What are the options available when resolving tax issues? Do you have to pay the whole balance at once? And what happens when you disagree with a tax agency’s decision? These are all legitimate questions, but people often do not get the answers they need. This guide addresses the fundamentals of tax resolutions and explains how tax professionals can help.

Tax liability resolutions vary from abating penalties to settling your balances with no payments at all. Each resolution comes with different qualifications and requirements for paperwork. Most IRS debt resolutions look at your current financial situation to determine if you qualify for it or not. Thus, it is essential to examine your situation before taking any action.

Tax resolution is the process of resolving tax-related issues or disputes with the tax authorities. It may involve challenging decisions made by tax agencies or negotiating favorable terms to reduce the financial burden associated with tax payments. The following are instances where tax resolution is necessary:

Individuals and businesses owning back taxes may seek resolution options to settle their arrears. Settlements can prevent the tax agency from commencing aggressive collection actions, such as tax liens or levies. Tax professionals can negotiate favorable payment terms when it is impractical to pay a lump sum. They can also help you file outstanding taxes to regain control of your finances.

Tax laws require taxpayers to file tax returns each fiscal year. However, many people cannot do so due to financial challenges or other reasons. In such instances, the IRS or state tax entities use documents such as Forms W-2 and 1099 to calculate the tax amount owed.

With the help of a tax professional, you can prepare your tax returns from the previous years and plan for the future. They can help you maintain accurate records to pay the correct amounts you owe.

Unpaid taxes lead to attract penalties and interests, which can compound over time. However, tax agencies sometimes reduce or waive the amounts on reasonable grounds. For example, you may qualify for penalty abatement programs, such as:

Tax professionals can examine your situation and help you find out if you are eligible for any of these programs. They can also help you gather the documents and apply.

There is no need to panic if you receive a notice that you will be audited. You may have a complicated tax return, and the tax agency wants to verify whether you are reporting legitimate incomes and deductions. While the audit procedure is daunting, it is crucial to cooperate.

Tax professionals can help you prepare and answer questions the IRS or state tax entity might have. They can also help you decrease the changes of an audit by avoiding the following triggers:

If you disagree with decisions made by the tax agency, tax professionals can help contest or appeal.

A tax resolution professional can help businesses deal with complex tax predicaments. They act as intermediaries between tax authorities and taxpayers. There are different tax professionals, including:

These professionals undergo training and obtain certification before acting on behalf of taxpayers. They must also complete a certain number of hours of continuing professional education. Various governing bodies oversee their operations to ensure optimal protection of the industry and client interests.

Tax professionals perform many functions. They can assess cases, advise clients and resolve tax disputes through negotiation and mediation. Tax attorneys can also represent clients during litigation.

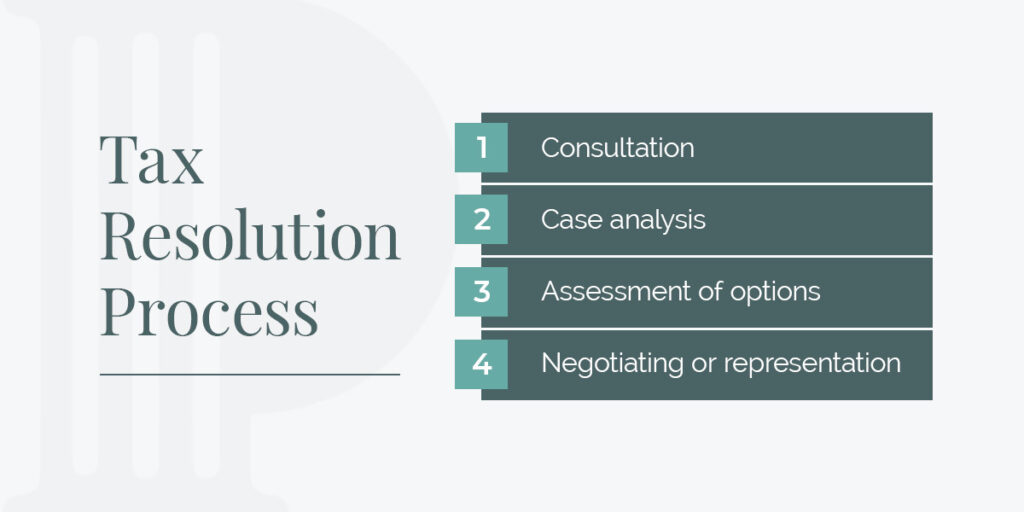

Tax resolution involves the following steps:

Below are the options available when resolving unpaid taxes:

An offer in compromise is an agreement between the tax agency and the taxpayer settling your tax liability for less than you actually owe. The advantage of an OIC is that you can pay tax balances for as low as $5, although amounts vary and depend on your finances. An OIC requires one payment to be made to the IRS, and your tax balances are settled as long as you remain compliant. If you are threatened with a levy, filing an offer can prevent future levies.

While an OIC has some benefits, it does have some downfalls. OICs are very hard to qualify for. Along with submitting the essential paperwork, you must usually disclose your finances and substantiate all expenses and income. You are assigned an Offer Specialist, who may require more paperwork. Once you submit the actual offer, it can take over a year to be approved. Usually, it takes months for the IRS to even look at your offer. Also, when you file your offer, liens are automatically filed but removed later once the offer is accepted and paid.

A PPIA is a payment plan that lets you pay off part of your tax balances in monthly installments until the tax liability expires. A PPIA for taxes can also lead to significant savings, like OICs. The monthly installments are usually affordable, and if the payment plan is kept, you can avoid levies and any new taxes owed. The monthly payment depends on the amount owed and the taxpayer’s disposable income.

The downside of a PPIA is that, like the OIC, they are very hard to qualify for. Because of the possible savings, the tax agency ensures you have financial hardship before they allow you to enter into the agreement. Again, like an OIC, you must provide all forms of income and all your expenses. Equity and other types of savings can be looked at as well. The IRS or state entity may review your payment plan if they find your finances have improved and you can make higher payments. Liens can be filed in this agreement.

An SLIA is a simple payment plan for those who owe less than $50,000 to pay off their tax liability within six years. You do not need to disclose financial information to qualify for this payment plan. You can avoid levies if you keep up with your payments and don’t accrue new balances.

While other resolutions can save you money, an SLIA does not. Unlike the PPIA, with an SLIA, you may have a high monthly payment. While no new liens will be filed once you enter into the payment plan, all prior liens will remain until your final payment is made.

An FPIA is a monthly payment plan that pays off the total taxes owed in 6 years or less. It requires you to disclose financial information to qualify for the agreement and can help you avoid collection action. Like an SLIA, a full-pay installment agreement can result in a high monthly payment. Any liens filed before the agreement is made will remain until the final payment. It is also unlikely that you will save money if you enter into this agreement.

A CNC status defers the payment of the outstanding tax balance for taxpayers experiencing financial hardship until the situation improves. With IRS CNC status, you aren’t required to pay any money, and you can avoid levies when you do not accrue new balances. However, the CNC status can change. While some people retain the CNC status until the tax arrears expire, others are reviewed. If you remain in CNC until expiration, your tax balance is gone, and you no longer have to worry about paying it back.

CNC status is meant to be temporary, so the IRS or state tax entity reviews your status to see if your financial situation has changed. If your financial situation improves, the CNC status may end, and you may start paying off your tax balances. This can happen if you get a job or a significant raise. If the tax agency reviews your status and sees you are still experiencing financial hardship, they will keep you on the status. While you must remain compliant when in CNC, the tax agency may also seize any tax refunds you are due while you are in CNC. Tax liens are also automatically filed when you enter into the status.

Innocent spouse relief relieves taxpayers of any unpaid taxes that arise because a spouse or former spouse neglects to pay the joint tax balances. It usually stops collection actions, such as liens and levies, and removes the tax liability. However, qualifying for the relief can be challenging. You must prove your innocence with credible evidence and complete a lot of paperwork. Getting professional assistance is crucial for your success.

There are different ways to resolve taxes, depending on the circumstances, and each option has its pros and cons and can be complex. It’s best to consult a tax professional when making decisions. Tax attorneys, enrolled agents and CPAs have the experience and knowledge to guide you and take the load off your shoulders.

Polston Tax provides efficient and personalized tax resolution services to individuals and businesses in the United States. Our team of trained professionals is ready to assist. We take over the case and handle all communications with the IRS or state tax entity. We will assess which option best suits your situation and represent you through the whole process. Contact us now to learn more, or schedule a free consultation today!

Feel free to also review our infographic on Types of IRS Tax Debt Resolutions: