Receiving a letter from the IRS can be intimidating, especially if you’re unsure what the notice is for or what to do next. Fortunately, many notices are purely informative and may even signify that you’re due a refund!

Our guide explores everything you need to do — and what not to do — after getting a notice from the IRS or the state so you feel prepared and can confidently take the next steps. By exploring the meaning of different notices and working with an experienced tax attorney, you can easily navigate these letters.

IRS notices and letters are the primary form of communication between the agency and taxpayers. They serve different purposes, such as informing you that:

Humans often fear the unknown — and the unfamiliar territory of IRS letters is a prime example. If you’ve been wondering what your IRS letter means, we’re here to help. Discover some of the do’s and don’ts of getting IRS letters in the mail.

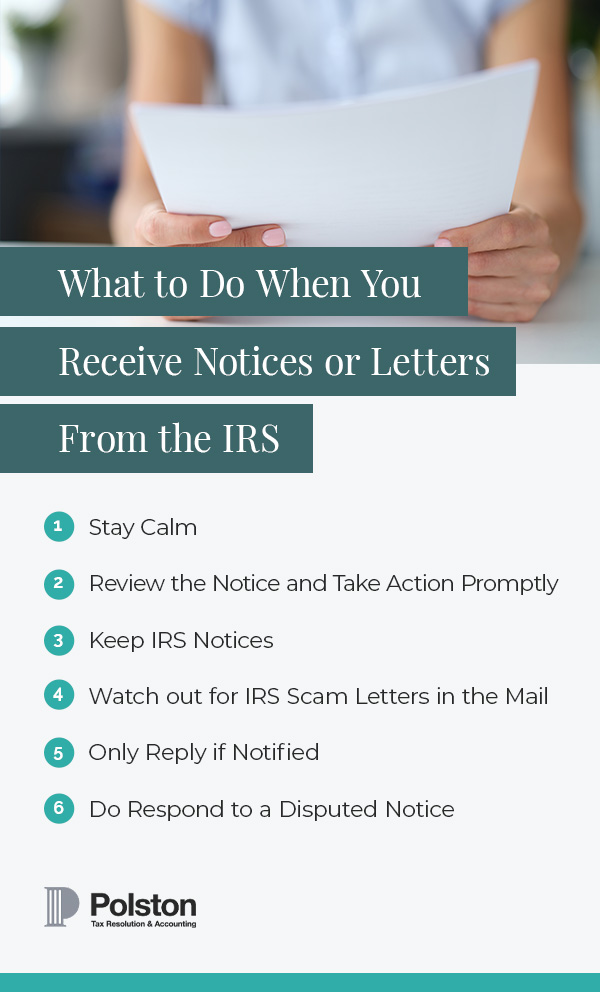

Take a deep breath and remain calm when you receive a letter from the IRS. Often, these notices are simply a way for the agency to share an update about your tax account or refund. Understanding the notice and what you’ll need to do to avoid minor issues becoming bigger is essential.

It’s unlikely that the IRS would seize your assets or garnish your wages without sending prior notices. Therefore, you must remain composed and keep your documents intact. If you wish to learn more about the letter and its implications, you may contact a reputable tax professional for tailored advice.

If you receive a letter from the IRS or the state, read and review it carefully. The notice will usually outline its purpose and what you need to do next. For example, if you’ve received a notice CP14 First Notice of Balance Due, it means there is a balance on your unpaid taxes that you owe. If you agree to the amount of the CP14, you can arrange to make a one-time payment online or set up a payment plan.

You must take action after reviewing what the notice is asking you for. Waiting too long to pay your tax balance could incur penalty charges and additional interest.

It’s crucial you retain the notice from the IRS or the state, even after you’ve taken the necessary actions. Keeping all these letters organized for your records will give you a reliable paper trail of your tax transactions. Sometimes, you’ll need information on the notice for your tax return, so consider filing them somewhere secure for the future. Ideally, you must keep the notices or letters for at least three years. You will need them during IRS audits.

Upon receiving a letter from the IRS, take a second to ensure it’s not a scam. Unfortunately, many criminals imitate the IRS and use their letterhead to scare people into giving them money. Remember that the IRS primarily communicates through the mail. If you’re getting messages from the IRS via one of the following channels, treat the correspondence as suspicious:

You should only share financial or personal information if you’re sure you’re communicating with the IRS. If you receive a notice saying you need to make a payment, but you are certain you don’t owe the government money, contact a tax professional such as a tax attorney. They can look over the letter and establish its legitimacy.

You usually have no reason to reply to a notice unless you receive specific instructions. For example, the notice may require you to pay a certain amount or provide some information. If you agree with the content, all you need to do is follow the instructions. Otherwise, you must file a response with reasons for your disagreement. Tax attorneys can help you deal with the complexities.

Anytime you disagree with the information on a notice from the IRS, you should respond with a letter explaining why you’re disputing it. You can send your dispute with all the necessary documentation to the address on the IRS notice. To craft your response, simply:

Submitting the supporting paperwork helps you resolve the case more efficiently and get the desired outcome. Tax professionals can help you prepare adequately. For more information, check out “Responding to a Notice” on the IRS website, or take a look at Publication 594, the IRS Collection Process.

The IRS communicates with United States taxpayers using over 70 different letters and notices. Use this breakdown of the most common types of IRS letters to further your understanding.

Correspondence letters are the documents the IRS sends to provide or request information from the taxpayer. Here is an overview of what you can expect in the mail and what you must do.

If you file your tax return and discover an error at a later point, you can contact the IRS or file an amended return to correct it. If the IRS corrects the mistake and makes the necessary changes to your return, they may send a CP22A. The CP22A notifies you that the adjustment has resulted in a balance due on your tax return. This notice contains the due date and the payment amount. Failing to comply with the instructions in the notice can lead to interest and penalties.

If you agree with the changes, you must correct the copy of your tax return and pay the balance by the due date. You can contact the IRS to make payment arrangements if you need to split the payment over a few months. However, if you partly or wholly disagree with the IRS regarding the changes, you must contact them and provide the necessary paperwork to prove your claim.

The IRS sends a CP75 Notice when they need you to provide more information or documentation about the year’s return. The information may relate to one or more of the following:

Depending on your situation, the IRS will let you know what you need to send back to them. Make sure that you send them copies of the documents they request. If you send the originals and they get lost in the mail, you won’t be able to make another copy to send to them. This is another instance where having a tax attorney is a tremendous asset to your case.

The IRS sends Letter 725-B when they schedule a meeting to discuss unpaid and unfiled tax returns. The meeting is typically in person at the IRS office or your premises, but you may arrange an over-the-phone meeting, depending on the situation. The notice will contain the date, time and location of the meeting and details regarding your tax liability. It will also provide the contact details of the revenue officer assigned to your case so you can call to reschedule or confirm the appointment.

The IRS Notice of Deficiency is a legal determination that you owe additional income taxes and often interest on that amount, plus additional penalties to the IRS. The IRS uses this form when they propose a change to a tax return because of an error where what you submitted doesn’t align with what they have on file.

People sometimes refer to this notice as the 90-day letter since the IRS gives taxpayers 90 days to dispute the change and the Notice of Delinquency. The notice comes with Form 5564, which shows the amounts due because of the changes. If you agree with the changes made by the IRS, you sign the form and return it to the IRS. If you disagree, you can petition the U.S. Tax Court within the specified period.

The IRS sends a CP2000 Notice when the income or payment on file does not align with what you’ve recorded on your tax return. The IRS will propose changes to your tax form with explanations. This is not an audit letter but a notice letting you know that the math was incorrect. If you agree with the changes, you can respond in writing and make your payment. If you disagree, you can indicate that on the form, give reasons and mail it back to the IRS. Working with a tax attorney can help you take care of your CP2000 Notice efficiently and accurately.

The IRS sends these notices to remind you of unpaid taxes:

Say you have filed your taxes with the IRS and maybe even sent a payment. If you still have a balance due, the IRS will use the CP14 letter to inform you of your unpaid taxes. It’s a first reminder or warning you owe money.

In June 2023, the IRS began issuing CP14 notices to taxpayers with unpaid taxes exceeding $5. A CP14 notice indicates an outstanding tax liability, detailing the amount owed and any penalties and interest and provides a due date for payment. It is typically the IRS’s first attempt to collect overdue taxes. Reasons for receiving a CP14 notice include unreported income, inaccurate deductions or processing backlogs.

If you’ve received a CP14 Notice that tells you about a tax payment you owe and you’ve set up an installment agreement plan, you’ve probably received a CP14IA. The IRS sends the notice to remind you about the payment plans you’ve created and how much you owe for each installment. Failure to address the notice can result in additional penalties and interest. The IRS offers multiple payment options, including installment agreements and short-term payment plans, for those unable to pay by the due date. Consulting a professional tax attorney, like those at Polston Tax, can help navigate the process, identify appeal options and potentially reduce the overall amount owed through strategies like Offers in Compromise.

If you’ve received a CP501 notice from the IRS, they’re reminding you that you have a balance due that you haven’t paid. If you continue to ignore this notice, the IRS may send further notices reminding you of the tax balance. The IRS may also commence collection actions, such as filing a notice of federal tax lien. A lien is a claim to your assets, such as money in your bank account. Therefore, you must pay the amount shown on the notice immediately if you have unpaid taxes.

You have various payment options when you receive a CP501 notice, including electronic, check and cash. If you cannot pay the total amount, you can negotiate a payment plan such as an installment agreement. Remember, delayed payments usually attract interest and penalties. If you disagree with the notice, you must contact the IRS and provide the necessary paperwork justifying your position. Relevant documentation includes amended returns and canceled checks.

Following the CP501 letter, you might receive a second reminder called notice CP502. It’s very similar in spirit to the CP501 letter. The language might be a bit firmer, but it basically reminds you that you owe the IRS money. The tax bill on the CP502 notice will likely be higher because of the interest and penalties accrued since the first notice. There will also be a deadline for payment. If you agree, you must take this notice seriously and pay the tax balance. Payment plans may still be available at this point, so you can take advantage of them. If you disagree, call the IRS. They can make mistakes, but you must be proactive and correct them.

Though it’s likely the third notice you’ve received, the CP503 letter acts as an official second request that there’s money owed on one of your tax accounts and you need to take action. Like the previous notices, the IRS will explain what to do. The notice will also detail the payment options and the due date. Considering that it’s the third notice sent, the IRS will be firmer in their demands. They are sending these reminders because you have likely ignored the previous ones, which is not advisable. You can contact a tax professional if you need assistance.

If you receive a CP504 in the mail, you have probably ignored all previous notifications from the IRS regarding a tax bill you owe. This is a notice that the IRS intends to levy your assets to pay off your past due amount.

While many of the notices and letters from the IRS are provided for information purposes and shouldn’t make you nervous, the CP504 notice should. After sending you the CP501, CP502 and CP503 notices, the IRS will need to take action against you. The CP504 is the final notice the IRS sends. If you don’t pay by the provided day, the IRS may look for assets it can levy toward your tax liability.

The notice of intent to levy usually provides a 21-day deadline. After that period, the IRS will likely file a federal tax lien. As discussed earlier, the lien allows the agency to levy your wages and bank account. They can also seize your properties or take your state income refund to pay the tax balance.

The CP504 notice can also activate the revocation or denial of a U.S. passport rule under the Fixing America’s Surface Transportation (FAST) Act. This law generally prohibits the State Department from renewing or issuing passports to taxpayers with seriously delinquent tax debts.

The IRS sends collection notices to warn or inform you about the intention to commence collection activities:

The CP90 letter is a notice from the IRS that they will put a levy on your assets. This means they can levy any real estate, bank accounts and retirement benefits. You can request a due process hearing if you disagree with the letter.

If you disregard previous requests to pay the taxes you owe, the IRS may send the CP90 Notice. The notice informs you they’ll levy your assets, such as:

If you’ve received this notice, you must take action right away. Reach out to a reputable tax attorney for guidance if you need help understanding the next steps after getting a CP90 Notice.

When the IRS sends a CP91 Notice, they’re letting you know that they intend to levy a maximum of 15% of your social security benefits to pay the taxes you owe. When you receive this notice, the chances are the IRS has sent earlier notices requesting payment, but you failed to comply. Notice CP91, like Notice CP90, typically has a 30-day deadline. When the time passes, the IRS will begin the deductions until you pay the tax owed or arrange a payment plan.

Notice CP297 is similar to the CP90, but it goes to your business instead of going to you.

A CP297 Notice is really the IRS covering all their bases of communication. This intent to levy is another warning that if you continue not to take any action, they will move forward and seize assets.

If you don’t respond to the CP90 or the CP297, the IRS will send you their final notice to levy through an LT11 Notice or Letter 1058. These indicate that the IRS intends to seize your property because of unpaid taxes. Once you receive one of these notices, you should contact the IRS immediately. A tax attorney is one of the most valuable assets you can have on your side in this situation.

A CP88 Notice indicates that the IRS is holding your refund because you owe taxes or haven’t filed at least one tax return. The agency will notify you immediately if they’re keeping your expected return and if they’re applying it to the previous year’s balance. When you receive this notice, you must file your tax return immediately and explain why you’re filing late. If you believe you’re not required to file or have already filed, indicate that in your response.

If you set up an installment agreement with the IRS but don’t make good on your promise to pay, the IRS will send you this letter. When you receive a CP523, the IRS informs you that they will terminate your installment payment plan if you don’t speak with them about resolving the taxes owed.

If you refuse to respond to this letter, the Internal Revenue Service will move forward and garnish your wages or seize your assets to recoup your taxes owed. You must take this note seriously because the IRS will not send you another warning.

This is a newly designed form from the IRS. It simply states that you have overdue taxes and the IRS wants to collect your unpaid money. If you receive an LT16, the IRS likely sent previous notices requesting that you file a return and pay the tax balance, but you did not respond. Ignoring an LT16 Notice may lead to enforcement action from the agency.

The IRS will use this form if your tax bill is seriously delinquent. If you receive this notice, you should know the IRS has communicated with the U.S. Department of State (DOS) about your delinquent taxes. If the IRS deems your tax account as seriously delinquent, they have the right to place limitations on your passport. The DOS can also opt to revoke or place limitations on your current passport because of this notice.

The IRS typically sends Letter 1153 and Form 2751 to employers who fail to pay their federal withholding taxes outlined in the Federal Insurance Contributions Act. These letters are delivered together. Letter 1153 is a TFRP assessment, while Form 2751 is a document you sign when you agree to pay the taxes owed before returning it to the IRS.

While the IRS may have paused collection activities due to the COVID-19 pandemic, practices have resumed as normal. So, it uses the LT38 Letter to notify taxpayers that it’s resuming collection activities for unpaid tax balances. It’s vital to file missing tax returns as soon as possible to stop interest and penalties from accruing. You can make a partial payment if paying the total would be financially challenging. Then, contact the IRS to negotiate a payment plan.

The thought of being audited by the IRS can be overwhelming and a little scary. Working with a tax attorney can make navigating the audit process simple, and they can help you file an appeal if necessary. The IRS uses several forms related to audits. The letters vary depending on how the IRS proceeds with the audit.

A tax attorney can assist you with your tax issues. These lawyers are well-versed in state, federal and local tax codes that you may or may not have abided by. They help you when you’re in trouble with the IRS and can help you with vital tax advice. When you partner with an attorney before receiving a letter from the IRS, the lawyer can help you avoid getting to this point. A tax attorney can help with the following:

Attorneys have the knowledge and the resources to conduct needed legal research. They must know about the latest tax laws and policies that change often. The correct tax attorney will know where to find this updated information so they can apply it to your case.

Do you disagree with the letter sent to you by the IRS? Want to know more about what the Internal Revenue Service needs from you? If so, you can speak with a tax attorney to learn more about your legal options. Instead of fumbling on the internet trying to find an answer to what you’re going through, you can depend on a lawyer to help you make it make sense. The attorney will also speak with the IRS and negotiate on your behalf.

If you’ve received a notice to appear in court for your tax situation, it is best to speak with an attorney. Unless you’ve had years of experience practicing law or have courtroom experience, you may want to leave this job to the professionals.

When you’re in a tax courtroom, you must understand the legal codes in your case and how to raise the proper defense. If the other attorney, who represents the IRS, knows that you are going up against them without help from a tax lawyer, they will see you as vulnerable.

Working with a tax lawyer who has courtroom experience is vital to winning your case or having the case provide you with favorable terms. It helps to work with a local tax attorney because they know how those courtrooms work. They have experience dealing with other lawyers and are familiar with the judges and how they rule.

As an American citizen, you have rights, especially regarding taxes. Several laws can work in your favor, and your attorney can use them to lessen your burden. Regardless of your situation and the type of help you need, the attorney can give you all your options.

IRS garnishment and tax liens are among the last resort strategies. The agency uses this tactic after it has sent several notices when the taxpayer refuses to respond. Still, you have options for navigating these challenges. Tax professionals can negotiate with the IRS to find a more favorable solution. They can handle all correspondence, taking the load off your shoulders.

It can be stressful to receive a notice in the mail that the IRS is conducting an audit on your tax returns. The IRS typically tells you what they need, but gathering all the appropriate documentation can be challenging if you aren’t sure what they’re looking for.

Even if you send the IRS what they need, they may send you additional communication or ask you more questions about what you sent. Your tax attorney can handle that on your behalf to avoid that tough conversation or needing to deal with the associated paperwork.

When you first search for an attorney near you, you may end up with an overwhelming amount of attorneys who pop up. Make sure you first double-check that you’re looking for a tax attorney. There are several different branches of law that an attorney can practice Once you find a few you like, please look at their reviews. You can use websites like Better Business Bureau or Google Reviews to see what other people have to say about their time with an attorney.

Pay particular attention to the reviews that talk about communication. You want to ensure that you work with an attorney who communicates with their clients and keeps them up to date on what is going on with their case.

The many different types of IRS letters can be challenging to decode. Partnering with an attorney with a background in tax law helps you navigate these documents, ensuring you only pay what’s due. The benefit of an experienced team is also negotiating with other tax attorneys with knowledge of the courtroom.

When you speak with your lawyer, ask them about their experience handling similar cases and what strengths and weaknesses your case has. If an attorney does not answer your questions or is quick to make you sign a contract with them before they give you more advice, you may want to seek counsel elsewhere.

We are the leading tax consultancy agency in the United States with over 100 years of combined experience. Our valuable team, comprising tax attorneys, accountants, financial analysts and enrolled agents, has what it takes to deliver practical results. We dedicate time to understanding your situation and developing tailored strategies.

When you partner with Polston Tax, you get end-to-end services, ranging from initial evaluation to tax preparation and resolution. This arrangement benefits individuals and business owners who want to save time and effort hiring different tax professionals for various functions. We provide all you need in one place!

Our solutions and support have earned us multiple awards. This feat encourages us to continue assisting clients, regardless of industry and case complexity, in finding the best possible tax solutions. Our goal is to take the load off your shoulders. You can trust us to go with you every step of the way!

If you’re wondering why you’re getting a letter from the IRS, it’s always best to review the document and take immediate action. Should you have questions about IRS or state notices, turn to Polston Tax Resolution & Accounting. We’re a law firm dedicated to dealing with taxation-related issues. Our skilled staff includes tax professionals such as IRS-enrolled agents and experienced attorneys. With our end-to-end tax resolution and accounting services, you can get your financial life on track and enjoy more peace of mind regarding your taxes. Are you interested in learning more? Contact the Polston Tax team to schedule a free consultation today!