Nevada sales and use tax laws require businesses to collect and remit sales tax when they meet specified criteria. Where the business owner does not collect sales tax, the buyer must pay use tax to the Nevada Department of Taxation. It’s vital to know which products or services are taxable and the rules on exemptions. Additionally, learning what qualifies a business to collect, remit and file sales and use tax is essential.

Learn everything you need to know about the sales and use tax rules in Nevada. This guide covers what sales and use tax entails, exemptions and sales tax audits, as well as registering, remitting and filing sales and use tax.

Sales tax is a consumption tax imposed on goods and services by state and local authorities. The seller collects the tax when the consumer buys the product and remits it to the government. The rate varies depending on the jurisdiction and item in question, but it’s usually a percentage of the sale price. There is a uniform statewide sales tax rate, but local authorities may levy additional taxes on products or services not subject to state sales tax.

Nevada first introduced the general state sales tax in 1955. In 2008, the state joined the Streamlined Sales and Use Tax Agreement (SSUTA). SSUTA provides guidelines on the structure of sales tax laws and registration processes. Yet, Nevada has specific tax laws. The Nevada sales tax rate is 6.85% and can rise as high as 8.375% in some parts of the state or slightly higher in areas with special accommodation taxes. The variation is because of the different local sales taxes.

Nevada is an origin-based state. This system means that in sales that take place within the state, tax is based on the seller’s location, not the buyer’s. For example, if a Las Vegas business sells to a Reno customer, it charges Las Vegas tax rates, even for online or phone sales. Brick-and-mortar stores add the tax rate at the physical location for in-person transactions. The customer’s place of residence does not matter.

Use tax is complementary to sales tax. It’s imposed on the use, storage or other consumption of items purchased from a retailer. Use tax applies to tangible personal property. It’s not levied when the transaction is subject to sales tax. Use tax usually applies when someone brings products into the state without paying sales tax. This arrangement ensures that items used or consumed in Nevada are taxed even if they were not subject to sales tax elsewhere.

The use and sales tax rates are the same in the county where the property is used. Purchases, except inventory intended for resale, usually attract use taxes. You must report such transactions to the Nevada Department of Taxation. The Department will apply any sales tax legally collected outside the state to the use tax.

Here is a classic example. An individual resident of Nevada buys a taxable item outside the state and ships it to Nevada to use. If the vendor does not collect sales tax, the resident must pay use tax on the item in Nevada.

Use tax promotes a competitive advantage between in-state and out-of-state businesses. It also generates funds for the state.

Businesses that sell taxable products or services or retail tangible personal property in Nevada must collect sales tax. This includes those with physical stores and remote sellers. The seller must be registered to collect sales tax if they meet the requirements. Otherwise, the buyer must pay use tax directly to the Department of Taxation.

Taxable products typically do not include digital goods and services. Businesses that lease or rent properties, vehicles or equipment may be subject to collecting sales taxes. Auctioneers must also collect sales tax on behalf of sellers. The critical factor is that the individual or business must meet the requirements.

In summary, sellers must collect and pay sales taxes if the product or service is taxable. Buyers pay use taxes when sellers do not collect sales taxes.

Nexus is the connection between the business and the state. It’s vital in determining whether a seller must collect, file and remit sales tax. Nevada state tax nexus can be assessed in two ways — economic and physical.

Previously, sales tax nexus was limited to businesses with a physical presence, such as an office, retail store or employees. This rule continued until 2018, when the United States Supreme Court changed the status quo.

The court eliminated the requirement that a seller must have a physical presence in the taxing state before being required to collect or remit state tax. Now, states can tax businesses on their economic or virtual connection with the state.

Out-of-state sellers without physical presence can establish state nexus in several ways:

Strong ties or affiliations with a business in Nevada can establish a nexus. To establish an affiliate nexus, the out-of-state retailer must satisfy the following requirements:

Businesses involved in designing and developing tangible personal property sold by retailers could be deemed to have ties with each other. Similarly, soliciting the sale of goods on behalf of a retailer could establish an affiliate relationship.

Click-through nexus occurs when there is an agreement to reward a person in Nevada for directly or indirectly referring potential customers using their website. The referral must result in a cumulative gross receipt of more than $10,000 in sales during the preceding four quarterly periods ending the last day of March, June, September and December.

You may be required to collect and remit sales and use tax in Nevada if you participate in events, conventions and trade shows in the state. A few weeks before the event, you must declare your intent to sell taxable products to the event promoter if you sell at one or two events during 12 months. The promoter will provide you with a one-time sales tax return. Complete the packet and submit the return to the promoter with the applicable sales tax. The promoter remits the tax to the state.

If you attend more than two events in 12 months, you must register for a sales and use tax permit.

Business owners who store property for sale in Nevada may establish a nexus with the state. Classic examples include inventory owned by Fulfillment by Amazon (FBA) merchants and stored in a Nevada warehouse. In such an instance, Amazon must own and operate the warehouse.

Since the decision in South Dakota v. Wayfair Inc., tax authorities can pursue sales tax from a business conducting an economic activity in the state. This includes e-commerce businesses with a significant presence. If you pass the financial threshold for total revenue or the number of transactions required in Nevada, you must register, collect and remit sales tax.

The state threshold is $100,000 annual gross revenue during the previous calendar year. Alternatively, the business must make 200 or more separate transactions during the last or current calendar year.

You have a physical nexus in Nevada if you have any of the following within the state:

Platforms that facilitate third-party sales are known as marketplace facilitators and must collect and remit sales tax for sellers according to Nevada law. But who are remote and marketplace sellers? Remote sellers are retailers with no physical presence in Nevada. Sellers who had no other legal requirement to register and collect sales or use taxes before the Wayfair decision also qualify.

Marketplace sellers are sellers who have an agreement with a marketplace facilitator to retail tangible goods through a marketplace. The marketplace facilitator owns, controls or operates the marketplace. Marketplace facilitators generally include businesses that facilitate retail sales. They provide the infrastructure or support for retail sales to occur. Marketplace facilitators also collect the sales price, process payments or receive compensation.

A marketplace could be a physical or electronic presence. Examples include stores, websites or a dedicated sales software application where the marketplace offers or sells tangible personal property. Platforms like Amazon, eBay and trade shows fall into this category.

Remote and marketplace sellers must only register and collect sales or use taxes if they meet the annual gross revenue or transaction threshold. Marketplace facilitators who do not meet the requirement must notify the marketplace seller. Notifying the marketplace seller prompts them to register to collect sales taxes should they meet or exceed the retail sales threshold.

The law allows marketplace facilitators to opt out of collecting sales tax on behalf of marketplace sellers. This arrangement is done by executing a written agreement, where the marketplace seller assumes the responsibility of collecting and remitting sales taxes resulting from their transactions. The parties must also ensure that:

It’s the marketplace facilitator’s responsibility to obtain and maintain exemption certificates if they facilitate retail sales on behalf of the marketplace seller.

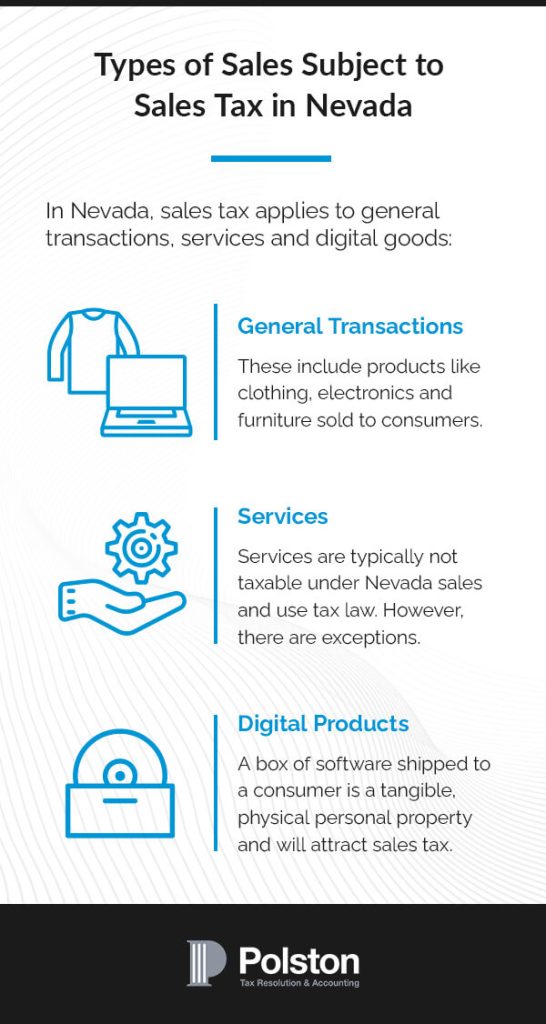

In Nevada, sales tax applies to general transactions, services and digital goods:

Sales and use taxes generally apply to the sale of tangible personal property. These include products like clothing, electronics and furniture sold to consumers. Leasing or renting tangible personal property may also attract sales and use taxes. Some products are exempt from sales and use taxes, such as the following:

Services are typically not taxable under Nevada sales and use tax law. However, there are exceptions. For instance, where a service is necessary to complete the purchase of a tangible personal property, that service is likely to be taxable. Short-term lodging attracts sales and use tax.

Software as a service (SaaS) is usually not taxable in Nevada unless the software is delivered in a tangible medium. The Department of Taxation defines SaaS as software licensing arrangements where consumers subscribe to access a vendor-hosted software application. A box of software shipped to a consumer is a tangible, physical personal property and will attract sales tax. Products like music, e-books and software typically do not attract sales and use tax unless they are in a physical form, like a disc.

Businesses that sell or lease tangible personal property must collect, remit and report sales tax. Different counties may also impose additional sales and use taxes on retail sales. Businesses that fall within the following categories are typically required to comply with the collection and remittance rules:

Nevada does not tax hotel room occupancy, but various cities or counties levy a transient lodging tax. For example, the City of Elko imposes a 15% lodging tax, whereas the City of North Las Vegas’s rate is 13%. City or county laws also define what the transient lodging tax entails and provide for exemptions.

Sales tax applies to the entire amount charged for the sale of wine, liquor and beer. This includes all other federal and state taxes imposed on the product.

Additionally, importers, wholesalers and suppliers pay excise tax, which varies from $0.16 per gallon for malt beverages to $3.60 per gallon for liquor ranging from 22.1% to 80% alcohol by volume.

Rental vehicle businesses with physical or economic nexus in Nevada must pay sales tax when they first purchase a vehicle or charge sales tax each time they rent out the vehicle for 31 days or less. Additionally, you must include the county vehicle rental fee plus a 10% government service fee. The government service fee is imposed on the subtotal only. For instance, if the rental total is $600 before taxes, the 10% fee is levied on the $600.

Nevada imposes a cigarette tax of $1.80 per pack of 20 and $2.25 per pack of 25. Other tobacco products, including vaping products, typically attract a 30% tax on the wholesale price. However, premium cigars are only taxed at 30% of the wholesale price if it is more than 30 cents but less than 50 cents. If the amount is less than 30 cents, the tax is 30 cents, and if the amount is more than 50 cents, the tax is 50 cents.

Recreational marijuana attracts 16.85% sales and excise tax — 10% in excise and 6.85% in sales tax. Medical marijuana attracts 6.85% in sales tax. The excise tax is waived as long as the patient has their card. The cultivator pays a 15% excise tax when they first sell the marijuana to the retailer.

While groceries are tax-exempt, prepared food intended for immediate consumption is taxable at 6.85%. Food intended for immediate consumption includes:

It’s sufficient if the food falls within any of these categories. Prepared beverages are also taxed at the same rate in Nevada. Beverages include tea, coffee and coffee substitutes.

Local jurisdictions can impose additional sales taxes on the state base for various purposes. For example, a city or county may use the funds to construct public roads and infrastructure or address prevailing issues. The taxes vary across jurisdictions, with each having a unique purpose. You must add the county tax to the state minimum tax rate to determine the total tax due. For instance, the tax in Clark County is 8.375%, which includes the state tax rate of 6.85% plus 1.525%.

Some products, such as nonprepared foods, medical prescriptions and groceries, are exempt from sales and use tax in Nevada. Similarly, some customers are exempt from paying sales taxes in Nevada. A classic example is a nonprofit organization established for educational, religious or charitable purposes. The organization must apply for and receive approval from the Department of Taxation to get exempt entity status. An exempt organization must renew its status every five years.

Government agencies are exempt and do not need an exemption letter. Merchants that purchase goods to resell are also exempt. Qualified sellers will receive a valid resale certificate. You must keep the records for when you file sales taxes. If you misplace the certificate, you may request a new copy. Otherwise, the Department could hold you responsible for uncollected sales tax. Sometimes, the Department of Taxation will apply late fees and interest.

You may be responsible for the tax due with the applicable penalties and interest if you meet the requirements but fail to collect sales tax. Businesses with nexus in Nevada must register for a sales tax permit within the specified time frame and charge the right amount. Charging the incorrect tax rate can classify your business as noncompliant. Additionally, filing sales taxes with the Department of Taxation on time is essential. You may be sanctioned if you miss the deadline for paying sales taxes.

Business owners who contravene the laws will likely receive a warning letter with the payment deadlines. In other instances, the Department may conduct sales tax audits. It’s best to resolve tax balances as soon as possible. You may seek assistance from trusted tax professionals for a practical solution.

If the seller fails to collect sales tax, the consumer must pay use taxes to the state tax agency. Like sales tax noncompliance, failing to pay use taxes can also result in penalties and interest. Again, the Department can audit the buyer for violating the law.

It’s good practice for businesses to meet their tax obligations proactively. To minimize sales tax audit risk, avoid a mismatch in sales and use tax filing. Any irregularity in the sales return can trigger an audit notice. Ensure your sales tax return matches other third-party data, like 1099-K reports and federal income tax returns. If you are exempt from collecting sales tax, keep your exempt certificate handy and produce it when necessary. Finally, keep accurate records of all transactions. Proper documentation could be helpful during audits.

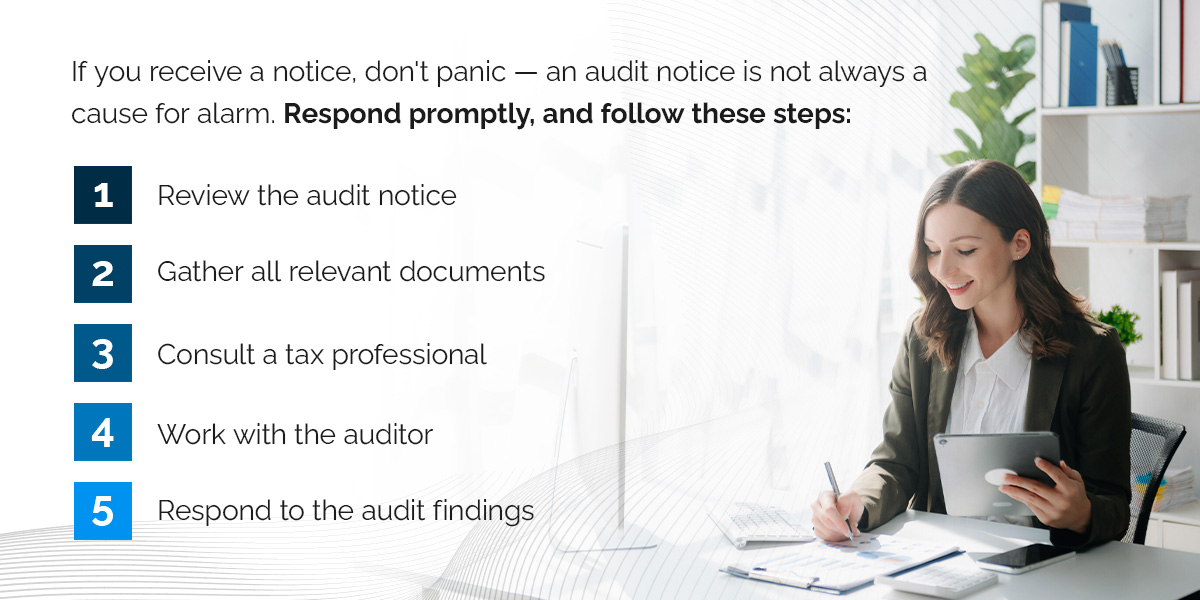

The Nevada Department of Taxation often audits businesses required to collect and remit sales tax. If you receive a notice, don’t panic — an audit notice is not always a cause for alarm. Respond promptly, and follow these steps:

Being professional and proactive in responding to a sales tax audit notice is crucial. Working with the best tax professionals can result in a smooth and successful process.

The auditors at the Nevada Department of Taxation are top professionals. You can expect them to be thorough when reviewing your business records and financial information. Their primary duty is to ensure compliance with the Nevada tax laws, which, in this context, relates to the collection and remittance of sales taxes.

The auditor will likely start the process by requesting information about your sales tax returns and supporting documents. For example, they may demand receipts, banking statements, financial statements and exemption certificates to understand the bigger picture. The auditor may also visit your place of business to observe activities. Some use that opportunity to review your documents in person. If there are any discrepancies, the auditor will likely ask you to clarify. Once an auditor determines that all sales are accounted for, they conduct a use tax audit as well.

Communication is vital during the audit process. Be cooperative and answer all questions to the best of your abilities. Concealing facts can worsen your case or create problems where none existed. It’s also vital to remember that while auditors are experienced and knowledgeable in their duties, they sometimes make mistakes. In such instances, you can challenge their findings using the established procedures.

In most cases, there will be an exit conference with the auditor at the end of the audit process. The auditor will produce an audit report with the corresponding documents to support their assessment. After a supervisory review, the Department may issue a Notice of Deficiency. The notice informs you that you owe additional taxes, with or without interest and penalties. It also states the due date for payment and the time frame for appeal. The Department will also add the following:

If you have any issues with the report, you must contest it within 30 days. It’s ideal to address the problems concerning documents and calculations with the auditor. Matters relating to the legal interpretation of sales tax are best resolved through an appeal to the Nevada Department of Taxation. You can protest unresolved issues before the issuance of the Notice of Deficiency using the Petition for Redetermination process. You must file the Petition for Redetermination within 45 days from the date of the Notice of Deficiency. Otherwise, you may lose your appeal rights.

The Department may refer the case for an administrative hearing if there are factual or legal disputes to resolve. A neutral Administrative Law Judge (ALJ) presides over the administrative hearing and makes a determination within 60 days. You may appeal the decision to the Nevada Tax Commission if you disagree with the ALJ’s decision. You must file the Notice of Appeal within 30 days. Again, if you are dissatisfied with the Nevada Tax Commission’s decision, you may further appeal to the appropriate District Court of Nevada within 30 days.

Businesses with nexus in Nevada must register with the tax authority. The Department of Taxation will issue a permit that allows you to collect, file and remit sales tax to Nevada. The sales tax permit is also called a Certificate of Authority. Let’s dive deeper into the registration and filing processes.

You can register for a sales tax permit in Nevada by following these steps:

First, gather all relevant information, including the following:

You can register online by visiting the Department of Taxation’s Nevada Tax Center online to access the digital registration system. Create an account using your name, email address and password. After you log in, you will provide information about your business and its sales tax obligations. Ensure the information you provide is accurate. You can submit the application after reviewing it for errors or omissions.

You may also register using a paper registration form and submit it by mail. You may be required to deposit funds based on the estimated sales tax due.

You will receive confirmation from the tax agency after you submit your registration application. Getting the permit generally takes a few weeks, but processing times can vary. Remember, you can only collect sales tax if you have a valid sales tax permit. Businesses that meet the requirements must go through this process.

You must register for a sales tax permit when you acquire an existing business in Nevada. Finally, remote sellers can register in multiple states through the Streamlined Sales Tax Registration System (SSTRS).

You must remit the sales tax you collect to the Department of Taxation by a specified date. This is a two-step process — filing the return and paying the tax. You must detail your total sales, the sales tax collected and the location of each sale. You can download the form from the Department’s website or file it online on the Nevada Tax Center web portal. You must file a zero return if no sales tax was collected.

The Department of Taxation assigns a filing frequency depending on your business’s size or sales volume. Larger companies are usually asked to file more frequently.

Business owners must file sales taxes according to the due dates associated with the filing frequency. The sales tax period could be monthly, quarterly or annual. Generally, you must file by the last day of the month following the tax period. For example, if your monthly reporting period is January, you must file by the end of February. If your quarterly reporting period is January 1 – March 31, you must file by April 30. Finally, if your annual reporting period is January 1 – December 31, you must file the sales tax return by January 31 of the following year.

If the filing deadline falls on a holiday or weekend, the due date is extended to the next business day. Late filing may result in penalties and interest on the outstanding tax due. If you miss the filing deadline due to circumstances beyond your control, such as an accident or harsh weather, the Department of Taxation may grant you an extension. You may be required to provide evidence substantiating your claim.

The Nevada sales tax holiday only applies to qualified Nevada National Guard members and their qualifying relatives who meet specific criteria. The tax holiday was legislated in 2021 and went into effect in October 2022. The law requires persons who seek to take advantage of the temporary sales and use tax exemption to apply annually through their commanding officer no later than 45 days before Nevada Day. The tax exemption period includes the last Friday in October, on which Nevada Day is observed, and the following Saturday and Sunday.

Eligible persons will receive a letter of exemption. They will pay sales tax to the retailer and then request a refund from the Department of Taxation. A formal request includes a written request, a copy of the letter of exemption and copies of receipts.

You must collect sales tax based on how you sell your products:

Sellers collecting sales tax manually must identify the goods or services subject to sales tax and apply the rate accordingly. You must ensure customers know the prices and the applicable rates. Keep records of all transactions and file the return in a timely manner.

If shipping charges, such as transportation, freight or delivery fees, are separately stated, they do not attract sales tax. Handling, packaging and crating are taxable, regardless of whether they are separately stated or included in the price. There are some exceptions, so it’s best to consult a tax professional at Polston Tax.

Our team comprises over 100 accounting, tax and legal team members, including those with particular knowledge of your state’s laws. In addition to bringing the knowledge you need, our Nevada tax firm is committed to helping you. We’re here to handle your tax needs, taking the responsibility off your shoulders.

Polston Tax helps businesses in Nevada and beyond with the sales and use tax challenges. Our experienced professionals can file your returns with end-to-end accounting and represent you during tax audits. We are ready to listen to your needs and provide practical, tailored solutions. Do you want to learn more about our services? Contact us now!