If you and the Internal Revenue Service (IRS) disagree on an outcome or decision involving your tax matter, you can legally appeal their decision. IRS tax appeals allow you to state your case to the IRS appeal division for another evaluation. Whether you need to dispute a tax penalty, assessment or other decision from the IRS being well-informed about the appeals process empowers you to approach tax appeals with confidence and clarity.

Understanding the process ahead of you will empower you as a taxpayer to advocate for an accurate and fair resolution to your tax matters. This article explores the fundamentals of tax appeals and how you can initiate them while following best practices.

A tax appeal is a formal process you follow to dispute IRS decisions about collection actions, penalties, interest, rejected offers in compromise to settle tax bills and more. The appeals process comes at no cost to you, unless you do not get a favorable outcome.

The Office of Appeals is a separate, independent IRS office where government officials and taxpayers can settle their tax disagreements. Most of these disagreements can be settled through this system without having to go to court. The Office of Appeals employs over 2,000 people, most with experience in auditing, accounting or legal practices. They review each appeal individually, aiming for quick turnaround times and to provide taxpayers with fair judgment.

You receive an examination report with in-depth details after your tax audit, which includes assessments, penalties, interest and taxes. Taxpayers can initiate the appeal process if they disagree with any of these calculations by not signing the report and returning the copy. The appeal process that ensues involves:

It is essential to be proactive when you file a tax appeal and promptly respond to communication you receive from the IRS. If you plan to file a tax appeal, you must understand your rights, strategically present your case for fair resolution and follow the appeals process. With adequate proof to support your case, you may be able to get a fair resolution or tax reduction.

Many people see some reduction in outstanding taxes, interest and penalties with a tax appeal. Your likelihood of a successful appeal increases when you have the right information and professional help to support your case. However, if you are unsuccessful, you become liable for additional penalties and interest accrued during the appeals and hearing process.

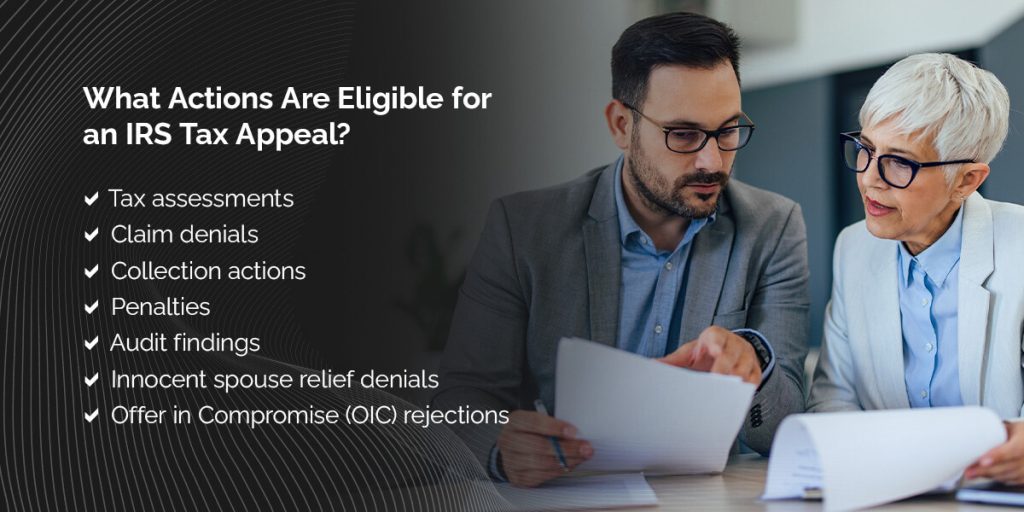

Consider filing a tax appeal when you need to dispute IRS decisions on denied claims, assessments or penalties. You may also have a valid dispute for:

Start by evaluating if you have a solid foundation for your disagreement. Look for calculation errors or other relevant evidence and start drafting your appeal.

While there are many cases where you are within your legal rights to appeal tax outcomes, there are also some restrictions. These ensure fair proceedings and clarify when to hold back on your appeal. For example, you cannot appeal if your IRS correspondence is a bill with no mention of appeals or if you failed to provide the necessary information to support your case during an audit. Additionally, the IRS will not consider appeals in cases where there is a recommendation for criminal prosecution or a tax-related offense.

You should also avoid an appeal process if your only concern is affording what you owe the IRS or state taxing entity — appealing is not an option. You can explore a few different options if you cannot pay your taxes or penalties.

Ensuring the action you want to file an appeal for is eligible involves understanding the IRS’ determinations and following procedures catering to each type of appeal. Getting professional advice or assistance before you start an appeal is a good idea to ensure compliance along the way. Actions eligible for an IRS tax appeal include:

The Collection Due Process (CDP) lets you challenge IRS collection actions. These actions include tax levies, liens and seizures. You have 30 days to request a CDP hearing. Otherwise, you must request a CDP Equivalent Hearing. Notices you may receive that allow you to request a CDP hearing include:

If you need to appeal a rejected OIC, complete Form 12711 to formally request the appeal within 30 days of receipt of the IRS’s rejection notice.

Your appeal process may look similar to this:

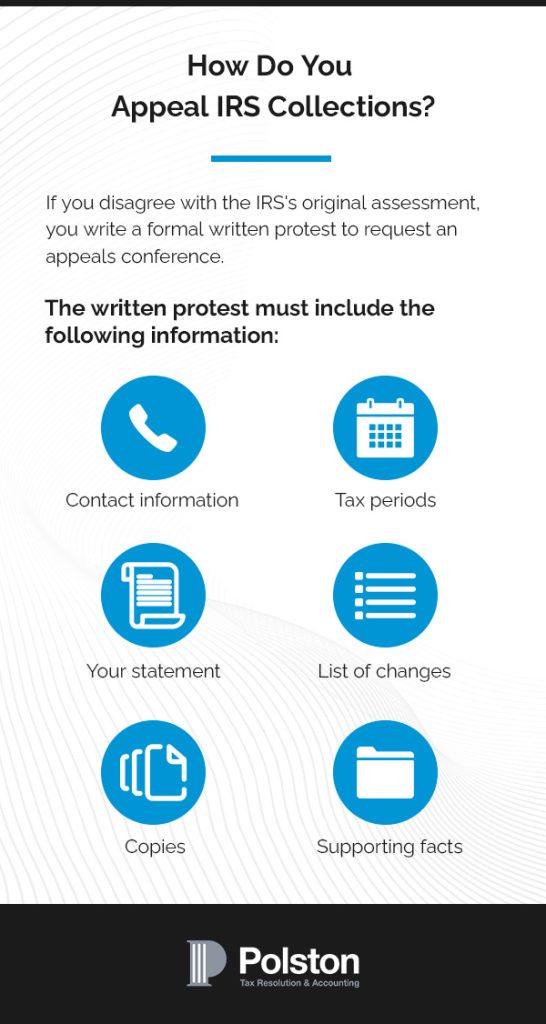

If you disagree with the IRS’s original assessment, you write a formal written protest to request an appeals conference. The written protest must include the following information:

Ensure you name the law or authority you are relying on during this appeal process. Finally, you must sign the written protest with the following disclaimer:

If your outstanding tax falls under $2,500, you can simply ask the auditor for an appeal. You may qualify for a small case protest procedure or other special appeal procedure for tax disputes, including penalties, that amount to no more than $25,000 and relieve you of any formal protest documentation. Still, keep those documents handy to support your case. If your balance exceeds $25,000, you must complete Form 12203 and make a verbal request. If you are unsure about this process at any point, consult with a tax attorney for support.

Should your case qualify for a tax appeal, an Office of Appeals employee objectively reviews the circumstances of your case. Note that if you fail to file the appeal within a specific time frame, the IRS will automatically deny your case. An IRS appeals conference is informal and done in person, via telephone or by correspondence, bypassing time-consuming court trials.

Your tax attorney will represent you at the hearing, whether in person or via telephone. They will propose adjustments and negotiate a settlement.

If the appeals officer agrees with the original assessment, you can consider challenging the IRS or state taxing entity in court. You will need to pay the tax in dispute and then file the necessary documentation in the U.S. District Court or the Court of Federal Claims for a refund. Should you be unable to pay, the U.S. Tax Court will have jurisdiction over your case.

Partnering with a tax attorney allows you to appeal your tax dispute effectively. While you will benefit the most from professional help in a high-stakes or complex case, you can benefit from their insight any time you need to dispute a tax return. They are knowledgeable in tax law and offer benefits like legal experience, increased chances of a successful appeal and strategic guidance for your case. Specific circumstances in which you will benefit from hiring a tax attorney include:

Additionally, tax attorneys can assist you with estate planning strategies, handling the paperwork and helping you lower your estate taxes. They are also vital in developing tax-related strategies when you are starting or expanding a business. Finally, they can help you appeal for installment payment plans or an OIC if you have an outstanding tax balance.

With objective, factual documentation and a reliable tax attorney at your side, you can file an IRS tax appeal. Navigating the intricacies of tax appeals can be challenging, but individuals and business owners must understand them. Getting professional advice and gathering the right support documentation to support your case will significantly strengthen your appeal.

At Polston Tax Resolution and Accounting, we have over 100 years of combined experience in tax matters. We offer you more than just a tax attorney. You get a team of tax professionals on your side. We help you meet all your tax needs to ensure you have full tax health for yourself, your family and your business. Contact Polston Tax today to learn more about our full-service tax and accounting team or to get access to a tax attorney for your IRS tax appeal.