One of the keys to business success is understanding the tax rules and how they apply to or affect your company. In states where marijuana is legal for medical or recreational use, there are usually special taxes that apply to the sale of the drug.

One of the keys to business success is understanding the tax rules and how they apply to or affect your company. In states where marijuana is legal for medical or recreational use, there are usually special taxes that apply to the sale of the drug.

If you’re considering opening a dispensary or own one already, learn more about the state rules and federal tax laws to ensure you understand the tax implications of owning a dispensary. Working with a tax attorney can help you comply with any regulations and avoid potential tax penalties.

Table of Contents

As of April 24, 2023, 38 states and the District of Columbia (DC) have laws that legalize cannabis for medical use. As of November 8, 2023, 24 of these states, the District of Columbia and two territories allow marijuana for non-medical adult use. As state laws change, entrepreneurs and business-savvy people see opportunities to open dispensaries.

Marijuana is still illegal at the federal level. But, the Internal Revenue Service (IRS) views any source of income as taxable, including income from the sale of marijuana. This means you’ll need to pay federal income tax on sales from your dispensary and file an annual return with the IRS.

It’s important to note that although you must file a return and pay taxes for your marijuana business, the Internal Revenue Code prohibits you from claiming deductions or tax credits on your return. The prohibition is for any business that sells controlled substances or participates in illegal activities, not just for marijuana dispensaries. Being unable to claim deductions or credits can mean the cost of running a dispensary is higher than the expense of operating any other type of business.

Dispensary employees pay taxes depending on which income bracket they fall into. Employers are not exempt from paying employment taxes. They are still legally required to declare payroll taxes for wages, whether they pay wages in cash or any other manner.

There are various forms of cannabis taxes in the United States, with many depending on the jurisdiction of your dispensary. States base cannabis taxes on three things — the price, the drug’s potency or the weight of the product. Often, the taxes will be a combination of these types of taxes. Common types of taxes you will encounter include:

Your obligations for state taxes depend on where you operate your dispensary. Many of the states where marijuana is legal have used the revenue from sales of the drug to fund specific programs. Some states will also impose an excise tax on the sale of marijuana, but all states have a sales tax requirement.

Alaska uses different tax rates depending on which part of the plant is sold. Since marijuana sales became legal in 2016, the state has charged a tax of $50 per ounce on sales of the drug. There is also an excise tax of $15 per ounce for stems or leaves and $25 per ounce for immature flowers or buds. Local governments may levy an excise tax on cannabis based on either weight or percentage of price. The revenue goes into the state’s general fund and toward programs that reduce repeat criminal offenses.

There is a 16% excise tax on cannabis sales in this state, which consumers pay and retailers remit when they file taxes. Additionally, local jurisdictions may charge about 2% on marijuana sales. It has been legal to sell the drug recreationally since January 2021.

Marijuana businesses and dispensaries in Arkansas need to pay a 4% special privilege tax on gross receipts from medical marijuana sales in the state. The special privilege tax is in addition to any other sales taxes.

In the state of Colorado, marijuana retailers have to have a sales tax license. If a business sells medical and recreational marijuana, it must have a license for each of these types.

Businesses that sell medical marijuana have to charge a local sales tax on top of the state sales tax. Recreational marijuana will have a state sales tax, state marijuana sales tax and local sales taxes. Tax revenue from marijuana sales goes toward education programs. There is a 15% excise tax on the average market rate, a retail tax of 15% and a local option retail tax of up to 8%.

The potency tax in Connecticut is per unit. Tax on the plant material is 0.625 cents per milligram of THC, the edibles tax is 2.75 cents per milligram of THC and the remaining products have a 0.9 cent tax per milligram of THC. Since the legalization of cannabis sales in January 2023, local governments can levy a 3% retail tax on all cannabis sales.

The District of Columbia imposes a 6% sales tax on medical marijuana and recreational marijuana purchases. However, this territory does not have any additional excise taxes on the sale of marijuana. Federal law does not allow retail sales, cultivation or distribution of cannabis at this stage.

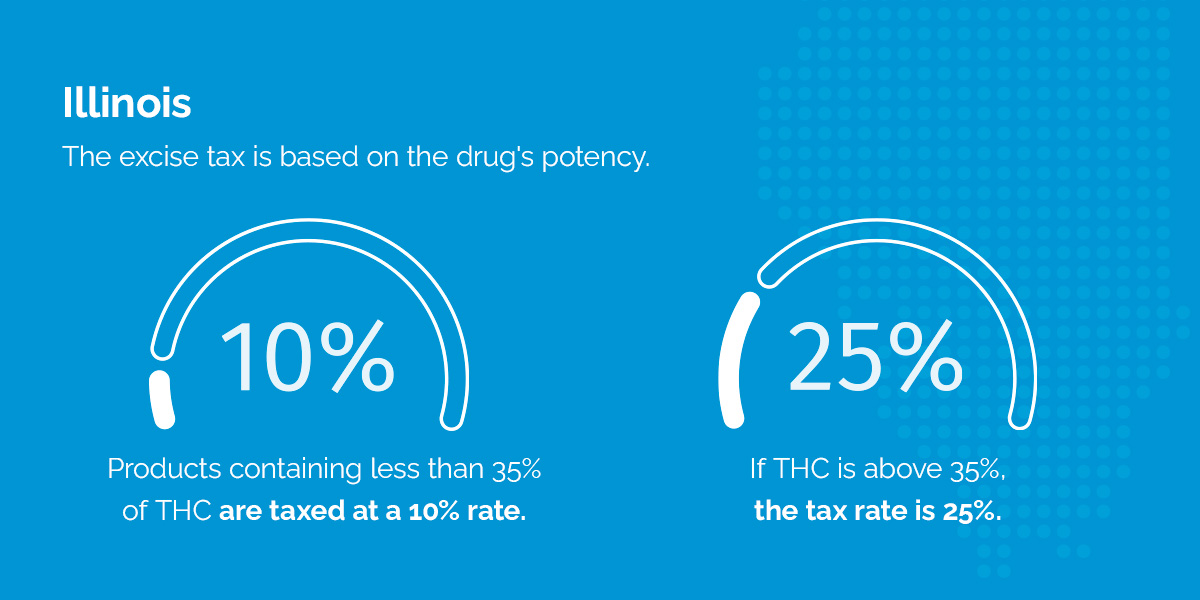

In Illinois, there’s a retailer’s occupation tax on marijuana and an excise tax on the sale of marijuana. The excise tax is based on the drug’s potency. Products containing less than 35% of THC are taxed at a 10% rate. If THC is above 35%, the tax rate is 25%. Cannabis-infused products like edibles have a 20% tax on their retail price. There is also a 7% excise tax on the cultivator’s gross receipts, known as the cultivation privilege tax. The state caps the local tax rate at 3% for municipalities and 3.75% for counties unless there is a municipal tax on the purchase, in which case the county tax will be capped at 3%.

Maine levies a 10% excise tax on cannabis sales as well as a weight-based tax, which cultivators pay and remit. Various parts of the plant get their own rates, which include a $335-per-pound tax on the flowers, $94 per pound on the trim, $1.50 per seedling and $0.35 per seed. The state has no local excise taxes since this taxing system was implemented in November 2020.

Legal sales began in July 2023. Maryland has no local cannabis excise taxes and levies only a 9% excise tax on cannabis products’ retail price.

If you open a dispensary in Massachusetts, the state will collect an excise tax of 10.75% on the retail sale of marijuana with a 6.25 % sales tax and the option for local governments to add a 3% excise tax. There is no tax on marijuana sold for medical use.

Michigan State has no local marijuana excise taxes, but it levies a 10% excise tax in addition to a 6% sales tax on all cannabis sales.

The Michigan Regulation and Taxation of Marihuana Act states that products subject to the excise tax are not to be bundled with products or services not subject to this tax in a single transaction. All marijuana funds collected under this legislation are distributed as follows:

While only nonintoxicating topical products and edible cannabinoids are legal to sell, the state imposes a 10% excise tax on cannabis purchase prices and a 6.87% state sales tax. Sellers must register with the Minnesota Department of Revenue to remit the new Cannabis Tax, which started July 1, 2023.

Local governments allow a levy of up to 4% retail tax on marijuana products for medical use and a 6% excise tax on retail sales for adult use at dispensaries in the state.

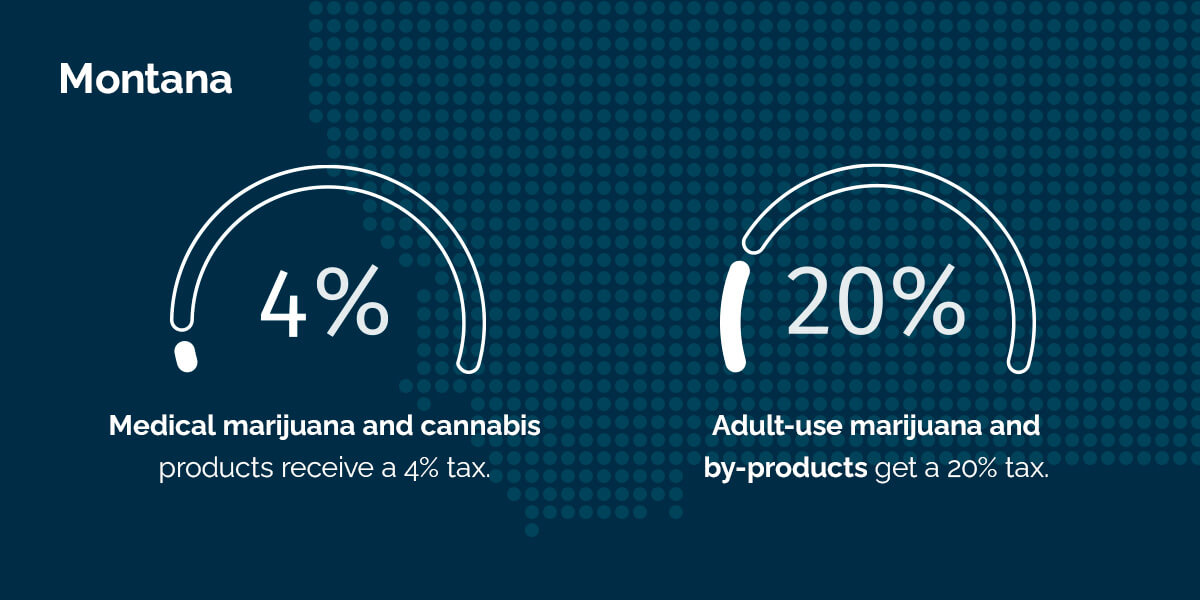

Medical marijuana and cannabis products receive a 4% tax, but adult-use marijuana and by-products get a 20% tax. Counties can add local sales tax up to 3% on top of both these taxes.

The state of Nevada has established a Cannabis Compliance Board that oversees all aspects of the cultivation and sale of marijuana in the state. The state charges an excise tax of 10% on retail sales of cannabis and a 15% wholesale tax. Medical sales are not subject to the excise tax.

The state collects a weight-based tax from cultivators on all parts of the plant. The current rate is $1.24 per ounce, and local governments can levy a 2% gross receipts tax on cannabis dispensaries.

New Mexico levies a 12% excise tax on marijuana sales with no local cannabis excise taxes. In July 2025, the excise tax will slowly rise over the next five years to 18%. In the Regulation and Licensing Department, the Cannabis Control Division regulates and issues licenses for producers and retailers.

There are two types of taxation on cannabis and its products. These include a 13% excise tax and a poverty-based tax. The latter is 0.05 cents per milligram of THC in flower products, 0.08 cents in concentrates and 3 cents for edibles.

Oklahoma voted to legalize medical marijuana in 2018. Currently, anyone who wants to grow, sell or transport marijuana in Oklahoma needs to apply for a license from the state. Oklahoma has residency requirements for businesses that want a marijuana license. The business will need to have resided in the state for at least two years prior to the date of application or for at least five out of the preceding 25 years.

Before receiving a business license, the company needs to get a sales tax permit from the state. Dispensaries in Oklahoma are responsible for sales tax and a 7% gross receipts tax.

Marijuana retailers in Oregon need to file quarterly tax returns and make monthly payments to the Department of Revenue. They must also register with the department as marijuana tax collectors. The state charges an excise tax of 17% on recreational retail sales and allows retailers to keep 2% of the tax collected to cover administrative costs. Some localities have additional taxes of 3%.

Local governments can levy up to 3% tax on retail prices of cannabis and its products, excluding accessories, with a 10% state excise tax. The excise tax does not apply to medical marijuana sales. The state also has a 7% sales tax rate.

South Dakota passed a measure legalizing medical marijuana in 2020. Businesses can apply for a medical cannabis establishment license, which also requires them to apply for a sales tax ID. The sales tax on medical marijuana in South Dakota is 4.2%.

Vermont levies a 14% excise tax on the retail sale of marijuana and marijuana products, including any food or beverages containing it. The excise tax is charged on top of the state’s 6% sales tax, and the two must be stated separately from each other on the customer’s receipt. Marijuana businesses and licensees must collect the excise tax from consumers at the time of the sales transaction. Resale buying and selling are not subject to excise taxes.

Washington requires a person who holds a retailer, producer or processor business license for marijuana to be subjected to a business and occupation tax. This applies to the gross receipts of the business.

Also in Washington, the business owner has to collect a sales tax on transactions and remit it to the Washington State Department of Revenue. The excise tax on marijuana is 37% of the retail price. Tax revenue from marijuana sales supports health care programs.

Marijuana dispensaries pay federal taxes just like any other business does. There are not as many opportunities for deductions when you have your own dispensary. The main reason for this is the type of product you sell. In the eyes of the IRS, the business is selling or trafficking controlled substances. This is technically prohibited at the federal level or even at some state levels.

For dispensary owners, this means that deducting things like rent, advertising or payroll is not an option as it would be for other types of businesses. The IRS does allow dispensaries to deduct the cost of growing the actual marijuana, however, because it is considered the cost of goods sold. The code that many refer to when speaking on this matter is IRS code 280E. It is one of the great barriers for many who want to get into the cannabis business legally because it creates a tax burden that some are unable to handle.

While many businesses may view deductions as something positive they get from the government, they can greatly impact the business itself. Deductions are designed to help businesses save some money by getting that money back in the form of a tax return. They allow businesses to make back some of the cash they had to spend in order to keep making money!

The problem is that when dispensaries are not allowed to have the same deductions, they are actually spending a lot more overall. They don’t get the opportunity to make back that extra money when tax season rolls around, so they spend more than the average business in the long run. In reality, some of these dispensaries could end up having to pay more in taxes than they get in profits. This is going to depend specifically on the business and how it is doing overall.

While cannabis tax regulations vary between states, current policies can be adjusted, and new tax policies may come into play, so you need to stay up to date. Knowing your legal obligations allows you to run your dispensary compliantly and efficiently.

Owning a dispensary means you can sell a product you believe in, but your taxes might be a bit more complicated than those of the average business. Polston Tax can help your dispensary with tax planning, preparation and cannabis-specific accounting. We understand federal and state tax laws and can ensure your dispensary files its returns on time and pays all the required taxes. To learn more about how the tax attorneys at Polston Tax can help you, contact us today and let’s get started.