Are you a cannabis business owner or an aspiring entrepreneur? The cannabis field is filled with exciting and innovative products and experiences. Getting loans to start or expand your company can be easier than you might think with our financial advice.

Cannabis financing enables businesses to cover the costs of running. These loans are a set of financial products that support the various functions of cannabis businesses, including equipment, inventory management and cultivation. They’re explicitly tailored to meet the industry’s needs.

Traditional financial institutions can offer loans to cannabis businesses, but it’s usually a challenging route. The stigma surrounding cannabis and legal hurdles can make it difficult for these companies to get assistance. Typically, the most popular options come from venture capitalists or private investors.

There are two main types of businesses in the cannabis industry — direct and indirect.

Indirect businesses, such as technology providers, don’t typically face the same stigma and financial challenges as those that work directly with the plant. However, direct establishments usually require financing to afford the services of indirect companies.

Here are the types of businesses at each stage of cannabis production and their typical funding requirements:

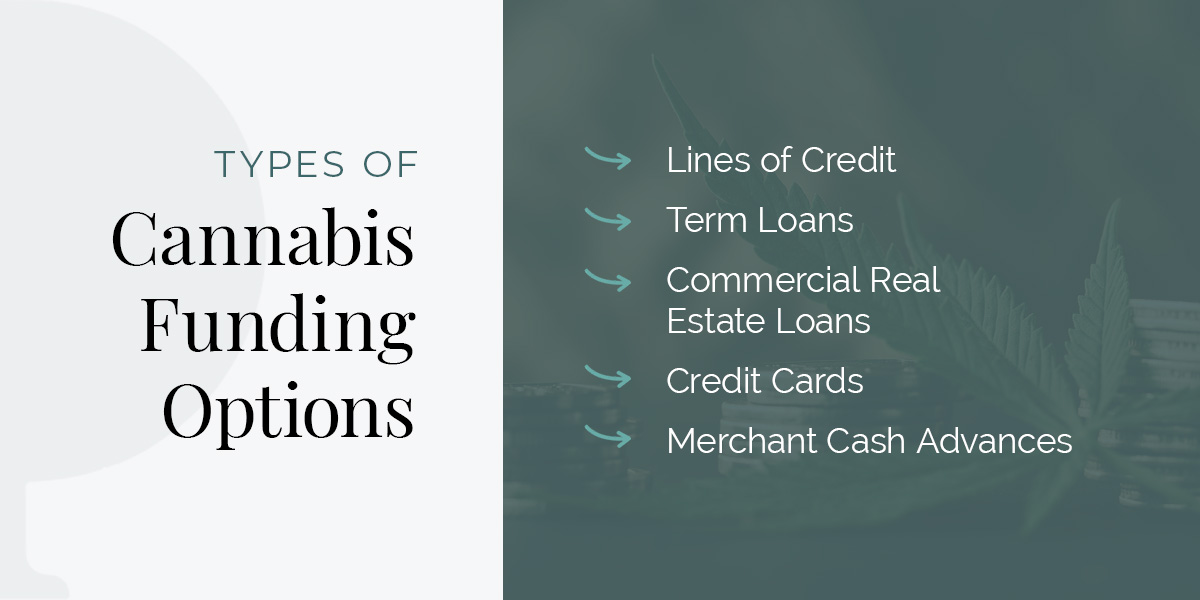

Many funding selections typically applicable to other establishments, like SBA loans, aren’t available for cannabis businesses. That doesn’t mean they don’t have great options, though. Here are some of the top types of cannabis funding choices that you can pick to meet your business needs:

A line of credit is a flexible source of funding that allows you to make strategic investments. You usually pay a small annual fee to access a specified amount. During the agreement with the financial institution, you can choose whether to borrow this amount.

It comes with an annual percentage rate (APR) usually adjusted according to current market conditions. You’ll only pay interest on the amount you borrow.

This funding option is excellent for businesses that want to be better prepared for potential emergencies or setbacks. You can use it as working capital, but you don’t have to. It allows you to use a line of credit without being obligated to do so.

Term loans are fixed-payment loans with fixed rates. They give you a lump sum of capital you can use to start or improve various aspects of your business. You’ll need to pay regular installments, which are usually monthly.

These loans can be unsecured or secured depending on the institution’s requirements. Interest rates will likely be lower with a secured loan, but rates tend to be higher in the cannabis industry. Companies often use term loans for specific investments like equipment upgrades or renovations. Ensure you have a plan to pay whatever amount you borrow. If it’s a secured loan, the lender will seize the collateral if you don’t pay it off.

Commercial real estate loans are ideal for cannabis businesses that need to acquire a property, typically for grow facilities. In most states, securing a location is a prerequisite for getting a cannabis license, so this loan may also be necessary for aspiring entrepreneurs.

As with a traditional residential mortgage, the property the borrower purchases is collateral for the loan. Interest rates are generally more favorable than many other types of hemp business loans, but real estate loans tend to have a longer approval process and include other steps like appraisal.

Using credit cards for cannabis transactions is tricky. Most large credit providers, like Mastercard and Visa, don’t allow cannabis-related purchases. However, if you’re a business owner, you can use the credit card for other payments, like store decor or non-cannabis equipment.

Credit cards are usually easy to apply for and attain if you have a good credit score. However, interest rates are high, so keep track of all your ongoing payments and ensure you have a plan to pay them back. This loan option works well for purchasing small non-cannabis-related items. Avoid using the full amount of credit, and pay it back quickly to reduce interest charges.

A merchant cash advance (MCA) is a type of financing used by small business owners to gain access to more capital. It’s also known as revenue-based funding. It’s commonly used as an advance against forthcoming accounts receivable.

Specialized alternative lenders provide this fast and easy short-term funding solution rather than traditional banks.

While many refer to MCAs as loans, they’re technically not. They give companies a lump sum of cash in exchange for a specified percentage of their future revenue.

To qualify for loans for your cannabis business, you’ll need to meet the following requirements:

Staying tax-compliant plays a huge role in qualifying for any cannabis business funding. At Polston Tax, we help you prepare your tax returns so you don’t have to worry about them. We can also solve your tax debts, state or IRS audits, and levies or liens.

When you hire us, you don’t just get an account. You get a team of qualified individuals, including a tax attorney, tax preparer, accountant and case manager, all working to get you the best tax resolution and deductions possible. Don’t hesitate to contact us for a free consultation, and get your business in a position that qualifies for funding.