A 1099-C form is used for reporting debt cancellation as income to the Internal Revenue Service (IRS) and the individual or entity receiving the canceled debt. It is crucial for tax reporting and compliance. Key aspects of this form include information that affects an individual’s annual tax return and when to file or send it out.

Whether you are a creditor navigating debt forgiveness or a debtor managing your taxable income from canceled accounts, understanding the intricacies of this form will help you handle it correctly.

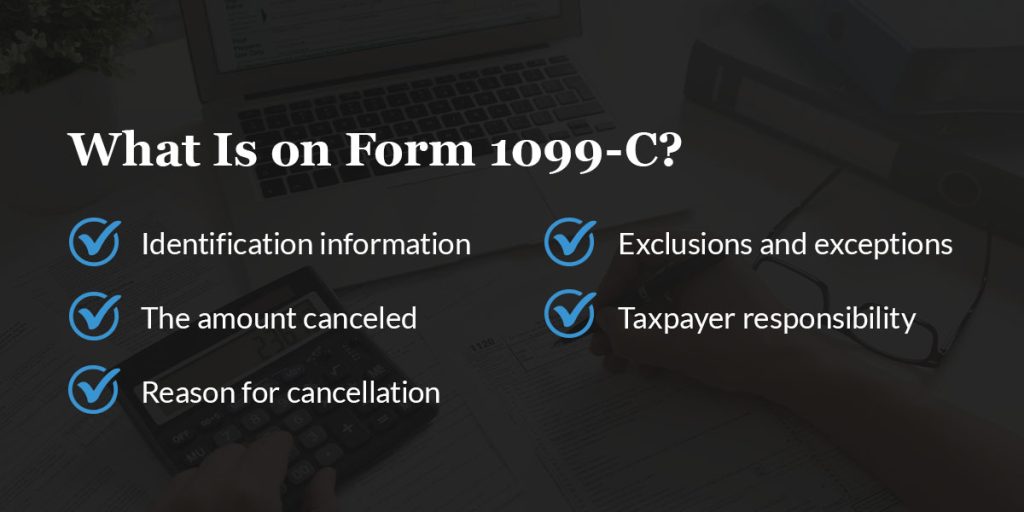

Creditors or lenders will file Form 1099-C if they cancel or forgive a debt of $600 or more. Key elements of this form include:

Note that all student loan forgiveness from January 1, 2021, to December 31, 2025, is completely tax-free. Since this debt cancellation does not count as taxable income, you will not see your student loan debt on Form 1099-C.

Since Form 1099-C is a cancellation of debt form, the creditor will fill it out when they forgive or cancel an individual or entity’s financial obligations. Creditors or lenders who cancel or forgive an outstanding amount owed to them by an individual or entity may file Form 1099-C. The lender will file Copy A, retain Copy C for their records and send you Copy B. Typically, these entities may have to file this form:

If you receive this form, you must report the indicated amount into Schedule 1 of Form 1040 as other income. Once you have filled out Schedule 1, record your adjusted income in line 10 or Form 1040 or 1040-SR. If you are aware of cancellation under $600 on your behalf and you do not receive Form 1099-C, you still have to report it. While you do not need to submit Form 1099-C, you should hold onto it for your records.

Use IRS Form 982 to find out how much of your canceled debt you can exclude from your gross income.

Ensure that all the details on your form are correct. Contact the lender immediately if you note any discrepancies, as they need to make amendments and send you an updated form. You should also contact the lender if you know you should receive For 1099-C but it does not arrive in time. If you file your taxes and the form arrives after that, file an amended tax return regardless of its effect on your tax bill.

While there is a statute of limitations on old debt, it’s important to note that Form 1099-C has no statute of limitations, so you may receive or send out this form relating to very old financial obligations. Contact a tax and accounting professional if you receive a copy of this form for an old debt.

Failing to report Form 1099-C, whether on your annual income tax or as an organization, can have several consequences:

While failing to report this form can have significant long-term financial and legal ramifications, partnering with the right tax professional can help you navigate the process efficiently.

If you receive Form 1099-C, carefully review the information and file it with your annual income taxes. Consulting with a tax professional will help you navigate the nuances of your debt cancellation and ensure legal compliance.

With over 100 years of combined experience, the Polston Tax Resolution and Accounting professionals are ready to help you navigate Form 1099-C and more. We can represent you in tax audits, planning and preparing for your obligations to the IRS. For more information, contact us today, and a team member will reach out to answer your questions or schedule your complimentary consultation.