With this comprehensive guide, we help you understand your tax obligations to the state of Missouri so you can avoid penalties and interest charges. Though navigating the world of Missouri sales tax rules can seem intimidating, we guide you through the process of registering and filing sales tax, exemptions and audits.

Understanding Missouri’s origin-based sales tax system is crucial, as businesses must collect sales tax at the rate in effect at their place of business. The Missouri sales tax rate is 4.225%. However, some districts, counties and cities in Missouri may also impose additional local sales tax. This means the amount of sales tax that businesses collect varies depending on their location.

Understanding Missouri’s origin-based sales tax system is crucial, as businesses must collect sales tax at the rate in effect at their place of business. The Missouri sales tax rate is 4.225%. However, some districts, counties and cities in Missouri may also impose additional local sales tax. This means the amount of sales tax that businesses collect varies depending on their location.

It’s important to note that up to 5.763% of additional local taxes can be added to sales tax. The combined average sales tax rate for Missouri is 8.36% as of 2023. This sales tax applies to retail goods and certain services unless they’re exempt by law, which we cover in detail below. Some of these goods include physical products such as home appliances, clothing and furniture. Businesses that make sales must collect sales tax from customers and remit it to the Missouri Department of Revenue (DOR) for distribution.

As a business owner, you’re responsible for collecting tax from purchasers on behalf of Missouri and paying it to the DOR. Failing to pass along this tax means you could be in violation of your tax liability, potentially resulting in penalties and interest charges.

Use tax is essentially the same as sales tax, except it applies to goods distributed, consumed, used or stored in a state or location where a consumer does not pay sales tax. This means the Missouri use tax rate is the same as the sales tax rate — 4.225%.

As with sales tax, use tax is also subject to additional local tax. Unless consumers already paid tax to the seller or the property is exempt from taxation, they must pay use tax on their purchase of goods, including tangible personal property, that is consumed, stored or used in Missouri.

While sales tax requires a sale to occur in the state, consumers must pay use tax on tangible personal property even if the sale didn’t happen in Missouri. For instance, if a consumer purchases something from an out-of-state seller and does not pay Missouri sales tax to the seller, they will be responsible for individual consumer’s use tax.

The same tax liability applies if a consumer purchases from someone not officially engaged in business. However, use tax does not apply if a consumer purchases from a Missouri seller subject to the state sales tax.

Business owners are responsible for collecting sales tax on retail sales from customers. However, use tax is a bit more complex. In Missouri, if an out-of-state retailer does not collect use tax from a consumer residing in Missouri, the consumer is responsible for remitting the use tax to the Missouri DOR.

Business owners are responsible for collecting sales tax on retail sales from customers. However, use tax is a bit more complex. In Missouri, if an out-of-state retailer does not collect use tax from a consumer residing in Missouri, the consumer is responsible for remitting the use tax to the Missouri DOR.

However, this only applies if the out-of-state retailer does not have a nexus with Missouri. A sales tax nexus refers to a direct connection that a state has to entities and businesses in other states. Any seller that sells tangible personal property to consumers in Missouri must collect and remit sales or use tax if they want to qualify for state contracts regardless of nexus status.

Additionally, a seller who is not engaged in business is not responsible for collecting Missouri use tax. In this case, the purchaser would be required to remit use tax to the state by filing a use tax return if their total purchases exceed $2,000 per year.

In previous years, businesses could only maintain sales tax nexus if they had a physical presence in the state where they made their sales. If a company sold to consumers in another state but didn’t have a physical presence there, they couldn’t collect sales tax. However, a 2018 Supreme Court ruling changed the rules about physical presence regarding sales tax.

Since this decision, states can now tax businesses and sellers through their virtual, as opposed to direct, connection to the state. This is known as an economic nexus, which enables out-of-state companies and sellers to collect sales tax on behalf of Missouri state.

As of January 1, 2023, a new economic nexus law was signed that enables remote and online retailers and marketplace facilitators who surpass $100,000 in sales within a calendar year to Missouri consumers to collect sales tax. This means businesses selling their goods online can collect and remit sales and use tax — if applicable — regardless of their location.

As of January 1, 2023, a new economic nexus law was signed that enables remote and online retailers and marketplace facilitators who surpass $100,000 in sales within a calendar year to Missouri consumers to collect sales tax. This means businesses selling their goods online can collect and remit sales and use tax — if applicable — regardless of their location.

Because of this law, there is no minimum number of transactions required for businesses to be allowed to collect Missouri sales tax. No matter how many sales your e-commerce retail shop makes, if you earn more than $100,000 from Missouri consumers in one year, you qualify for economic nexus.

If you establish economic nexus in Missouri, you must register for a Missouri sales tax permit before you can start collecting the tax from your customers. You can review your gross receipts from taxable sales from 2022 to determine if your business has met the $100,000 sale threshold.

If you’re having trouble determining if your business has physical nexus in Missouri, learn more about the state’s sales tax nexus to understand better. Additionally, you check whether you have any of the following elements in the state:

Even if you don’t have any of the above qualifications, your business may still maintain economic nexus in Missouri.

As of January 1, 2023, remote businesses and marketplace sellers — such as those that sell products through an electronic marketplace — that sell goods in Missouri must collect and remit local use tax on their sales if their gross earnings exceed the $100,000 threshold for the year.

As of January 1, 2023, remote businesses and marketplace sellers — such as those that sell products through an electronic marketplace — that sell goods in Missouri must collect and remit local use tax on their sales if their gross earnings exceed the $100,000 threshold for the year.

Remote sellers must register with the Missouri DOR and file a vendor’s use tax return, but marketplace sellers selling through a marketplace facilitator only — meaning they do not make sales independently — are not required to do so.

You might be wondering if the goods and services you sell are subject to sales or use tax. In Missouri, the following items of physical property are generally considered subject to sales tax:

The following services may be subject to Missouri sales tax:

The following purchases may be subject to use tax in Missouri:

As you can see, sales and use tax are required for most purchases in Missouri. Because different districts, counties and cities can place an additional sales or use tax rate depending on your location, it’s important to know how this impacts various industries. For instance, if your business falls under one of the following categories, you may have a different tax obligation than other companies.

According to the Missouri DOR, hotel and motel room sales are subject to additional sales tax, which is also called lodging tax. The following sales may be taxable:

According to the Missouri DOR, hotel and motel room sales are subject to additional sales tax, which is also called lodging tax. The following sales may be taxable:

The room tax a hotel or motel must pay on their room sales varies by location. For instance, in the city of St. Louis, hotels and motels must pay a 3.5% tax for Convention and Sports Tax and a 3.75% tax for Convention and Tourism Tax. In Springfield, hotels and motels must pay a tax of 5% of the gross rental receipt for sleeping accommodations. Depending on the city or district, business owners can decide whether to pass on the tax to customers or pay it themselves, but there are no exemptions.

Businesses that sell or manufacture alcohol, including liquor, wine and beer, may be subject to an alcohol excise tax that must be collected and remitted to the Missouri Division of Alcohol and Tobacco Control. The excise tax rates for these goods are:

Businesses that sell or manufacture alcohol, including liquor, wine and beer, may be subject to an alcohol excise tax that must be collected and remitted to the Missouri Division of Alcohol and Tobacco Control. The excise tax rates for these goods are:

Businesses with alcohol licenses must provide reports and payments for excise taxes by the 15th of the month after the sale of alcohol.

Businesses that supply fuel in Missouri are responsible for reporting and paying tax on the number of gallons removed from their location. Consumers who purchase the fuel pay this tax. Distributors who import fuel must also remit fuel tax to Missouri. The tax rate on motor fuel depends on the year and the type of fuel:

Businesses that supply fuel in Missouri are responsible for reporting and paying tax on the number of gallons removed from their location. Consumers who purchase the fuel pay this tax. Distributors who import fuel must also remit fuel tax to Missouri. The tax rate on motor fuel depends on the year and the type of fuel:

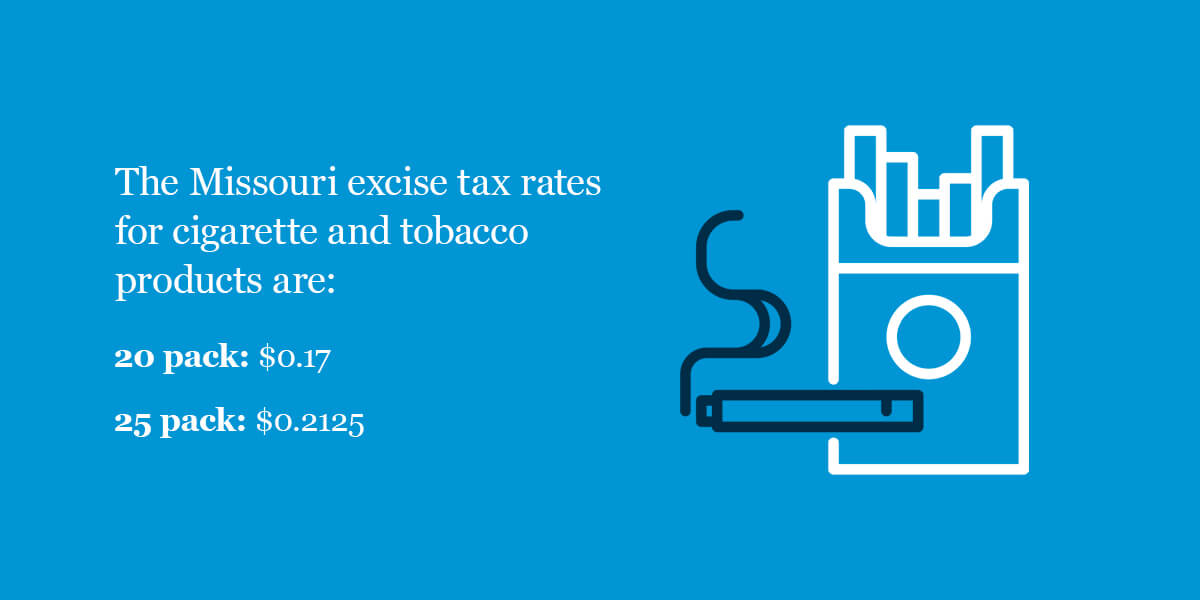

A separate tax is also applied to cigarettes and other tobacco products sold in Missouri. This tax is imposed alongside sales tax and federal tax, which sits at approximately $1.00 per pack. The Missouri excise tax rates for cigarette and tobacco products are:

A separate tax is also applied to cigarettes and other tobacco products sold in Missouri. This tax is imposed alongside sales tax and federal tax, which sits at approximately $1.00 per pack. The Missouri excise tax rates for cigarette and tobacco products are:

For those in Jackson and St. Louis County, there is an additional $0.05 tax charge. For other tobacco products sold and purchased in Missouri, there is a 10% tax on the manufacturer’s invoice price.

Missouri is one of the very few states that place a sales tax on grocery items. As of 2023, the non-prepared food sales tax rate is 1.225%. However, depending on the city, county or district, individuals and businesses may see additional rates ranging from 2% to over 8%.

Depending on the type of business you run, you may be eligible for certain tax exemptions. Consult with a tax professional to help you better understand this process. They can assist you with your specific industry and tell you what your tax obligations are and what you are exempt from. Here is a list of some Missouri sales and use tax exemptions and exclusions:

Depending on the type of business you run, you may be eligible for certain tax exemptions. Consult with a tax professional to help you better understand this process. They can assist you with your specific industry and tell you what your tax obligations are and what you are exempt from. Here is a list of some Missouri sales and use tax exemptions and exclusions:

Missouri holds a back-to-school sales tax holiday for residents. This tax break extends over a three-day period that places a state sales tax exemption on certain purchases. As defined by the state statute, the following items are exempt from state and local sales taxes within this period:

Many Missouri cities do not participate in the tax holiday, meaning they still collect local taxes.

Before we get into the consequences for failing to collect Missouri state sales tax, it’s important to know the most common ways for business owners to fail to comply with sales tax requirements, which include:

If your business commits one of the above actions, you will likely receive a warning letter with the payment deadlines. If you do not resolve your tax obligations after that, you will likely gain penalties and interest on the taxes you owe or receive a sales tax audit.

If the Missouri DOR believes your business is underreporting or underpaying sales tax or you have failed to collect or remit sales tax, an auditor or representative from the DOR will contact you by mail or phone to let you know you have been selected for an audit. If you receive an audit notice, you will have follow-up discussions regarding the audit period, account records and when the audit will be conducted.

If the Missouri DOR believes your business is underreporting or underpaying sales tax or you have failed to collect or remit sales tax, an auditor or representative from the DOR will contact you by mail or phone to let you know you have been selected for an audit. If you receive an audit notice, you will have follow-up discussions regarding the audit period, account records and when the audit will be conducted.

After this point, there are several factors to consider. As a business owner, if you do not have prior experience dealing with audits, you may not know how the process works or when to provide certain documents. In addition, you may not thoroughly understand your risk for exposure when it comes to sales and use tax or whether your assigned state auditor is following proper procedure. If you don’t understand sales tax in Missouri generally, this can become even more complicated.

If you do not feel confident in your ability to navigate the audit successfully and protect your business at the same time, it’s worth hiring a tax professional. A tax attorney who can provide services like IRS account investigation, sales tax representation and audit representation can guide you through the process of the critical decisions you may face in your sales tax audit.

An experienced professional can handle the process for you and help file an appeal with the taxation division if you do not agree with the penalties.

Undergoing an audit can feel intimidating, particularly if you have no prior knowledge of audits. This is why it’s so important to contact a tax professional who can explain the steps to you and help alleviate stress throughout the process.

Though audits happen for many different reasons, they generally involve the same sequence of steps. Once you’ve contacted a tax attorney, you will need to provide the Missouri DOR with a signed power of attorney form for them to communicate with your tax professional about the audit and allow your lawyer to be present for the audit. Your assigned auditor will likely conduct the audit at your business location.

The complexity of your records and the size of your business influence how long the audit will take, but you can expect the process to take several days to about a week. Your auditor will examine your federal income tax return to reconcile your sales tax return and other items in your accounting records. Then, the auditor will give you extra time to gather any additional documents they request and schedule follow-up meetings if necessary.

If you plan on opening a business or already have an established business in Missouri, you need to know how to register your business and file your sales taxes with the state to avoid an audit or penalties.

If your business sells tangible personal property or services subject to sales tax, you must register with the Missouri DOR. To do so, you can use the online DOR registration system or fill out the Missouri Tax Registration Application Form 2643. If you use this form, mail it to the following address:

If your business sells tangible personal property or services subject to sales tax, you must register with the Missouri DOR. To do so, you can use the online DOR registration system or fill out the Missouri Tax Registration Application Form 2643. If you use this form, mail it to the following address:

Before you can register, be sure to have the following information on hand:

Depending on your business type, you may also need a separate license, such as if you are a motor fuel supplier.

Next up is understanding how to file sales taxes once you collect them. The most important elements of filing sales tax include:

To simplify things, you have several options for filing and paying your business sales tax. You can:

The return dates for sales taxes are different in every state. In Missouri, when you register for your sales tax permit, you’ll also be assigned a filing frequency, which will let you know when you should file your taxes. Generally, this frequency is based on the amount of sales tax your business collects from customers in the state. In Missouri, businesses are required to file sales tax returns monthly, quarterly or annually.

The return dates for sales taxes are different in every state. In Missouri, when you register for your sales tax permit, you’ll also be assigned a filing frequency, which will let you know when you should file your taxes. Generally, this frequency is based on the amount of sales tax your business collects from customers in the state. In Missouri, businesses are required to file sales tax returns monthly, quarterly or annually.

According to the Missouri DOR, here are the due dates for filing sales tax returns:

If any of your file due dates fall on a Saturday, Sunday or a holiday, you can still file. As long as you postmark it or file online by the next business day, it will be considered on time. If you still have questions regarding your sales tax return due dates, check out the tax year calendar on the Missouri DOR’s website or contact a tax professional to help y