Whether you own a business or are an individual taxpayer, you may receive an audit notice from the Internal Revenue Service (IRS). In fiscal year 2023, the IRS audited 582,944 tax returns, resulting in almost $31.9 billion in additional taxes. Although many believe the IRS is more likely to audit affluent individuals, that is not always true. The IRS frequently audits individual tax returns from people who claim the earned income tax credit (EITC) — a benefit for lower-income individuals.

The IRS can choose to audit any taxpayer on a random basis or if they notice an issue. Any errors in your tax returns — whether accidental or intentional — can result in an income tax audit penalty. A penalty for IRS audits can include fees or criminal repercussions. Fortunately, understanding how and when the IRS can audit you can help you prepare and avoid penalties should this situation arise.

The majority of IRS audit penalties relate to errors on tax returns, and they can levy more than 150 different penalties. Consequently, you will likely end up with a larger tax bill if the IRS does conduct an audit on your tax return. The most common reasons why you may receive a penalty after an IRS audit include:

In most cases, an IRS audit is random. Some people — such as those who are self-employed or have prior liabilities — are more susceptible to continuous audits than others. It is possible for the IRS to audit you for several years in a row. However, there is a limit to how many times they can audit you if you have previously won a dispute on a similar issue.

Several factors can trigger the IRS to conduct an audit on your tax returns:

The IRS will notify you if you qualify for an audit. They typically conduct audits by mail or in-person interview. If the interview is in person, the IRS will first contact you via mail with contact information and instructions. They will then set up an interview with you at a local IRS office, your home, your place of business or your accountant’s office.

If your audit is via mail, the IRS will request additional information regarding items on your tax return. These items may be income, expenses or deductions. If there are too many records to mail, you can request to conduct the audit in person.

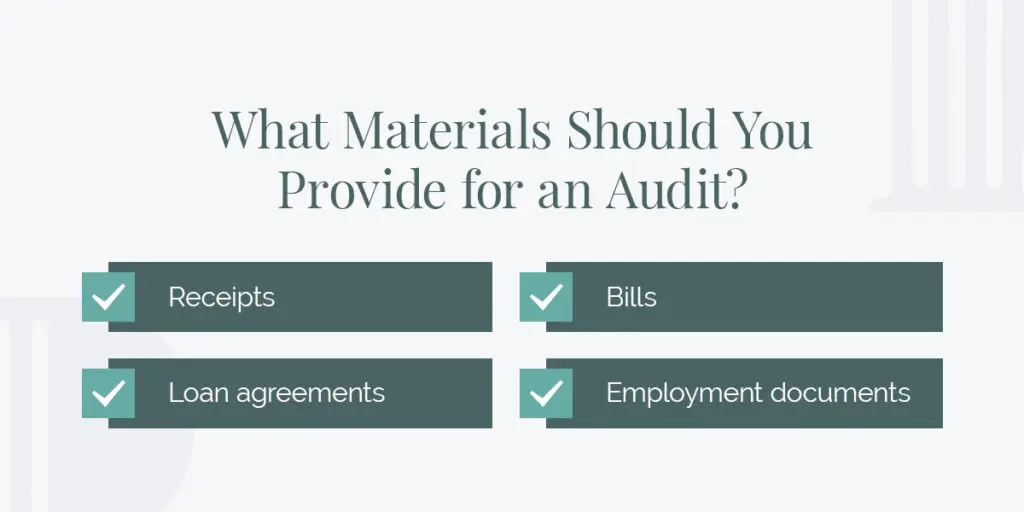

The IRS will provide a written request for the specific documents needed in the letter you receive. Some documents the IRS may request are:

Your audit begins as soon as you receive the first notice through the mail. From there, the audit’s length largely depends on the type of audit, the issue complexity and the auditor’s availability. How you respond to the audit can also affect how long it takes. For example, you will extend the audit process if you disagree with the results and file an appeal.

One of the easiest ways to prevent a lengthy audit is to keep your tax records and supporting documents organized. When they ask for specific information, you should submit it on time to prevent delays. Legally, you must keep all tax return records for at least three years after filing. Keeping these records longer is a good idea so you are better prepared if an auditor needs tax returns from an earlier period.

A statute of limitations for IRS audits regulates how far back into previous tax returns the IRS can go to perform an audit. They can go back as far as three to six years and even longer if necessary.

Based on the federal statute of limitations, the IRS can conduct an audit typically up to three years after filing your tax return. For example, if you filed your federal tax return on the federal due date of April 15, the IRS can audit this return until April 15, three years later.

Here are a few points to keep in mind about due dates:

While the IRS usually only has up to three years to collect back taxes owed, there are some exceptions. The IRS has up to six years to conduct an audit on back taxes that you owe in the following circumstances:

The statute of limitation may not apply in very exceptional circumstances, meaning that the IRS has no limit on how far back they can collect back taxes owed. They can do this for the following scenarios:

Filing a fraudulent tax return is a serious felony. A taxpayer who files a fraudulent tax return can face imprisonment for up to three years, a fine of up to $100,000 or both.

When the IRS audits your tax return and finds a flaw, you can be subject to additional interest or penalties, including civil, civil fraud or criminal penalties.

You can accrue additional interest on your return if you file it late or fail to pay taxes owed on time. The interest depends on how much you owe in unpaid taxes and the precise timing of the underpayment. Moreover, the IRS can charge minimum late filing fees when you file your return 60 days or more after your tax return due date, which includes the extended tax return due date. The fee would be $485 for 2024 tax returns or 100% of the tax you owe, depending on which amount is less. If you file late when the IRS owes you a tax refund, they won’t charge a late filing fee. However, you must file your taxes to get your refund.

A civil penalty is applicable if you make errors in your tax return. If there is a significant discrepancy in your return between what you listed and the amount you actually owe, you may have to pay a civil penalty of 20% of the underpaid amount. You must pay any overdue taxes after 21 days of an audit. Whether you underpay the taxes you owe or fail to pay the taxes altogether, you will need to pay a penalty of 0.5% each month on the unpaid tax.

The IRS can issue a civil fraud penalty when a taxpayer underpays their taxes due to fraud. In this case, the IRS can charge a penalty of up to 75% of the amount that you underpaid, which they add to your overdue tax bill.

The most severe penalty that a taxpayer can receive is a criminal penalty. Fraud and tax evasion fall into this category. Can you go to jail for not paying taxes?

If you’re facing penalties from an audit and would like to challenge the outcome, you can submit an audit reconsideration request. However, it’s best to do this alongside a tax professional. The IRS will only reconsider your audit under limited circumstances. Penalties and interest continue accumulating while the IRS reconsiders your audit.

If the IRS rejects your audit reconsideration, you may be able to arrange an alternative settlement like an offer in compromise (OIC) or a penalty abatement. You may receive an OIC if you cannot pay your taxes. If accepted, the IRS will allow you to settle your liability for only a small portion of the amount you owe.

You can also request a penalty abatement for certain penalties. When granted, the IRS may waive your tax penalties partially or in full. To qualify for a penalty abatement, you must have reasonable cause or a good tax history.

Dealing with IRS audits and penalties can be terrifying, especially if you have to face them alone. If the IRS notifies you of an audit, your first step should be contacting a tax attorney for help. At Polston Tax, we have over 100 tax professionals on staff from all areas of the tax industry.

Our team has the skills and knowledge to deal with complex tax matters and negotiate with the IRS on your behalf. We can help you prepare for this intense inspection of your tax documentation and answer questions the auditor may have. With us, you can improve your chances of receiving an offer in compromise, penalty abatement or installment agreement with the IRS.

If you feel the IRS has treated you unfairly in an audit or made an error, our tax lawyers will investigate your situation in-depth and guide you through the entire process. We’ll help you provide the IRS with the appropriate documents and avoid making damaging errors. Have peace of mind knowing that our team is fully equipped to protect you and your assets and achieve a resolution in your favor.

Contact us to book a free consultation today!