Sales tax can be a daunting topic for any business owner, especially if your organization sells across state lines. Knowing the ins and outs of sales tax law is essential for staying compliant and avoiding fines, and it can help you set up your business to meet the requirements of different states, including sunny Florida.

Whatever Florida’s sales tax rules mean for your business, the professionals at Polston Tax can help. We’ve compiled a comprehensive guide to sales tax in Florida to make sense of the complex tax code and support businesses in or doing business with the Sunshine State.

Sales tax is a tax paid to the government — state, local or federal — for the sale of specific goods and services. The list of taxable goods and services is long and includes everything from clothing to concert tickets. Different counties and municipalities in Florida can charge their own local and special district taxes, called discretionary sales surtaxes, which can go toward efforts like emergency fire rescue services and transportation systems. While Florida’s general sales tax is 6% — with some exceptions — these sales surtaxes often increase total tax rates to 7% or 7.5%.

Business owners act as agents of the state of Florida when they collect tax from purchases and pass it on to the relevant tax authority. In Florida, that authority is the Florida Department of Revenue (DOR). When you collect tax on a purchase, those tax dollars belong to the state of Florida, and you must remit them through regularly filed tax returns and payments.

Your role as a business is to properly manage and collect these taxes in line with applicable state and local laws. If you fail to do so, you may incur penalties and interest charges.

Use tax may apply to goods and services if sales tax wasn’t paid when they were purchased. For example, a Florida resident might pay use tax on an item purchased out-of-state and used within Florida, assuming they did not pay the other state’s sales tax. Other times someone might pay use tax instead of sales tax include:

In these cases, the purchaser must pay the use tax directly to the Florida DOR when they file their state income tax returns.

Collecting sales and use tax can vary widely depending on how you make your sales, but doing it correctly is essential. You’ll need to determine the correct rates, list them properly on receipts and keep careful records.

Sales tax is almost always collected at the point of purchase. Adding it is simple enough at a brick-and-mortar store, where your point-of-sale (POS) system can set the appropriate tax rate for your location and the type of product being sold. Some mobile POS systems, such as Square, can even use your GPS to identify your location and apply the right rates.

The process becomes more difficult when we move to online stores. Fortunately, many online sales solutions, like marketplaces and hosted stores, have tools to help you integrate tax rates. For example, if you host your store on Shopify, the platform offers integrated sales tax rates, which helps determine the appropriate rate based on applicable factors.

Florida uses destination-based sales tax, in which the rate is determined based on the buyer’s location, rather than the seller’s location. One unique exception is florists, which must use the rate at their place of business, even if selling to customers in other states. For online sales, a platform like Shopify could identify that the buyer is in Florida and apply Florida’s tax rates.

These additional services may require a fee, but they can be invaluable if you ship your items throughout the country. You can typically manage your tax settings from your store or marketplace dashboard.

Florida sales tax is calculated for each taxable transaction, and you must use the state’s rounding algorithm. Calculate your tax to the third decimal place and, if this third decimal place is greater than four, round up to the next cent.

You can apply this algorithm to the aggregate of the amount for all taxable items on an invoice, or you can apply it to the taxable amount on individual items.

When charging for sales tax, customers need to see what they’re paying for. On each invoice, receipt, sales slip or other evidence of a sale, you must state Florida sales taxes. You can merge sales tax and discretionary sales surtax into one total or display them separately.

Some industries, including alcoholic beverages, amusement machines, concession stands and vending machines, can use effective tax rates and rate divisors where it might be impractical to separately state the sales tax.

If you charge for shipping and handling, including services like delivery, freight and postage, Florida’s sales tax may apply. Typically, these charges are taxable when they’re included in the sale price of taxable tangible property and not stated separately on an invoice.

However, shipping and handling charges may be taxable if they’re unavoidable. If a purchaser can come pick up an item or arrange for delivery themselves, the charges are exempt, as long as they are separately stated on the bill of sale. If you charge your users for shipping, list the charges separately and offer an option to pick up the item, you do not need to collect and remit the taxes.

You can usually collect shipping and handling taxes through your POS or online storefront through your tax settings.

In general, businesses must pay Florida taxes if they have a nexus in Florida — which we’ll go over next — and sell taxable goods and services to Florida purchasers who must pay sales taxes. If we pull that phrase apart, we can see that the business needs:

Collecting and remitting sales tax typically falls to business owners, who usually charge it to the purchaser at the point of sale. These business owners might include retailers, service providers, leasers and renters and auctioneers.

Use tax, however, is often the responsibility of the consumer. Businesses need to pay a seller’s use tax if tax wasn’t collected on a sale that would qualify for Florida sales tax and if the business uses or stores a qualifying taxable item.

Consumers must similarly pay taxes on qualifying transactions, which include items subject to sales tax. If a sales tax wasn’t imposed at the time of purchase, the buyer must then report, file and remit the use tax on their income tax return. For instance, if you bought something online but the seller didn’t collect tax, you would be responsible for paying it to the state. Another common example is items purchased in another state and brought into Florida for permanent use, such as vehicles or furniture.

A sales tax nexus is a connection made between a business and a state that triggers the need to collect sales tax. Before the age of the internet, a Florida sales tax nexus usually occurred when a business had a physical presence in the state, such as an office or a retail store. Nowadays, businesses can also have nexus through economic and virtual connections. In these instances, the DOR can require the business to collect, file and remit sales tax.

An economic nexus is based on the value of taxable goods and services sold into the state, while a physical nexus is based on business locations or activities in Florida. If you have any kind of nexus, you must register your business with the state and begin collecting and remitting sales taxes. If you don’t, you may face penalties and interest fees or even an audit from the Florida DOR.

Other nexus activities include:

An economic nexus typically applies to remote sellers who lack a physical presence in the state but still do significant business with its residents. In Florida, remote sellers who make $100,000 or more in sales during the current or previous year would have an economic nexus. This threshold does not include a minimum number of transactions.

You may also have a Florida sales tax nexus if you keep inventory in the state, including warehouses and Fulfilled by Amazon (FBA) merchandise. If you sell through the FBA program, you must pay attention to where your inventory is stored because it can trigger a physical nexus.

Some activities that would establish a physical nexus in Florida include:

If your business triggers a Florida sales tax nexus of any kind, you must register for a sales tax account and begin collecting and remitting sales tax.

Remote sellers may not have a physical presence in Florida, but if they meet the economic nexus threshold of $100,000, they must collect and remit sales and use tax on qualifying transactions. Examples of these sales include online purchases, mail-order catalog purchases and furniture purchased from dealers in another state.

Some marketplaces will collect and remit taxes on facilitated sales delivered into Florida, but this service can vary from partner to partner, and you may need to set up your tax collection preferences through your account.

Except for exempt transactions, most goods and some services for sale, admission, storage or rental are taxable. Typically, Florida’s general tax rate of 6% applies, along with any discretionary sales surtaxes. Exceptions to the state’s tax rate include:

Most retail goods are taxable, with exceptions for items like grocery food, medical devices and transportation services. Other taxable goods include rentals, leases, licenses and admission into places of amusement, sport or recreation.

While many items are taxable in Florida, most services are not. The few taxable services include investigative and crime protection services, nonresidential pest control services, interior nonresidential cleaning services or services for repairing or creating products. If your services don’t fall under any of these categories, you may not need to collect and remit sales and use tax for them.

While we can’t list every single item that would be taxable under Florida’s sales tax laws, we can highlight a few notable categories. The funds from these taxes usually go toward related efforts, such as a gas tax helping to fund roadwork. Below are some of the sales tax rates for specific items, also called excise taxes.

Florida’s communications services tax (CST) applies to services such as cable and satellite television, video and music streaming and phone services, including Voice-over-Internet Protocol (VoIP). The businesses providing these services collect and remit the additional taxes for them.

Local rates can vary by jurisdiction but the Florida CST rate is 7.44%. Direct-to-home satellite services have a slightly higher rate of 11.44%.

Like many states, Florida has a tax on cigarettes. The state excise tax is $1.34 for a pack of 20, in addition to the standard sales and federal taxes. Florida also imposes a tax of 85% of the wholesale price for tobacco and snuff.

Florida imposes some of the highest excise taxes on alcohol, too. However, unlike most sales and use taxes, the alcohol excise tax is collected directly from the merchant selling the alcohol. Still, the consumer ultimately pays through higher alcohol prices. Florida’s regular sales tax and federal excise taxes also apply to these transactions.

Here’s how different types of alcohol are taxed in Florida:

Some counties also have transient rental taxes, which apply to rentals or leases for six months or less in certain accommodations, such as hotels, apartments, mobile home parts and condominiums. The transient rental tax rates can vary by county, adding an extra 3% to 6% to these transactions.

You may need to report and remit these taxes directly to the local government, or they may be charged by the owner of the accommodation. These taxes, also called hotel, tourism or resort taxes, are usually used by individual counties on tourism-related spending, such as maintaining the shoreline or building facilities.

If your business sells fuel, you’ll need to understand Florida’s fuel taxes. Although the consumer ultimately pays the tax, it gets wrapped into the total price you charge. Fuel tax rates change each calendar year and are due every month. They include the inspection fee, state tax, local option tax and pollutants tax. The 2024 total fuel taxes on motor fuel amount to $0.36525, not including local option taxes above the statewide minimum, which many counties impose.

Some other types of fuel taxed in Florida include:

Many products and purchasers are tax-exempt, removing the sales tax entirely. Some tax-exempt goods in Florida include:

Several purchasers can also avoid paying sales taxes, depending on their status or how they plan to use the items. These tax-exempt purchasers include government agencies, some nonprofits and merchants purchasing goods for resale. Before making these purchases, a buyer must have a Certificate of Exemption or Resale. Certificates of Exemption generally go to organizations like government entities, school districts and non-profit organizations, while each business registered with the Florida DOR receives a Certificate of Resale.

When you register with the Florida DOR to collect sales, your business is issued a resale certificate. They expire each year on Dec. 31, but registered, active dealers will be issued new ones. If you file electronically, you must print out your own certificate. If you file paper returns, you’ll receive the new one in the mail in mid-November.

Sellers must validate exemption or resale certificates for each transaction and maintain their copy for potential audits. If you cannot provide a certificate during an audit, you may be charged interest and penalties on the associated sales tax.

Florida often has sales tax holidays throughout the year, during which specific products do not incur sales or use tax. The state determines these holidays with each fiscal year. Two common sales tax holidays include disaster preparedness in late spring and back-to-school in early summer. They often promote important goals, like energy efficiency, safety or education, giving businesses and the public an incentive to buy helpful items.

While many of these holidays occur over short periods, such as a weekend or a few weeks, some can extend across an entire year or more. The tax holidays in the 2023-2024 fiscal year, for instance, include the following events:

Although the events can change yearly, they usually run in similar timeframes and address similar goals.

If you do not collect sales and use tax, you may be responsible for paying the uncollected amount out of your own funds. Businesses that have not been contacted by the DOR about their tax liability may be able to use Florida’s voluntary disclosure program, which can help reduce your tax obligations by waiving penalties.

Should the DOR audit your business, they may identify significant amounts of sales tax that your company must pay, along with potential interest charges, fines and legal fees. Florida uses a floating interest rate on late payments, changing it each year on January 1 and July 1. The 2024 update puts this rate at 12% between Jan. 1 and June 30.

Remember that collecting, filing and paying sales and use tax involves many steps, and staying compliant requires vigilance. Some of the ways you might fail to comply with Florida’s sales tax rules include:

Any of these activities could result in a warning letter from the Florida DOR with specified deadlines. You’ll need to resolve your tax obligations before then or face penalties, interest or an audit. If you continue to avoid your tax liability, the state can take legal action, such as issuing liens on business assets or even criminal charges.

The Florida DOR may conduct an audit on your business if it suspects you are underreporting or underpaying on your sales and use taxes. An audit notice typically comes by mail or phone from an auditor or a representative from the DOR. They’ll discuss the audit period and account records with you and determine when the audit will occur.

At this point, gather up all your records and consider contacting a professional in sales tax law. Unless you have prior audit experience and an impeccable understanding of Florida’s sales tax rules, working with a professional can help minimize risk and ensure everyone follows the proper procedure. Skilled sales tax attorneys can investigate accounts, represent you during the audit and help you make critical decisions with as much information and experienced guidance as possible.

Audits can be daunting, especially if you’ve never experienced one before. Though the scope of the process can vary widely, business tax audits typically follow a similar pattern.

After contacting your tax attorney, you will give the Florida DOR a signed power of attorney form, which allows them to discuss the audit with your tax professional and have your lawyer be present during the audit.

Your auditor will inform you of the records you’ll need to produce, such as tax returns, purchase and sales journals and sales tax exemption or resale certificates. In Florida, audits can go back three years, so you should keep records for at least that long. The more organized your records are, the smoother your audit should go.

Auditors usually conduct audits at your business, but the audit itself can take some time, depending on the amount and complexity of your records. Most businesses can expect the process to take a few days to about a week, during which the auditor will review your federal income tax return to reconcile your sales tax return and other accounting records. You will then have some time to gather any requested documents and schedule follow-up meetings, if needed.

Once finished, your auditor will notify you of their findings and discuss any taxes due or clarify information. You can also hold an audit conference if you disagree with the findings.

To avoid an audit, one of the first things you’ll need is a seller’s permit, which will allow you to collect, report and remit sales and use tax. You’ll then need to correctly file your sales tax returns on time.

You can register for a Florida sales tax permit online through the DOR. The application will ask you for information about your business, including the name, address, contact information, federal employer identification number (EIN) and the date your business activities started or will begin. You’ll also need a general idea of what you’ll sell, how much you’ll sell and how much of it is taxable.

Certain events require you to notify the DOR. The fastest option is to update your online account. Keep the DOR updated if:

If you ever change your legal entity or change ownership of the business, you must submit a new registration.

When it’s time to file your sales and use taxes, you’ll need to finish a two-step process of filing the sales tax return and remitting the required sales tax dollars to the DOR. Some businesses will have the option to file manually or electronically, while others will be required to file electronically. Filing frequencies often occur monthly or quarterly, but can also occur annually or semiannually.

You must prepare to file and pay sales tax electronically if your business paid $5,000 or more in sales and use tax in Florida’s prior fiscal year, which runs from July 1 to June 30. This requirement starts with the January tax return of the next calendar year. If you still submit a paper return, you’ll receive two $10 penalties, one for filing and one for payment.

To ensure you submit your returns and payments on time, keep these aspects in mind:

Although you can file your sales taxes directly with the Florida DOR, entering this data manually can be time-consuming. If you have a significant amount of transactions, consider working with a qualified accountant or bookkeeper. Many businesses working with a professional in Florida sales tax codes to save time and prevent expensive errors.

The due dates for sales tax returns and payments occur on the same day — the first of the month following each reporting period. After the 20th of that same month, your return and payment are considered late.

To avoid penalties and interest from late filing, you must initiate electronic payments and receive confirmation by 5 p.m. Eastern Time on the business day before the 20th day of the month. Give yourself plenty of leeway to avoid missing this deadline.

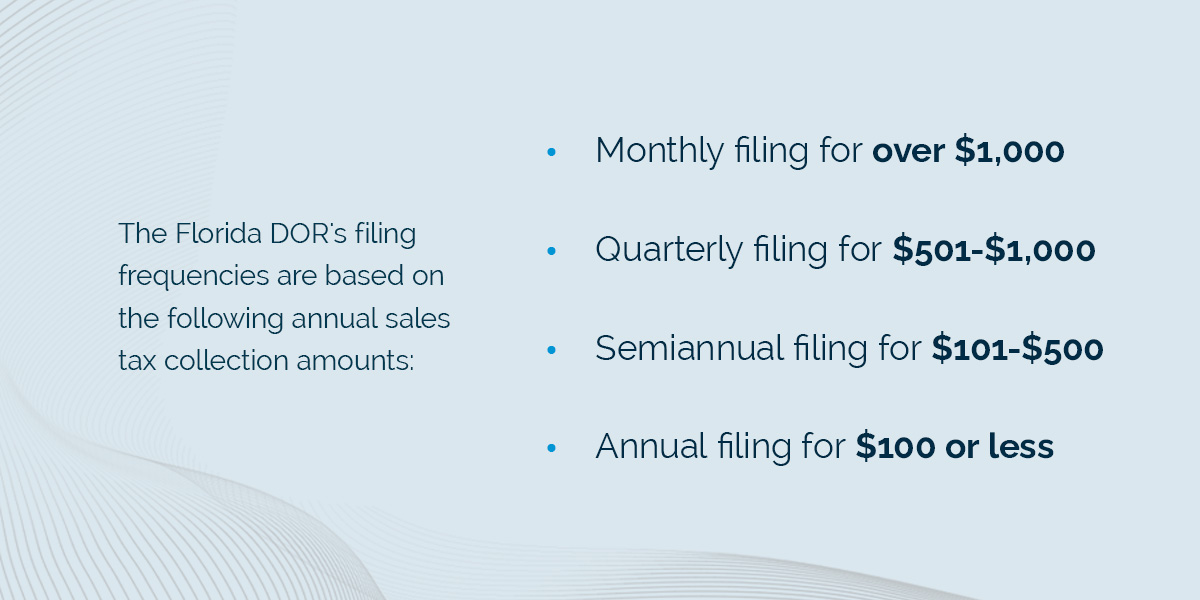

Most new businesses will file and pay quarterly, but the DOR assigns your frequency based on factors like sales volume and business size. The larger you are, the more frequently you might need to file. Sometimes, you can request a specific frequency. The Florida DOR’s filing frequencies are based on the following annual sales tax collection amounts: