Every year, employees throughout the country receive a bonus from their employers. Whether it’s a little extra to celebrate the holidays or a reward for completing a specific project, your bonus shows your employer’s appreciation for your hard work. These bonuses are nice to receive, but you may find yourself asking “are bonuses included on my W-2?”. The short answer is yes, bonuses are taxable, meaning you must pay the corresponding taxes on them. So, how do you report a bonus on your taxes?

Keep reading to learn everything you need to know about filing a bonus on your tax return.

The Internal Revenue Service (IRS) considers bonuses “supplemental wages.” In other words, your bonus is just additional income you earned, so it can be taxed. A few common examples of supplemental wages that aren’t typical holiday bonuses include moving expenses, severance pay and overtime.

Not all bonuses come as money. At your job, you may have received prizes, gift cards or some other form of bonus. These bonuses may also be called “fringe benefits,” meaning they’re a perk that a business gives to its employees alongside traditional compensation. Any bonus that is a cash equivalent item is subject to taxation. However, you usually don’t need to report small non monetary bonuses, such as a bottle of wine.

For the most part, understanding how to report a bonus on your tax return is simple.

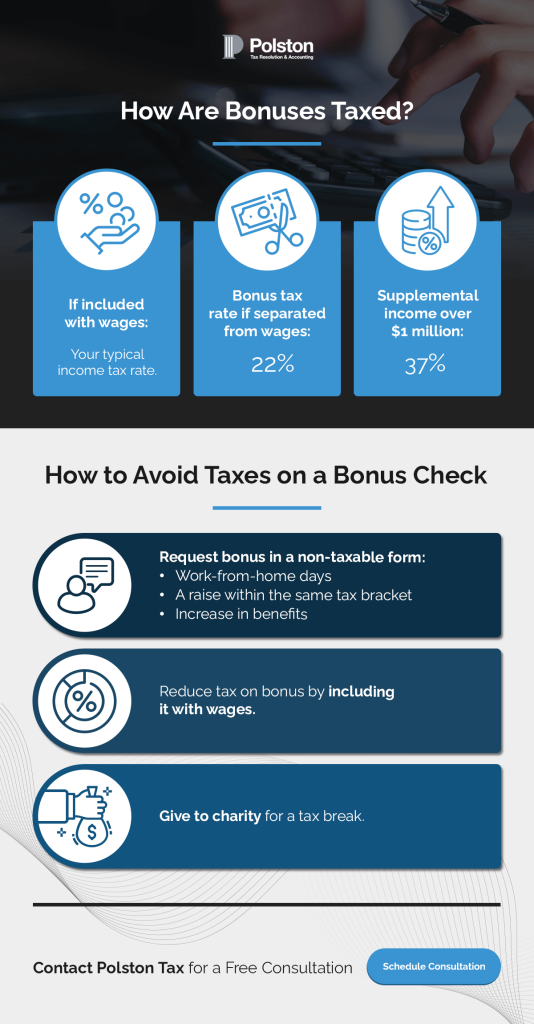

If your employer pays you according to a standard payroll system, they will report any bonuses on your W-2 Form in box 1. Additionally, if your employer includes the bonus as part of your yearly wages, they are responsible for taking the taxes out for you, meaning your bonus is taxed at the same rate as your regular income. However, if you receive the bonus separately, it’ll be taxed at a flat rate of 22% regardless of your tax bracket.

It’s also important to note that if your employer gives you a bonus that is not in cash, they will still report it on your W-2 form with its fair market value. For example, a gift card or a free vacation and the associated expenses covered would be added to your normal wages or salary, just as a cash bonus would.

If you don’t receive a Form W-2 because you’re technically self-employed, you will report the bonus on line seven of Form 1040. If you have any questions about entering that information into your Form 1040, you can work with a professional tax service so you know it’s correct.

Mostly, reporting a bonus on your tax return requires little to no action on your end. However, you may want to reduce your bonus tax rate. If your employer separates your bonus from your wages, the IRS will tax you 22% — and your tax bracket may be less than that. Additionally, supplemental income that exceeds $1 million is taxed at 37% once it surpasses that mark, which may be more than you want to pay.

You can consider a few different options if you want to reduce how much you pay for your bonus taxes.

Often, it’s worthwhile to ask your employer about how they plan to process your bonus. If your typical income tax rate is 12%, think about asking your employer to include the bonus in your yearly earnings so it’s taxed at that amount.

Note that your bonus won’t push you into another tax bracket. If you’re on the brink of being taxed at 22% and a bonus technically puts you in that zone, you’ll be taxed as usual.

Donating to a charity or contributing to certain types of savings accounts can reduce how much tax you have to pay on your bonus:

In almost all cases, either you or your employer will need to file your bonus on your tax return. Remember that there are exceptions, such as when you’re a member of the military serving in an active combat zone. When in doubt, you should speak with your employer about your bonus to ensure you take the right steps to claim it on your taxes.

The only way to avoid bonus taxes altogether is when your bonus is tax-exempt. However, you can sidestep taxes on a monetary or cash equivalent bonus by asking your employer for a bonus in another form. Ultimately, a bonus is a reward for your hard work! Therefore, you may want to explore other options with your employer. For example, you could ask to work at home on Fridays for the rest of the year or take the opportunity to negotiate a raise.

Polston Tax’s team of tax professionals can help you with your tax needs. Whether you require assistance with tax appeals or tax court representation, we’re ready to support you. Are you confused about how your bonuses will be taxed? Learn more about our tax return preparation services, which take the pain out of doing your taxes so you can move on to the next task on your schedule.

Fill out our contact form to get in touch with us today.