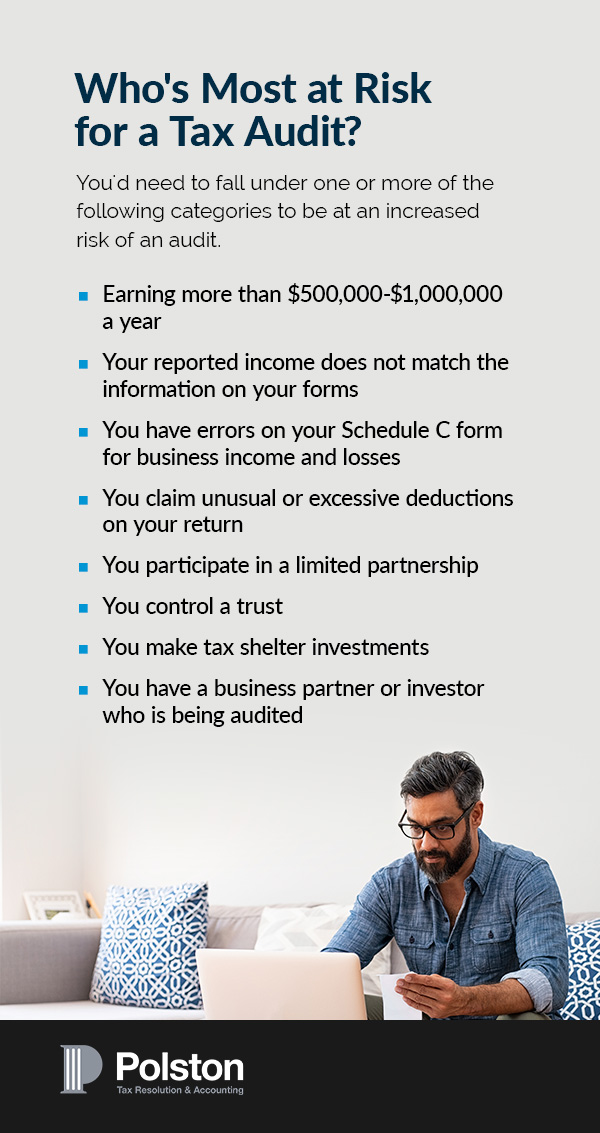

If you’re concerned about getting audited for a mistake you make when filing your tax return, the first thing to keep in mind is that very few people are at risk for being audited. Typically, you’d need to fall under one or more of the following categories to be at an increased risk of an audit:

Keep in mind that none of the above factors mean that you are doing anything wrong, necessarily, it simply means that your tax return paperwork may be more complicated and, therefore, require a higher level of scrutiny from the IRS. The IRS also conducts a random selection process through a computerized system. This system compared your tax return against similar returns and can sometimes trigger an audit.

However, the odds of an IRS audit decreased slightly in the fiscal year 2022. Out of nearly 165 million individual tax returns, only 626,000 were audited, down from 659,000 in the 2021 fiscal year. This means that the odds of getting audited in 2022 were at about 3.8 for every 1,000 returns.

Unfortunately, those who were audited included low-income individuals and families, which is why it’s critical to rely on a professional. While some believe that higher earners are the only ones at risk for an audit, oddly, those who make less than $25,000 can also have a higher audit rate if they claim the earned income tax credit.

If you want to learn how to avoid a tax audit, here are five tips to help you streamline the process and prevent the IRS from flagging your tax return.

First, make sure your taxes are filed correctly. Take that extra day or two to look it over and make sure the numbers match. If you have it prepared by a tax accountant, look it over with them and make sure you understand the entire return. It doesn’t matter who prepares your tax return, YOU will be responsible for whatever the tax return says.

Then, make sure your math is correct. Don’t make up information or round up your numbers. Put in the numbers exactly as they should be. It might seem small and some taxpayers think a minor addition error will be overlooked, but that mistake can make the IRS wonder what other mistakes there might be. If they see one mistake, they’re more likely to look through your entire return.

Generally, the IRS doesn’t mind if you round up to the nearest dollar, but you should never try to round up expenses by tens or hundreds of dollars. For instance, rounding up $199.52 to $200.00 may be acceptable, but rounding $180 to $200 is not. If you have some of the same expenses year after year, make sure they’re the same as they’ve always been, otherwise, it could raise a red flag.

Whether or not your expenses have changed, always keep records of your business expenses to support what you’ve reported. Always avoid stretching the truth and causing inconsistencies that an auditor will be looking for. In addition to preventing mathematical mistakes on your expenses, it’s also required to accurately report all income you receive throughout the year, including any freelance work you perform. Those who underreport their income will likely have to pay back taxes, penalties and interest on the taxes they already owe.

Another way to avoid getting audited by the IRS is to ditch the paper return and file your tax return online. When you file a paper tax return, you’re more likely to make a mistake that could lead to the IRS flagging you for an audit. These errors could be a missing page, math errors or empty boxes not filled in with information.

In the same way many businesses use automation software to reduce human error in their everyday tasks and organization processes, filing electronically for your taxes is both convenient and can even help flag any incorrect information before you submit. For those who file online, the likelihood of errors may drop significantly.

While it may seem obvious, many people forget to file their taxes on time. Scrambling last minute to try to collect your necessary documents and file your taxes yourself can be very frustrating and time-consuming. Cutting it too close to the deadline can also cause you to rush through the paperwork, increasing your likelihood for making errors. Luckily, if you don’t think you’ll have it all done by the tax deadline, file for an extension and use the extra time to double check everything.

Many people may wonder whether filing a tax extension increases audit risk, and the answer is no. While you should always try your best to file your taxes on time, you can easily file for an extension for a variety of reasons and it will not increase your audit risk. If you do file for an extension until October, however, keep in mind that you still have to start paying any taxes you own in April.

If you plan on taking a few deductions, make sure to have substantiation. You should be tracking your deductions throughout the year and keeping documentation for each deduction. If the IRS decides to ask you about a certain deduction or the amount, you’ll want to have the proof to support it.

For instance, claiming an excessive or unwarranted amount for your home office deductions, such as all of your monthly rent, can put you at risk for getting audited. Only deduct the space you use for work and the expenses associated with your home office. No matter what type of job you have or how much income you earn, having extremely high deductions, especially if you’ve never taken them before, is likely to get noticed.

Whether you’re trying to improve your tax planning and preparation process or facing a tax audit, it’s important to reach out to a professional tax attorney to handle your accounting, audit representation and resolution to ensure everything is done correctly.

Working with a tax resolution service can simplify the process for you as your IRS tax relief specialist will contact the IRS on your behalf, perform a comprehensive analysis of your finances and provide you with alternatives until you find the best solution for your unique situation.

When it comes to getting audited, it’s critical to work with a skilled team that’s familiar with the IRS requirements and can get you the most favorable outcome. Once your audit process is complete, you can continue relying on your tax specialist to prevent an audit in the future.

If you find out you’re being audited, or simply want to work with a professional to prevent getting audited in the future, don’t hesitate to ask for help! Tax preparation and planning can be stressful enough as it is, and if you get audited, you may not even be sure what to do. At Polston Tax Resolution & Accounting, we can eliminate stress from dealing with taxes, fines, penalties and other financial issues.

It’s our goal to help you with the tax help you need. Our experienced and knowledgeable taxation professionals will fight for you across a wide range of services, including appeals, IRS account investigation, tax court representation, audit representation and so much more. Call us at 405-801-2146 or contact us to schedule your free consultation today!!