State tax agencies use various strategies to recover unpaid taxes. One classic example is a tax lien, which allows the tax agency to secure an interest in a property until the owner resolves their tax liability. This tactic can make it challenging to handle the asset. Tax lien laws vary from state to state, but there are similarities. This guide discusses state tax liens and their impact on individuals and businesses. You also learn ways to prevent and remove tax liens, depending on your situation.

A tax lien is a tactic state tax authorities use to collect outstanding debt. It gives the agency an interest in your property if you fail to pay your taxes. This means the state tax agency can legally claim your assets and record the lien against your property until you resolve the tax balance.

State tax agencies can put a tax lien on any valuable asset, including real estate, vehicles, investment accounts, bank accounts and intellectual property. Once the lien is established, you cannot sell that property unless you pay your taxes. A lien is a powerful tool — taxpayers must act cautiously when they find themselves in such situations.

A tax lien is different from a tax levy. While a tax lien lets the state tax agency make a claim against your assets, a tax levy allows the agency to seize your assets to satisfy unpaid taxes. Unlike tax liens, tax levies are current and active collection actions. For example, the agency can levy your wages or accounts receivable to cover the taxes owed.

State tax liens can impact you in many ways, especially when you want to sell the asset. Liens can result in inconvenience, including limiting how you manage your assets. Let’s dive deeper into how tax liens can affect you:

A tax lien is a serious financial issue that can have long-lasting consequences. To mitigate adverse implications, you must address the lien promptly and work towards resolving the underlying tax debt.

Preventing tax liens is the preferred option in most cases. But how do you do that? Here are two tips on how to deal with back taxes and avoid liens:

Filing your taxes and paying balances promptly is the most effective way to avoid a tax lien. This means determining your filing status by verifying your residence in the state where you must file taxes. State laws vary, so it’s best to consult a tax professional for tailored advice. However, the process generally includes the following:

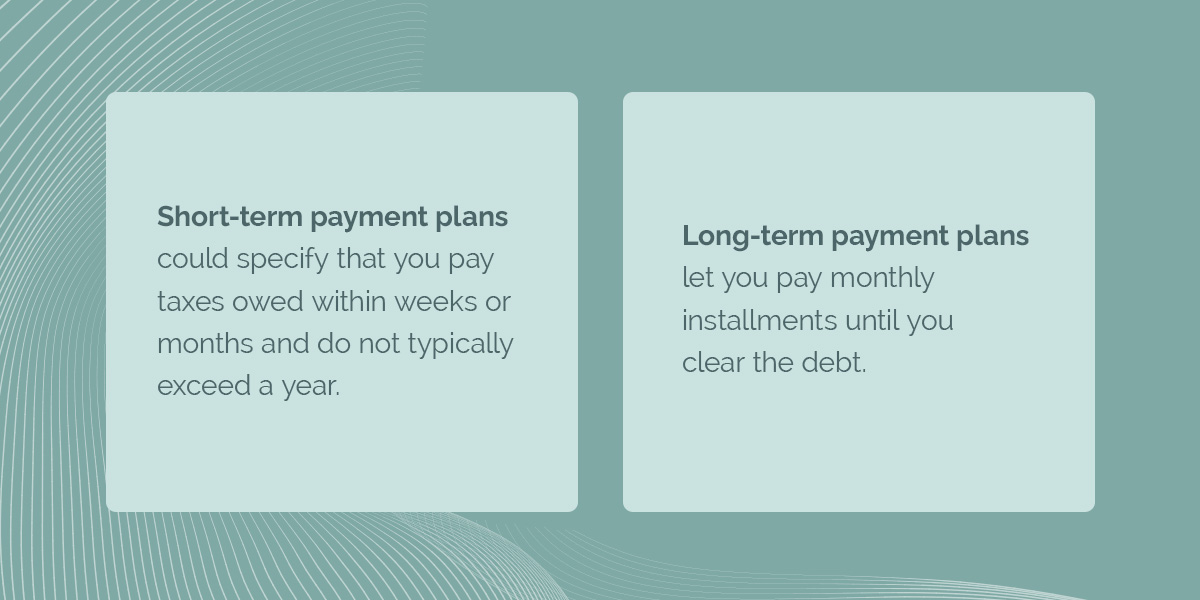

If you have unpaid taxes, you can still prevent tax liens, but you must act promptly. A tax balance can accrue interest and penalties, so avoiding the extra burden is best. If possible, you should pay one lump sum to eliminate the taxes owed. However, if the amount is significant, you can set up a payment plan with the state tax agency. Payment plans allow you to pay back taxes over an extended duration.

There are short-term and long-term payment plans. Short-term payment plans could specify that you pay taxes owed within weeks or months and do not typically exceed a year. Long-term payment plans let you pay monthly installments until you clear the debt. The tax agency will provide a payment plan, considering the taxes owed and your financial situation.

You can set up a payment plan by contacting the state tax agency. But first, review the eligibility requirements in your state. There are often financial caps for each type of payment plan. Also, payment plans may come at a fee, so it’s essential to check. You must provide information such as your tax identification number and file the relevant forms. Be ready to explain why you cannot pay the full amount owed. For example, you could be facing financial hardship or unexpected expenses.

Propose a payment plan based on your financial situation, but note that the agency makes the final decision. You may be able to negotiate monthly installments or another arrangement that fits your budget. While this process might seem tedious, working with a tax professional can simplify things.

If you cannot pay your taxes or agree on a favorable arrangement with the state tax agency and they put a tax lien on your asset, there are ways to remove the lien. Here are three strategies to consider:

Tax liens can affect multiple assets, from real estate to bank accounts and investments. However, in some cases, you can request the state tax agency to discharge or remove the lien from a particular asset. If approved, the agency will remove the lien from that property while the others remain. Discharge of property can happen due to several reasons:

Discharge allows you to sell the property without encumbrances. Discharge processes can be complex. It’s best to work with a tax professional to assess whether you qualify and negotiate on your behalf to increase your chances of success.

Sometimes, you can request the state tax agency to withdraw the lien notice. Although this arrangement does not clear the tax owed, it allows you to apply for credit or sell your assets without challenges. The withdrawal requirements may vary from state to state but generally cover the following instances:

Also, you can have the lien removed from public records after you:

Tax liens take precedence over other credits, but that can change. Lien subordination is when the state tax agency agrees to relegate its interest in the property in favor of other creditors. It’s like letting another creditor cut in line. Technically, the arrangement does not remove the lien — it only allows another creditor to move ahead of the state tax agency.

Tax agencies will usually accept a subordination request if you want to refinance the property at a lower interest rate to make larger monthly payments on your taxes. Subordination makes it easier for creditors to offer loans against your equity. You can use the funds to reduce your tax balance.

Resolving state tax liens can be a complex process, making it essential to hire a trusted professional. Here are three ways they can help:

Certified public accountants (CPAs), enrolled agents and tax attorneys have an in-depth knowledge of state tax laws and can help you understand the complicated language and processes. They can educate you on your tax obligations, deadlines and potential pitfalls to avoid. Tax professionals can also provide ongoing support to help you avoid collection actions like liens.

Tax professionals can help you avoid costly errors. For example, they can help you file your taxes accurately and timely. If you miss a deadline, a tax professional can apply for an extension to avoid penalties. Moreover, resolving state tax liens involves paperwork and strict timelines. By working with a professional, you can avoid mistakes that can lead to additional sanctions or extended liens.

Most professionals are skilled negotiators who can advocate on your behalf to reach a favorable resolution with the tax entity. For instance, they may negotiate to remove an existing lien and agree on a payment plan that suits your financial capabilities. If your case escalates to legal proceedings, a tax attorney can represent you and help protect your rights.

Here are answers to some of the frequently asked questions regarding state tax liens:

Tax liens can affect your ability to secure loans. While they do not show on your credit report or negatively impact your credit score, they can appear on public records. Creditors can access this information and use it to determine whether they should extend credit or approve a loan.

You can negotiate tax liens with the state agency, which requires knowledge and skill. Whether you are negotiating an installment payment, offer in compromise or any other arrangement, you must understand your financial situation and the relevant tax laws. Additionally, you must present persuasive arguments with strong supporting documentation to convince the agency. You should consult a tax professional to assess your situation and provide representation where necessary.

State tax agencies can transfer a tax lien from one property to another in several instances. For example, the agency may allow the transfer if you want to sell the property to pay part of the tax balance. You must convince the agency that transferring the lien will benefit them and allow you to pay the balance faster.

Do you need help resolving a tax lien with your state tax agency? Polston Tax has knowledgeable and licensed professionals ready to assist, regardless of how complex your case might be. We can examine your situation, provide tailored advice and handle all communications with the state on your behalf. Our professionals understand the tax codes and have years of experience in the industry. Schedule a free consultation today to get help with tax lien resolution!