Staff

We have over 100 tax professionals on our team, including financial analysts, accountants, tax attorneys and more.

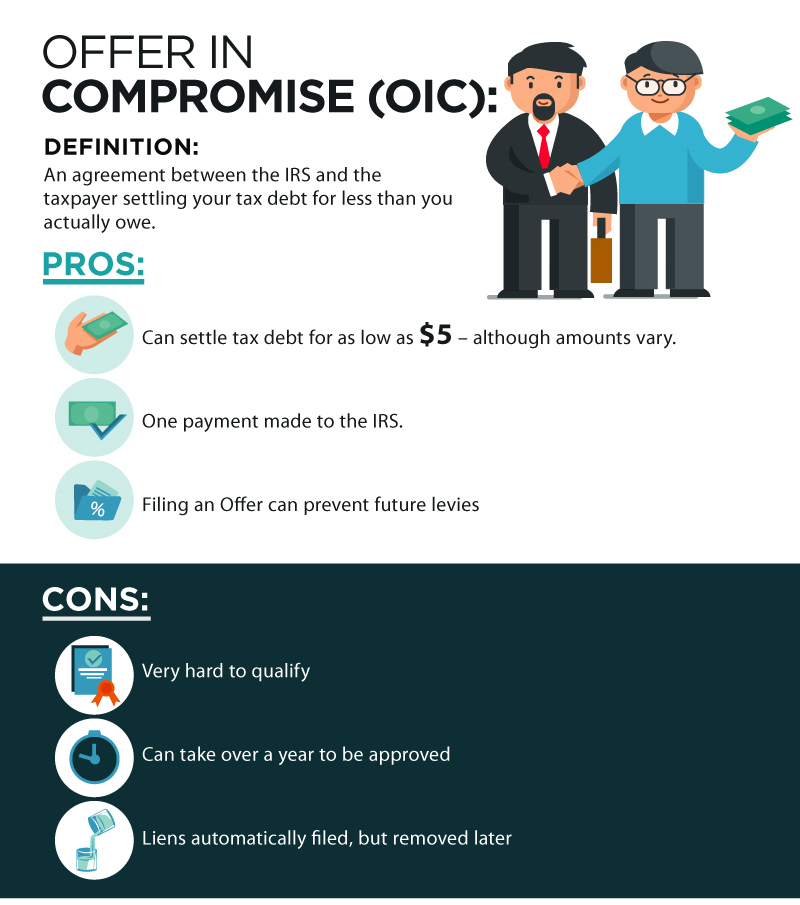

One of the ways you may be able to lower your overall tax liability is to arrange a settlement with the IRS called an offer in compromise (OIC). It’s important to understand that every taxpayer will not be able to achieve this outcome, but those who qualify may be able to save significantly! The best way to know for sure is to ask a tax professional for help.

Call us at 844-841-9857 or click on the “Contact Us” button below to fill out the form so we can reach out!

How does tax OIC or offer in compromise work? This IRS-instituted program states that if a taxpayer cannot afford to pay back the taxes he or she owes and doesn’t have any significant assets, the IRS may accept an offer in compromise to recoup as much as it can — even if that means settling for less than the actual tax bill.

Whether the IRS approves an offer in compromise depends on various factors, including a taxpayer’s:

Not everyone gets approved for a tax OIC. To qualify for an offer in compromise from the IRS, you must have filed all your tax returns and made all estimated payments that were required for the year. If you’re a business owner, you’re also required to have made all federal tax deposits for the current quarter.

Even if you’ve successfully completed these steps, the IRS still may not accept your request for a tax OIC. Usually, the IRS won’t approve an offer in compromise unless the amount the taxpayer offers equals or is larger than the reasonable collection potential (RCP), which is the amount the IRS estimates that the individual is able to pay. This value comes from the sum of the individual’s assets and anticipated future income.

Unfortunately, the process for a tax offer in compromise is complicated. First, the IRS will look closely at the taxpayer’s financial situation to determine what can be paid now and in the future. The paperwork for an offer in compromise can be quite complicated, involving significant financial records, strict regulations and more.

One mistake could delay the entire process or cause your IRS offer to get lost in the maze of IRS procedural requirements before it is even reviewed by the IRS. It’s also not a fast process. Offers in compromise can take years to be received, reviewed and accepted, even if you qualify immediately!

An offer in compromise attorney can help you throughout the entire process so you can provide the necessary records and ensure your offer is reviewed.

At Polston Tax, we believe no one should have to face the IRS alone. That’s why we stand behind our clients nationwide to help them get the financial freedom they deserve with our offer in compromise services. Our team has extensive experience working with the IRS, giving us the knowledge and background to professionally handle all types of cases. We know what to expect when it comes to the IRS, including what negotiation strategies are most successful and how to get our clients their desired outcomes.

Our OIC tax service attorneys use a team approach for each case they take, working together to help you resolve your tax issues and take back your financial future. When you choose Polston Tax, you can ensure we’ll be by your side from beginning to end.

Our process begins when you contact us by phone or online. Afterward, we’ll gather some initial information from you and schedule a new client appointment with one of our tax professionals either in person, on the phone or through Zoom. Once your consultation is over, we’ll determine a service option that works for you and send you a price estimate.

Booking offer in compromise or OIC tax services from qualified tax attorneys comes with many benefits for your case.

We understand that there’s no one reason people find themselves owing taxes. These issues can stem from a business closure, family tragedy, filing confusion or anything in between. That’s why Polston Tax is dedicated to helping people lift the weight of owing taxes off their shoulders to set them up for a more promising financial future.

We have over 100 tax professionals on our team, including financial analysts, accountants, tax attorneys and more.

Our company has earned numerous awards and gained recognition across many major media outlets.

With over 20 years in the business and more than 100 years of combined experience across our team, we’re the tax firm you can rely on.

We honor and support our community by hosting quarterly volunteer events that our team participates in every year.

You can relieve a portion of your taxes owed with offers in compromise tax services at Polston Tax. Unlike many law offices with only one or two tax lawyers on their staff, we’re the best at what we do because tax and accounting are all we do.

Contact us today! You can also fill out our confidential contact form.