Sales and use taxes are integral to many states’ revenue. Any business or entity with nexus in the state of California must collect and remit sales tax. Understanding your filing frequency, how your business collects sales tax based on your or the buyer’s destination, and proper recordkeeping is essential. The sales tax rules also apply to marketplace and remote sellers.

Adhering to the Golden State’s sales tax requirements will keep your business operations compliant. With many nuances to navigate, tracking these responsibilities can take a lot of work, but this go-to California sales tax resource will help you stay on track.

Sales tax is a consumption tax based on the sales of goods and services levied at the point of sale. The state imposes its own sales tax, with local and municipal governments adding their own sales tax. Usually, this is charged as a percentage of the retail cost of the product or service at the point of purchase.

In California, businesses must collect sales tax on the sale of tangible goods. They add sales tax to the product’s sale price at the point of purchase. During each reporting period, businesses report their sales and pay the sales tax collected from customers to the California Department of Tax and Fee Administration (CDTFA).

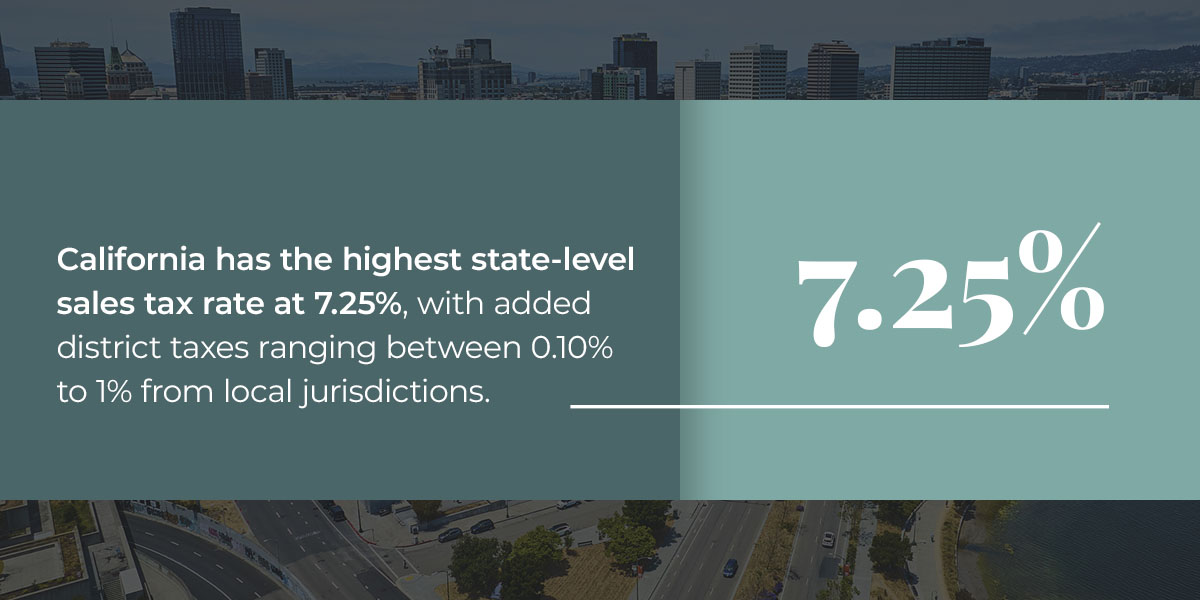

The rate varies by location and includes local and state taxes. California has the highest state-level sales tax rate at 7.25%, with added district taxes. Some cities and counties charge no additional sales taxes, as of the tax rates effective on April 1, 2025. The highest rate, effective April 2025, is 11.250%. This rate is found in Lancaster and Palmdale. Both cities are located in Los Angeles County. You can search using your address for more clarity on the right rate in your area.

CDTFA determines if a business has sufficient presence and is engaged in business in the state to register for a seller’s permit. These factors also help establish a nexus, meaning that your company must start collecting and remitting state sales tax.

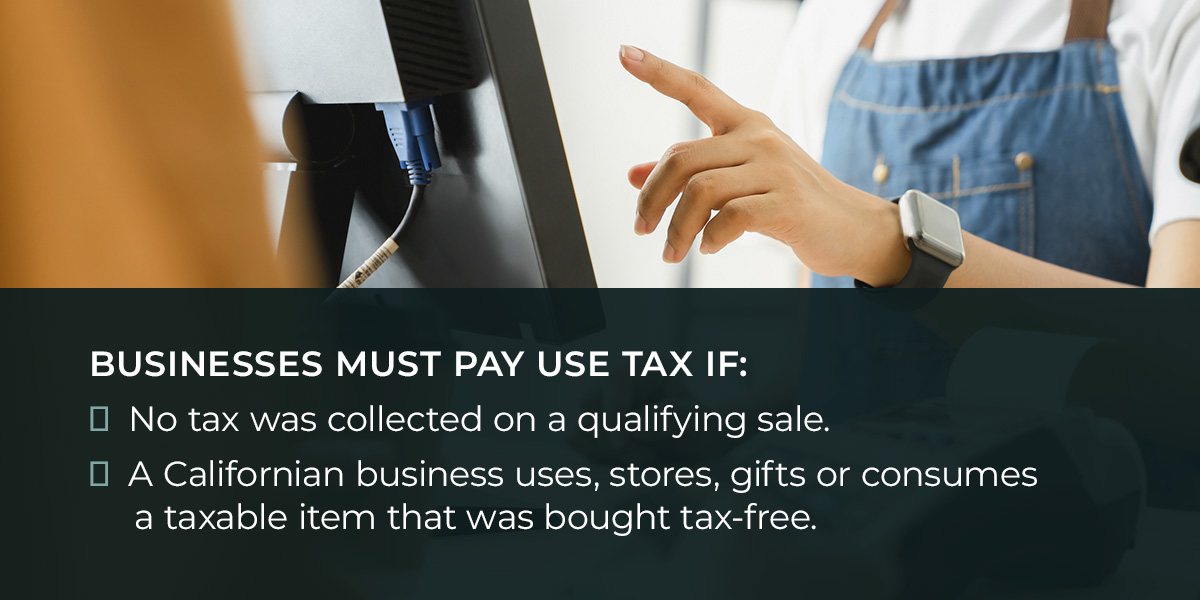

Individuals and businesses must pay tax on items bought without California sales tax if those items are used, consumed or stored in the state. Use tax applies to both in-state and out-of-state purchases where the seller doesn’t collect sales tax. This structure creates an even playing field for businesses in California. For example, if your company buys office supplies from an online retailer, your business must report and pay the use tax on those supplies. Businesses must pay use tax if:

Use tax keeps taxation fair and ensures state revenue is allocated to essential services. Reporting use tax is part of filing your sales and use tax return with CDTFA. Individuals report their use tax on their state income tax return using CDTFA’s use tax return form. If your business has ongoing use tax to file, you must report use tax according to your assigned California sales tax filing frequency. For this reason, keeping all receipts and purchase records to report and accurately pay any owed use tax is crucial.

It is essential to keep records of any out-of-state purchases for which you did not pay sales tax. Accurate recordkeeping simplifies reporting and makes paying the appropriate use tax easier when you file tax returns.

When businesses do not collect tax on product or service sales, the buyer is responsible for reporting, filing and remitting their purchase’s total use tax on their California income tax return. It commonly happens with taxable online purchases where the seller does not collect sales tax.

Complying with sales and use tax collection ensures that your business pays its required tax amount, bypassing potential legal issues stemming from noncompliance. Companies must collect sales tax if they have a compelling connection to the state — in other words, if they have a nexus. Organizations with nexus in California must pay sales tax. Any business selling taxable goods or services to local residents must collect the sales and use tax. The responsibility to collect sales and use tax falls on retailers and certain service providers. Specifically, these entities:

Sellers who do not have to collect sales tax must pick up a valid exemption or resale certificate from buyers to validate their exempt transactions. Entities that do not have to collect sales tax include:

Businesses establish a nexus in California when they have sufficient economic or physical presence in the state. Nexus obligates businesses to collect and remit sales tax. Out-of-state sellers can also establish sales tax nexus through related entities. A relationship with in-state affiliates or businesses helps establish a market in California, creating an affiliate nexus. For example, an out-of-state business with an affiliate in California that helps with order fulfillment or promotes sales may establish a nexus.

A good indicator of your nexus status is whether your organization is engaged in any business within the state. If you have nexus within California, you must stay informed about each of the 58 counties’ tax rates and their tax districts. Keep in mind that some of these tax districts overlap, too.

Economic nexus depends on a business’s financial connections in the state. You are considered “doing business” and must pay sales taxes if any of the following are true:

The monetary values for an economic nexus in California change every year to adjust for inflation, so if you’re paying sales taxes for a previous year, check that you meet the nexus requirements for that year. The threshold includes all sales of tangible personal property delivered into the state, whether the sales are taxable or exempt. Meeting this threshold also means your business must register with CDTFA to start collecting sales tax on your sales to local customers.

Businesses can establish a physical nexus in California in several ways:

Both remote and marketplace sellers with qualifying product sales must file regular sales tax returns with the CDTFA, detailing their taxable sales and the amount of sales tax collected. As California has different rates in different areas, tax rates depend on the customer’s location.

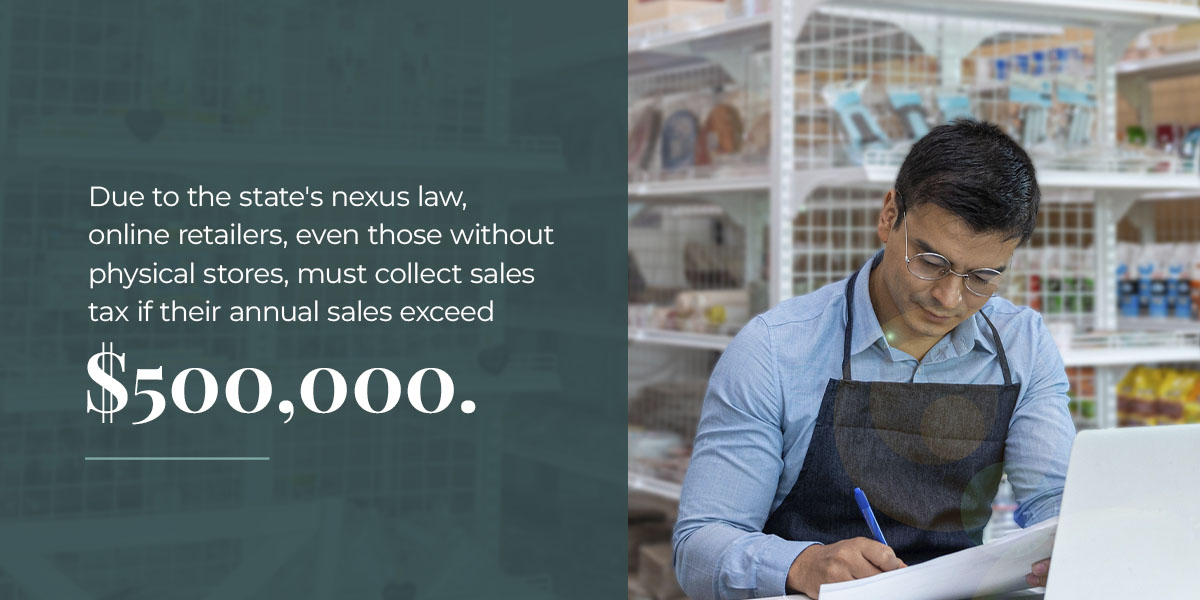

Sellers without a brick-and-mortar store in the state must also collect use tax if sales of tangible personal property in the state or for delivery in the state exceed $500,000 for the preceding or current calendar year. This number applies to total combined sales by the retailer and all persons associated with the retailer. Remote sellers meeting the annual sales threshold must register with CDTFA to collect and remit their use tax. This includes sales of tangible goods delivered to California. Remote sellers are classified through various dealings in the state.

Since April 1, 2019, remote sellers must collect and remit sales tax when their sales into the state exceed the aforementioned threshold. Meeting this sum gives the seller economic nexus in California.

Businesses that perform services connected to tangible personal property, like product design or development, may also establish nexus if they work with a retailer engaged in business in California.

Since October 1, 2019, sales through a marketplace like Etsy, eBay or Amazon, the marketplace facilitator has been responsible for collecting and remitting sales tax on your behalf. This rule applies to both out-of-state and in-state sellers who use these platforms. Sales must surpass the economic nexus threshold of $500,000. Marketplace facilitators are those who:

Storing goods you plan to sell in the state triggers sales and use tax collection responsibilities. This includes merchandise owned by Fulfillment by Amazon (FBA) and merchandise stored in a warehouse that Amazon owns and operates in California.

If your business attends trade shows or conventions in California, you might be liable for collecting and remitting use tax on sales and orders made during those times. Your business may be exempt if:

It is important to note that the sales tax nexus can extend even after your business stops its qualifying activities in the state. Trailing nexus can last throughout the year and the following calendar year, after which your nexus-triggering activities stop in the state.

In California, sales tax applies to most retail sales of goods or merchandise. Services and labor related to tangible personal property, like fabrication labor and repair or installation services, are included when they relate to tangible personal property. It includes the following:

The Field Operations Division and the Business Tax and Fee Division administer California’s local, state and district sales and use tax programs. These cover over 80% of all CDTFA-collected revenue, including sales subject to additional taxes. There are also special tax and fee programs that may impact your business, including:

California has several sales tax exceptions to reduce costs for some purchases and encourage specific activities, especially for sustainability efforts. These exemptions include any sales to the United States government and sales of products paid for with electronic benefits transfer (EBT) cards.

Certain food products for human consumption, excluding alcohol and hot, prepared foods, are exempt from sales tax.Any medication prescribed by a doctor and medical devices, like wheelchairs and other devices prescribed for patients, are exempt. Many sales to nonprofit organizations are exempt if the items are used for charitable purposes. Sales of fertilizers, seeds and pesticides used in commercial agricultural production are sometimes exempt from sales tax. Feed sales for animals used to produce food or products for human consumption fall under this exemption.

You are also in luck when it comes to solar energy systems. Solar panels and photovoltaic (PV) system equipment have a partial exemption from tax if they are used in primarily agricultural activities. Finally, machinery and equipment for manufacturers, developers and researchers may qualify for a partial exemption.

One-time sales of business assets are generally exempt if they are not part of the business’s regular activities, as are sales of water, gas and electricity delivered to consumers through lines, pipes or mains.

Failing to collect California state tax on sales can have several detrimental consequences. The state can issue interest and penalties or conduct a formal audit and demand back taxes. You can also receive fines and be required to pay outstanding taxes out of pocket. Not collecting sales tax and staying compliant can also harm your business’s reputation, potentially leading to legal trouble.

Businesses that fail to comply with sales tax laws for any reason may be subject to more frequent and thorough CDTFA audits in the future.

A sales tax audit is often a routine process without cause for concern. Be open and honest throughout the process and cooperate with the auditor. Follow these steps when you receive an audit notice:

Review the audit notice and ensure you understand the scope of the audit, including the auditing period and documents you need to provide. Note the auditor’s contact details, as this person is your primary point of contact throughout the auditing process.

Gather all relevant records for the audit. Refer to the audit notice to confirm which documents you need and if there are any documents you may need to clarify transactions or discrepancies.

Hire a certified public accountant (CPA) or tax attorney with experience in sales tax audits to support your case. They can verify your documents, offer valuable guidance, and represent you during the audit or any situations where you want to contest the auditors’ findings. The tax professional can also help you understand your obligations and rights during the auditing process.

Contact the auditors to schedule your initial meeting and discuss the audit’s timeline. Clarify the scope of the audit and the process ahead. Ask any questions during this meeting to ensure you cover all your bases.

Submit documents promptly, as delays can prolong the audit and lead to penalties. Keep copies of all the documents you give the auditor to ensure you have a record of everything submitted. It is also crucial to be responsive and honest with the auditors. Misrepresenting facts can cause legal issues and lead to legal penalties.

Request a preliminary report and discuss the auditor’s findings. Now is the time to correct errors and provide evidence to dispute these errors.

Review the final audit report with your tax practitioner when you receive it. You have the right to appeal if you disagree with any of the findings. In most cases, there is a 30-day window to petition for reconsideration. However, in certain circumstances, that time frame is reduced to 10 days. You can also request an administrative hearing or explore further appeals.

Alternatively, if you agree with the findings, follow the instructions to pay any amounts due.

A sales tax auditor in California will review your business records to ensure you have collected and paid sales tax correctly. The auditor will examine your sales receipts, invoices and tax returns. They may also ask questions about your business operations and transactions. It is essential to provide all the requested documents and offer clarity on any discrepancies.

The audit can take anywhere from a few weeks to months, depending on your business size and the complexity of your transactions. If any additional errors are found during the audit, you may need to pay additional interest, taxes or even penalties.

Registering for and filing business taxes starts with determining the type of registration your business needs:

When you are clear on the registration types, register online with the CDTFA and other agencies, such as the Employment Development Department or Franchise Tax Board.

You will then be set to file your sales and use tax returns, income tax returns, employment taxes and franchise tax.

How to Register for Your California Sales Tax Permit

Businesses register for their seller’s permit with CDTFA or apply in person at a local field office, free of charge. You may have to submit a California Secretary of State number, but if your business is based outside the Golden State, call the California Department of Tax and Fee Administration. Have the following information on hand when you register for a sales tax permit:

California businesses can file sales and use tax returns through the CDTFA, provided they have a seller’s permit. Companies must collect sales tax on all taxable sales and maintain accurate records to ensure they remit the right amount of sales tax. Filing frequency differs for various organizations, depending on their estimated sales volume.

Prepare for your return by gathering all the necessary information, such as your taxable sales, the amount of sales tax your business has collected and your total sales. Additionally, ensure you have records of purchases subject to use tax if this applies to your remittance.

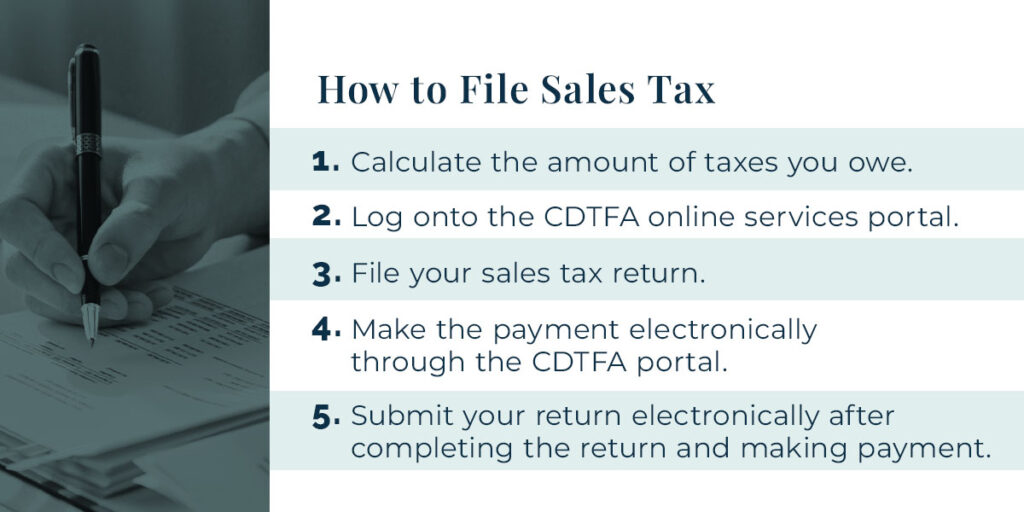

When it is time to file your sales tax, there are five steps:

Calculate the amount of taxes you owe.

Log in to the CDTFA online services portal.

File your sales tax return.

Make the payment electronically through the CDTFA portal.

Submit your return electronically after completing the return and making payment.

There are three filing options — file through the mail with California’s short form sales, use a tax return form or file through the online system with the California Department of Tax and Fee Administration.

When you file your sales tax return, it is crucial to double-check your entries for accuracy. It may be best to hire a reliable tax practitioner to help your business comply with California’s sales and use tax intricacies.

California business tax laws state that when businesses file and pay their sales taxes depends on the state’s due dates and the business’s assigned filing frequency. You are assigned a filing frequency after registering for a sales tax permit. These frequencies can be monthly, quarterly, semiannually or annually. The due date is always the last business day of the month after the reporting period. Select high-volume sellers must file quarterly and pay their sales tax in monthly prepayments by the 24th of each following month.

Late filing can result in penalties and interest on outstanding taxes. According to Publication 75 from the CDTFA, additional reasons for penalty charges can include operating an unlicensed business, knowingly withholding collected sales and use taxes, and accidentally failing to include payments in your remittance. If you miss a filing deadline due to circumstances out of your control, like accidents or weather issues, the CDTFA may grant an extension if you can provide supporting evidence.

When you purchase an existing company, you are responsible for past sales and use tax liabilities once the sale has gone through. For this reason, if you are acquiring a business, contact the CDTFA to confirm the status of your acquisition.

Sales tax holidays are periods during the year when certain items are exempt from sales tax. These holidays typically apply to back-to-school items, energy-efficient appliances or hurricane-preparedness supplies. Many states offer sales tax holidays, but California is not one of these states.

Most states’ sales tax collection procedures are either origin-based or destination-based. California’s collection process is a combination of both. In-state sellers should collect sales tax based on the buyer’s location or the item’s destination and based on the district where the business is located. This process means you collect at least two rates, as more than one district tax may apply in your location. California has four sales tax districts to consider for sales tax collection. If your business has multiple locations in the state, you collect more taxes from your buyers.

Businesses based outside of California with sales tax nexus in the state charge their sales tax based on the buyer’s destination. The state requires sellers with economic nexus to collect sales tax using destination sourcing. How your business collects sales tax depends on how you sell goods:

Sales tax also applies to your shipping and handling charges if they are part of the sale. Collecting these taxes correctly involves:

Keep detailed records of all transactions, including receipts and invoices showing shipping and handling charges, to ensure compliance and provide transparency during potential audits.

Polston Tax helps businesses that owe back taxes to the IRS. We also offer full-service accounting and tax navigation assistance. Our team will negotiate your tax resolution options, such as Installment Agreements, Levy Releases, Offers in Compromise or Penalty Abatements.

When you partner with Polston Tax, you get a tax attorney with a whole team of tax professionals with over 100 years of combined tax resolution experience. Our CPAs and accountants can help keep your business’s books compliant, and our tax strategists provide advanced tax planning to help you save on the taxes you pay.

Understanding and complying with California taxes and regulations is essential for all businesses operating in the state. Properly collecting, reporting and remitting sales tax helps your business avoid costly penalties and legal issues. Stay current with local tax laws and maintain accurate records to ensure your operations run smoothly. Navigating California’s sales tax can be a daunting task. Ensure your organization complies by partnering with an organization that can help you with your business accounting.

At Polston Tax, our team has the experience to help your business navigate the California tax nuances to minimize liabilities. If your company is audited, we can represent you and contest audit findings. We also offer tax planning, preparation and state tax balance resolution services. Contact us today for more information on our full-service tax resolution and accounting.