State income tax changes usually take effect on January 1, the start of the calendar year. While the 2026 state income tax brackets have yet to be fully updated, some states have already implemented tax changes effective July 1, 2025, the start of the fiscal year.

Most One Big Beautiful Bill Act (OBBBA) tax changes also take effect in 2026. While the Tax Cuts and Jobs Act (TCJA) was meant to sunset in 2025, OBBBA makes many of the TCJA changes permanent, while adding new tax rules for the short and long term.

These changes affect your federal tax filing process, as they can influence your decision on whether you should go for the standard or state and local tax (SALT) deduction. This article details what to expect with your state income tax, the possible changes for the coming year and how you can benefit from tax extensions.

Unlike the federal progressive tax system, some states have a flat tax system where a single rate applies regardless of your income. As of 2025, states with a single-rate structure include:

The states with a progressive tax system include:

Nine states don’t impose income tax:

Note that Washington charges a flat 7% income tax on capital gains. The tables also include income tax rate changes from Georgia and South Carolina, effective July 1, 2025.

Other states also made tax changes in other areas. For instance, Alabama’s overtime income tax exemption expired last June 30, 2025, while Virginia increased its standard deduction for individual income tax returns from $8,500 to $8,750 for single filers.

Kansas also offers potential tax cuts on individual and corporate income taxes for 2026, depending on whether the tax revenue is doing well compared to 2024, and if the Budget Stabilization Fund is at least 15% of the previous year’s tax collections.

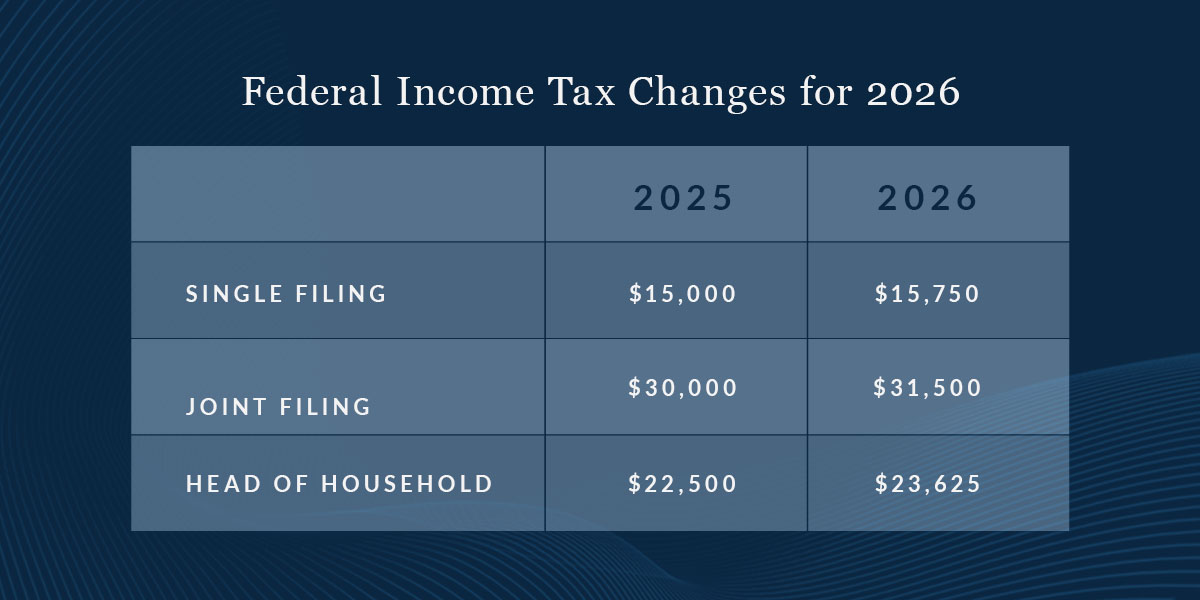

Because of the progressive tax system, the higher your income, the higher your tax rate. However, tax credits and deductions reduce your taxable income, potentially offering more savings. OBBBA increases the following standard deductions starting in 2026:

| 2025 | 2026 | |

|---|---|---|

| Single filing | $15,000 | $15,750 |

| Joint filing | $30,000 | $31,500 |

| Head of household | $22,500 | $23,625 |

Reducing your taxable income through the standard deduction helps you qualify for lower tax rates. Suppose you’re single with an income of $40,000, and you opt for the standard deduction. Your taxable income would be $24,250. For 2026, the IRS will adjust income brackets to account for inflation.

Other significant changes from the OBBBA include an income tax deduction for up to $12,500 of qualified overtime pay, and $25,000 for married filing jointly, and up to $25,000 of reported tips. The child tax credit for qualified taxpayers also increases from $2,000 to $2,200.

Your state tax rates affect your federal income tax through the SALT deduction. SALT deduction is available to those taxpayers who choose to itemize their deductions as opposed to taking the standard deduction, whether you’re a W-2 employee or self-employed. The TCJA capped this deduction at $10,000, while the OBBBA increased this limit to $40,000. The SALT deduction also increases by 1% each year until 2029. After which, the cap resets to $10,000. The $40,000 cap also phases down to $10,000 at a 30% rate for incomes over $500,000. This means the $40,000 cap is reduced by $0.30 for every dollar over $500,000.

Here’s what the changes look like:

| SALT Cap | Income Threshold for When the Cap Phases Down | |

|---|---|---|

| 2025 | $40,000 | $500,000 |

| 2026 | $40,400 | $505,000 |

| 2027 | $40,804 | $510,050 |

| 2028 | $41,212 | $515,151 |

| 2029 | $41,624 | $520,302 |

To know if you’ll benefit the most from SALT deduction, itemize your deductions and compare the sum to the standard deduction. The SALT deduction is only available should you choose to itemize your deductions.

A federal tax extension extends your deadline for filing your tax return. However, the federal tax extension does not extend the time to pay. You must still pay the tax by the original due date, even if you are extending your return. Missing filing and payment due dates can lead to penalties. Your delayed payments are also subject to interest.

You can request an extension before the April filing due date through the IRS Free File, using an IRS Form 4868, or when you pay your estimated tax bill. The extension is until October 15.

If you cannot pay your taxes on time, check if you’re eligible for a payment plan. The IRS may allow you to pay in installments over an extended time frame.

A federal extension is separate from a state extension. While some states, like Colorado, have automatic extensions, other states require a separate request. You need to fill out a state-specific form or use your state’s free online filing services. The extended deadline is also typically October 15.

Polston Tax has been helping clients navigate their tax obligations since 2001. Based on our clients’ unique situations, we take over the entire process through the myriad strategies we’ve developed under our belt. We can also take over our clients’ financial side of the business, so they can focus on running their core operations. Whatever their tax needs may be, our team of tax attorneys, case managers, accountants and tax preparers is ready to help.

The state tax brackets for 2026 have yet to be fully determined. While some states, like Georgia and South Carolina, have already made legislative changes, you can expect most changes to take effect on January 1, 2026. Most tax changes brought about by the OBBBA also take effect in 2026, while some changes, like the increase in SALT deduction cap, are effective in 2025.

Polston Tax understands that managing taxes can be complex. We’re here to make tax preparations easier for you. We’ll help you identify which deductions you can make and apply the optimum tax strategies depending on your situation. Having worked with the IRS since our inception, you can count on our tax and accounting team to streamline each process. If you’re ready to get started, contact us for a free consultation today.