The oil and gas industry produces federal revenue that supports a variety of government programs. In 2023, oil and natural gas leases accounted for 93% of the total federal revenue from onshore leasable federal lands, totaling $8.497 billion. Royalties made up the largest portion of this revenue at $8.370 billion.

The recent changes in federal law, particularly the One Big Beautiful Bill Act (OBBBA), have significant implications for these earnings, which are shared by the federal and state governments. While the Bureau of Land Management is primarily responsible for implementing laws related to oil and gas leases and development, other committees, such as the House Committee on Natural Resources and the Senate Committee on Energy and Natural Resources, are also responsible for conducting oversight.

The economic outlook for energy-producing states is highly variable. Learning about the federal changes can help you prepare for potential tax implications and understand how they might impact your cash flow. This article explains what you need to know.

Different federal laws play key roles in the revenue of oil- and gas-producing regions.

The Mineral Leasing Act of 1920 (MLA) governs onshore oil and natural gas programs. It addresses the challenges posed by the Mining Act of 1872, which allowed private parties to claim mineral deposits without paying government royalties. This resulted in ineffective management of oil, gas and other valuable resources.

The MLA provides a leasing system, where the government grants private parties the right to extract minerals while maintaining ownership. Companies only need to pay a royalty fee based on production. This offers the federal government a reasonable amount of return while promoting the responsible development of natural resources. The Secretary of the Interior is responsible for overseeing the leasing process.

The Inflation Reduction Act of 2022 (IRA) was enacted during the Biden administration and amended the MLA’s provisions. The act resulted in a:

The royalty rate increased to a minimum of 16.67% of oil and gas production value, effective August 16, 2022. This rate applies for 10 years and will not fall below 16.67% after that period.

The IRA also links offshore oil and gas lease sales to those of offshore wind. It requires the Interior to offer minimum amounts of federal acreage for oil and gas leases before it can offer offshore wind leases and onshore wind or solar rights-of-way.

The OBBBA was enacted on July 4, 2025, and includes changes to the country’s energy policies. It reversed key provisions set by the IRA, pivoting to a renewed focus on domestic energy, while scaling back on clean energy technologies. The OBBBA:

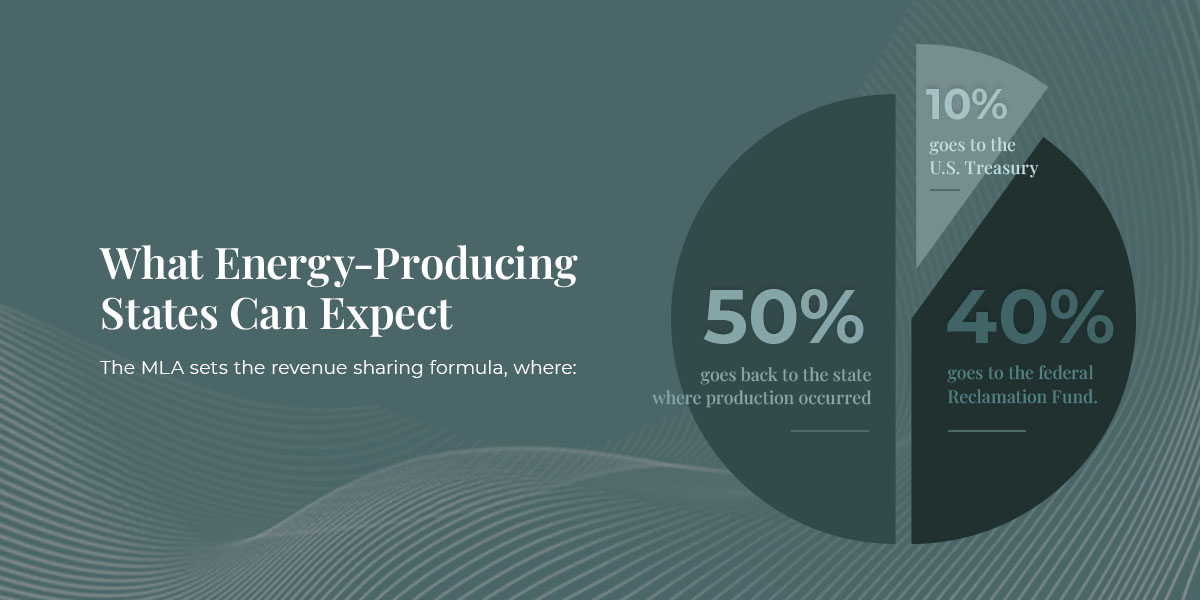

Changing the minimum royalty rate directly impacts the revenue and disbursement of oil and natural gas leases. The MLA sets the revenue sharing formula, where:

Alaska is an exception, where it receives about 90% of the revenue, with 10% going to the Treasury. State disbursements are subject to a 2% administrative fee.

In 2023, when IRA rates were applied, the $8.497 billion revenue consisted of:

Disbursements amounted to:

The reduced rates in the OBBBA can impact the federal and state revenue, while also reducing the regulatory burdens experienced in the industry. The reduction is expected to result in 225 additional leases for 2026, with an average of 160 wells in the next few years. Nine states are also required to have quarterly onshore lease sales:

According to an analysis by Resources for the Future, oil and gas production is currently at an all-time high. The top three regions include Williston, parts of Appalachia and Denver-Julesburg. However, 11 regions are currently in a long-term decline, such as Wind River, Green River and Piceance.

Apart from the changes in royalty rates, OBBBA brings about tax changes within the industry, including:

While state revenue is impacted by the recent changes from the OBBBA, the industry benefits from the rate and requirement adjustments, which reduce obligations and revive certain tax benefits. To make the most of the changes, consider working with tax professionals who can suggest the most suitable tax strategies for your company.

Polston Tax is a full-service tax and accounting firm that offers advanced tax services. With over 100 years of combined experience, we can help you expertly manage your taxes, whether you need to prepare and file your tax returns or negotiate a resolution.

Our team comprises over 100 tax attorneys, certified public accountants, case managers and other professionals. Let us help you navigate federal law changes and maximize your revenue. Request a free consultation today.

Linked Sources: