Beginning with the 2025 tax year, the cap on state and local tax (SALT) deduction rises from $10,000 to $40,000, or $5,000 to $20,000 for married filing separately. It will revert in 2030, creating an arrow window for residents of high-property-and-income-tax states to take meaningful action. The new law includes a 30% phase-down for high earners, limiting the benefit for households with modified adjusted gross income (MAGI) above certain thresholds.

This temporary expansion gives residents with high tax state deductions a five-year planning window to maximize deductions, reduce tax debts and avoid legal levies or audits. With the Internal Revenue Service (IRS) and state taxing entities monitoring compliance closely, finding a professional tax partner to help you avoid audits, collection actions and costly mistakes becomes critical.

The SALT deduction is an existing itemized deduction (Schedule A) that lets taxpayers itemize and subtract state and local taxes, usually income and property taxes, from their federal income. In the past, residents in high-tax areas used this to reduce their federal liabilities, but the Tax Cuts and Jobs Act (TCJA) of 2017 put a $10,000 cap for tax years 2018 through 2025. This cap ended unlimited deductions and would trigger legal, political and migration debates.

The new federal bill, the One Big Beautiful Bill Act (OBBB-Act), adjusts the cap starting in tax year 2025. For the first time since 2017, taxpayers in high-tax states will see meaningful relief.

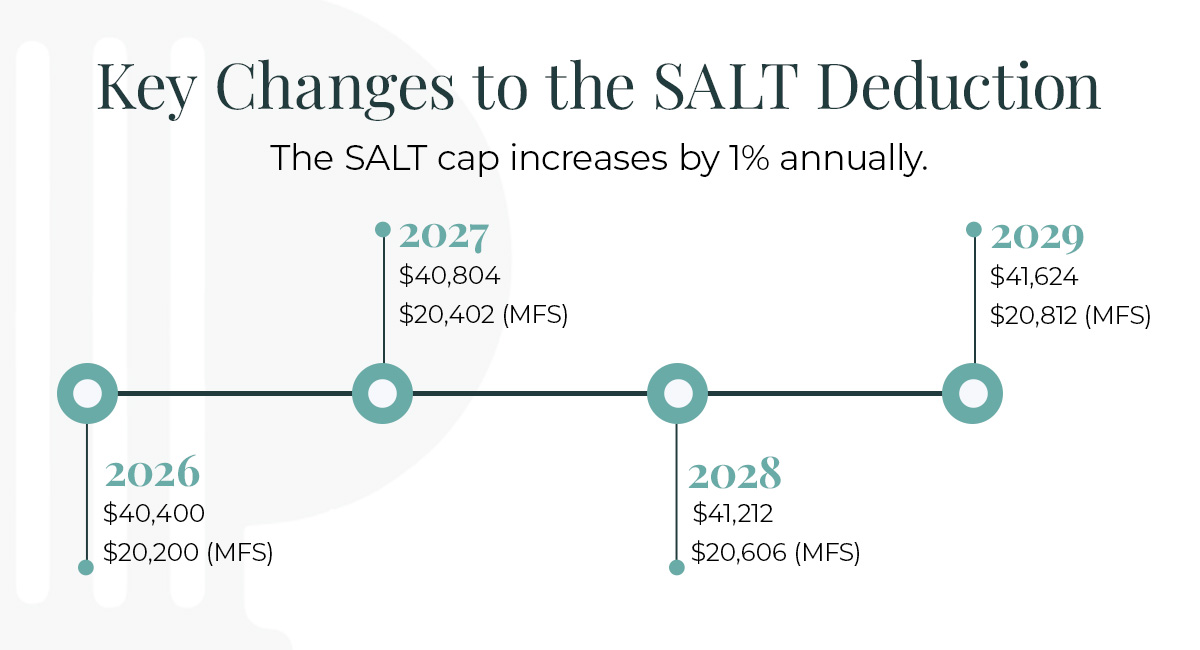

The OBBB-Act, signed on July 4, 2025, temporarily lifts the cap. By temporarily raising the cap and phasing it in through 2029, the law creates new opportunities for middle- and upper-middle-income households to reduce their federal tax bills. The cap changes each year according to income thresholds:

This structure creates a short-term opportunity with a hard deadline.

The expansion mainly helps middle-and upper-middle-income taxpayers in high-tax states who itemize deductions. For example, a New Jersey homeowner paying $30,000 in property taxes and $15,000 in state income tax can now deduct the full $40,000 cap in 2025. Under the TCJA rules, the taxpayer was limited to $10,000.

Those who keep taking the standard deduction of $30,000 for married filing jointly in 2025 may not see much change unless their combined itemized deductions exceed that threshold. Still, more filers in high-tax states will now find itemizing worthwhile.

The law limits benefits for high-income taxpayers. Joint filers between $500,000 and $600,000 MAGI get a gradual phasing out of this state and local tax deduction. Taxpayers with over $600,000 MAGI’s deduction is capped back at $10,000, eliminating most of the relief. This restriction ensures the wealthiest taxpayers do not reap full benefits, but still gives partial relief in the $500,000 to $600,000 range.

Pass-through entity owners, such as limited liability companies (LLCs), S corporations or partnerships, remain eligible for SALT workarounds, but the cap applies at the individual level. This clear structure offers planning flexibility for business owners with higher incomes.

States with high property and income taxes, such as California, New York, New Jersey, Connecticut, Illinois, Maryland and Minnesota, will benefit most. However, analysts caution that expanded SALT relief may not reverse long-term migration trends. While state budgets see a temporary boost from better federal deductibility, the five-year window is too short to guarantee lasting revenue stability.

The expanded deduction is a rare change for high-tax residents to reclaim thousands in tax savings, but it comes with strict limits and a hard expiration date. Failing to plan means risking losing valuable decisions or triggering audits for which you will need representation if the rules are misapplied. With just under five years to go to 2030, taxpayers should act strategically:

Partnering with a knowledgeable tax professional gives you a partner who will help you model these scenarios to ensure you maximize your deductions while staying compliant.

Unless Congress acts again, the SALT cap will revert to $10,000 in 2030. Taxpayers in high-tax states should prepare for this return to restrictive rules now. Waiting can lead to larger IRS or state taxing entity bills, unexpected debts or audits.

The message is clear. Use the next few years wisely. Build a strategy that captures maximum benefit under the expanded cap while preparing for a future where the $10,000 limit comes back into force.

The temporary expansion of the SALT deduction offers taxpayers a rare, high-value opportunity. But that window closes in 2029, with the $10,000 cap returning in 2030. For those facing tax debts, audits, levies or planning ahead, the time to act is now. Partner with a reliable tax professional to help you with proactive planning and tax resolution.

Polston Tax Resolution and Accounting can help you navigate the 2025 SALT deduction cap changes and plan your taxes accordingly. Since 2001, we have had a team dedicated to Advanced Tax Planning services, and we streamline your tax preparation process with professional tips and guidance. Working with us means getting a dedicated team of case managers, accountants and tax attorneys. Our goal is to give you the tax help you need and find the best tax solution for your situation.

Contact us today for your free consultation.

*This information is for educational purposes only. For advice tailored to your specific situation, consult with a qualified tax professional.