Cannabis companies are under a lot of financial pressure, not just to turn a profit but also to pay taxes. There is a price to pay for having a cannabis business in the form of taxes. These companies are among the highest taxed in the country, as state and federal governments seek to get their share of the profits.

The amount of taxes owed takes many cannabis business owners by surprise. They often find themselves in positions where they can’t pay taxes. If you find your cannabis company in a position where you can’t pay taxes to the IRS, you do have some options. Continue reading to learn what they are.

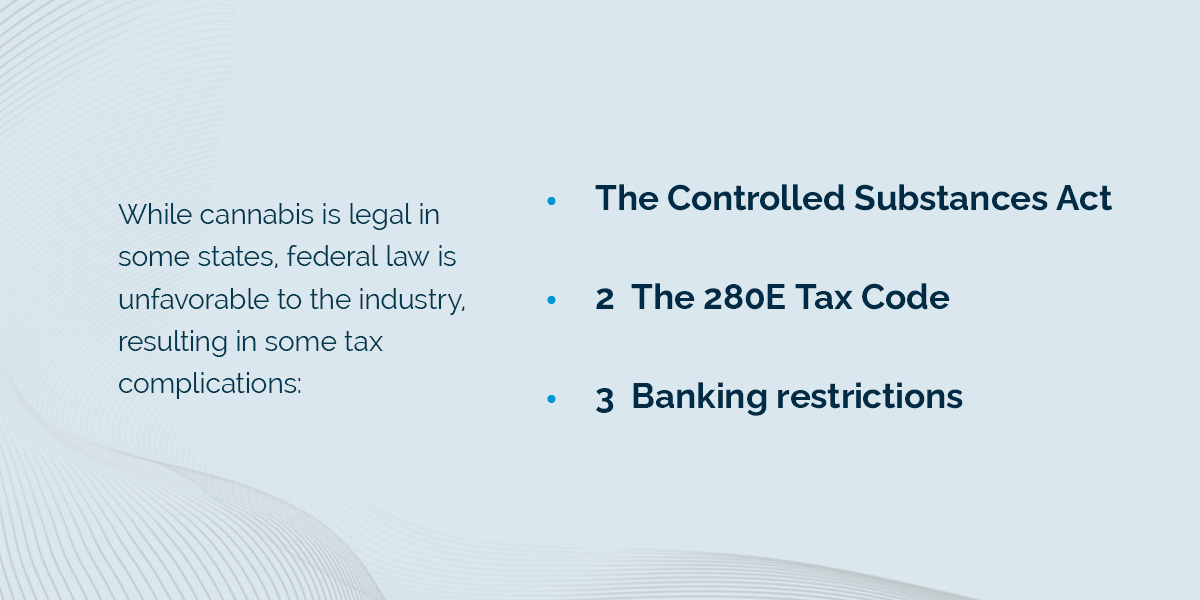

Cannabis businesses face challenges when it comes to paying taxes primarily because of the conflict between state and federal laws. While cannabis is legal in some states, federal law is unfavorable to the industry, resulting in some tax complications:

While it may be challenging to pay your taxes, you have options. These include installment payments, offers in compromise and applying for “currently non-collectible” status. You may also pay what you have or file for receivership:

If you find yourself owing a lot more than expected, you may be able to enter into an IRS tax installment plan. This is where you agree to pay the balance owed in monthly installment payments rather than one lump sum.

Keep in mind that there are fees to enter into an installment agreement. You’re also going to accrue penalties and interest on the amount owed. Again, you have to make sure you pay your taxes according to the agreement. Should you miss a payment, the IRS could say that you’re in default and resume collections activities against you.

An offer in compromise is a way to get a fresh start on your taxes. If you know that you can’t pay your taxes and will have trouble paying your tax bill, you may make an offer for a portion of the taxes owed.

You have to make a reasonable offer and show that you don’t have the resources to pay your entire bill. This is a very long and complicated process, which can take anywhere from 12-24 months. If the IRS accepts your offer, you must pay your taxes on time and in full for the next five years. If you fall behind on your taxes again, the IRS will rescind the agreement.

If you can’t pay your taxes because your cannabis business is going through a temporary slowdown, then you may be able to pause collections activities for a few months. You can apply for a designation called currently non-collectible status, which gives you some breathing room to catch up on your tax obligations. If you are granted currently non-collectible status, the IRS will pause collections activities for some time, usually six to 12 months. You are still obligated to pay your taxes, along with penalties and interest.

If you are done with your taxes and can’t pay your tax bill, you could pay what you can now. You then have 120 days to pay the balance off. Remember that your cannabis business will also have estimated taxes and payroll taxes due during that 120-day period. You need to ensure you can take care of all of your tax obligations. Otherwise, you could find yourself in a situation where you’re constantly behind on your taxes.

If you cannot pay your cannabis business taxes, your business is likely becoming insolvent if you’re not already there. Ordinarily, an insolvent business would negotiate with creditors or pursue reorganization in a federal bankruptcy proceeding. However, cannabis businesses cannot resort to bankruptcy since they are still considered illegal under federal law.

While federal courts will not hear bankruptcy petitions from cannabis businesses, the company can be put into receivership under state law. Receivership places your business in the hands of a receiver or trustee to manage the business, including assets and liabilities. The receiver makes financial and operational decisions with the help of the principals, although their authority is limited.

The purpose of a receivership is to stabilize the business. It’s a court-supervised process that protects the interests of the tax authorities and ensures they collect tax debts equitably while also protecting the taxpayer’s rights. It’s often the last resort when other efforts are unsuccessful.

Not having enough money to pay taxes is a scary prospect for many business owners. It’s common to let fear take over and make bad decisions. Those decisions lead to big mistakes that make the problem much worse than it needs to be. These are the mistakes that you need to avoid:

If you can’t pay your taxes, the IRS won’t magically disappear. They won’t look over the facts, either. The worst thing you can do is absolutely nothing. It’s not advisable to stop filing tax returns just because you cannot pay the taxes you owe. Filing your tax returns is a legal requirement regardless of whether you can afford to pay the taxes owed.

Failure to file can result in penalties and interest. The best approach is to communicate your financial challenges to the IRS to find a solution. Consult with a tax professional to understand the available options.

Since you have a cannabis business, you’re under a lot more scrutiny by the IRS and state revenue divisions. You’re more likely to get questioned and audited, even more so if you can’t pay your taxes. You must prove your status, and the IRS may want to look at your books. The best defense against that is to keep clean, organized records.

There are consequences to your actions if you don’t file at all. You can be responsible for penalties and interest on your unpaid taxes. That can be about 0.5% of the amount owed each month, with a maximum penalty of 25% of your unpaid taxes.

The IRS also has the right to pursue collections activities to recoup the taxes owed. That can mean you’ll get automated letters in the mail. With each letter that doesn’t get a response, the IRS will escalate its activities. Eventually, you’ll get certified letters that state you’ll face bank levies or property liens. At that point, the IRS reserves its right to seize your property and bank accounts.

You certainly don’t want to wait for your tax situation to get to that point. The sooner you take control of the issue, the better off you’ll be. As noted earlier, you have a few options if you can’t pay taxes. You could try to contact the IRS yourself, but you should expect to spend a lot of time on hold.

You can work with an experienced tax team to help you find the best course of action, whether to file an offer in compromise or go on an installment plan. They can look at your entire financial and tax picture to give you an objective view.

Here are some FAQs regarding cannabis taxation:

Cannabis companies cannot deduct ordinary business expenses, but they can deduct the cost of goods sold. The cost of goods sold is the expense incurred in the direct production of goods or services, like labor costs and maintenance.

Cannabis businesses cannot deduct ordinary expenses like advertising, marketing and banking services charges.

First, keep all financial records as evidence of the economic challenges and tax payments. Second, contact the IRS to negotiate favorable terms. The options available, such as installment payments or offer in compromise, depend on the particular situation. Finally, consult with a tax professional for advice. They can help you develop a strategy.

At Polston Tax, we understand the challenges of cannabis tax laws and are here to help, whether you’re starting a new business or growing an established company. Since 2001, our CPAs, accountants, tax preparers and attorneys, and case managers have provided tax and accounting services for businesses nationwide. We stay up to date on the most current cannabis tax laws and regulations to help these companies maintain compliance.

When you work with Poston Tax, your experienced team of tax professionals creates a custom strategy for your cannabis business. We’ll design solutions to keep you compliant, resolve any outstanding tax liability and plan for the future. Our goal is to build a solid relationship and provide services that help you save money and avoid audits. If your business is audited, we’ll support you with review, preparation and representation services.

As Benjamin Franklin said, the only two certainties in life are death and taxes. Both of those things strike fear in almost everyone. It’s not easy to run a business and find yourself in a position where you can’t pay taxes. You must approach the situation objectively and take care of it as soon as possible.

Polston Tax is a leading tax resolution and accounting firm with experience in the cannabis industry. Our team of knowledgeable professionals can assess your financial and tax situation and provide tailored solutions. We can also provide representation during an audit if necessary. Contact us today to learn how we can help you with your tax problems.