Navigating the tax season can be complex, especially if it’s your first time. Apart from gathering the required documents, you must apply the right amount of credits and deductions to avoid underpaying taxes and incurring penalties. Additionally, the One Big Beautiful Bill Act (OBBBA), passed on July 4, 2025, made plenty of tax changes that impact your obligations. Preparing early can help you identify the best way to approach your taxes.

While the upcoming tax season requires 2025 tax rates, the Internal Revenue Service (IRS) also released the updated rates for the incoming tax year. This ultimate guide to the 2026 tax season details the notable changes you need to know.

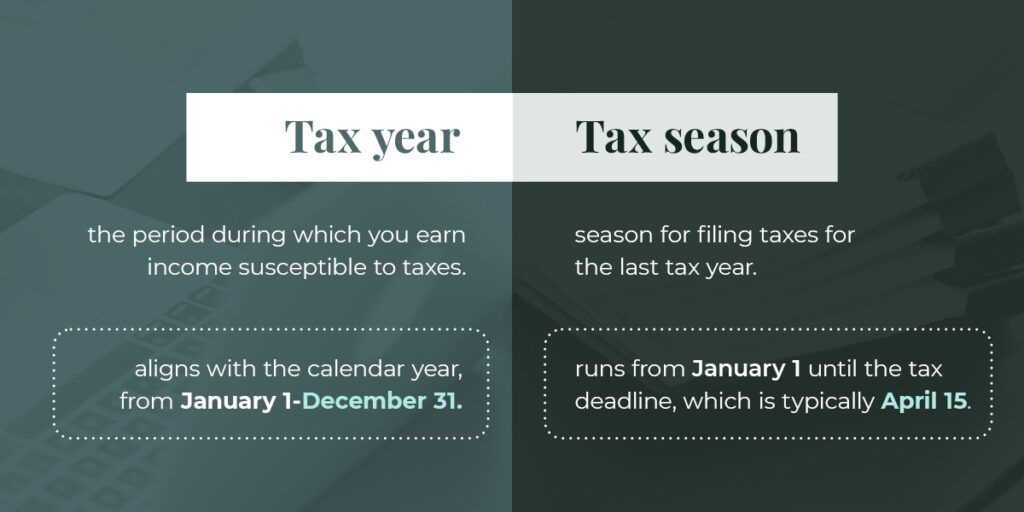

To accurately prepare your taxes, you must first understand the difference between tax year and tax season:

Your tax obligations are affected by a base tax plus the marginal tax rate amount. If your income falls into a specific bracket, only the income within that bracket is taxed at the specific rate. Here are the tax brackets for the income you’ve earned in 2025:

| Marginal Tax Rates | Single Tax Bracket | Married Filing Jointly | Head of Household | Married Filing Separately |

|---|---|---|---|---|

| 10% | $0-$11,925 | $0-$23,850 | $0-$17,000 | $0-$11,925 |

| 12% | $11,926-$48,475 | $23,851-$96,950 | $17,001-$64,850 | $11,926-$48,475 |

| 22% | $48,476-$103,350 | $96,951-$206,700 | $64,851-$103,350 | $48,476-$103,350 |

| 24% | $103,351-$197,300 | $206,701-$394,600 | $103,351-$197,300 | $103,351-$197,300 |

| 32% | $197,301-$250,525 | $394,601-$501,050 | $197,301-$250,500 | $197,301-$250,525 |

| 35% | $250,526-$626,350 | $501,051-$751,600 | $250,501-$626,350 | $250,526-$375,800 |

| 37% | Over $626,350 | Over $751,600 | Over $626,350 | Over $375,800 |

The base tax rates to add to the marginal tax rate amount include:

| Marginal Tax Rates | Single Tax Bracket | Married Filing Jointly | Head of Household | Married Filing Separately |

|---|---|---|---|---|

| 10% | $0 | $0 | $0 | $0 |

| 12% | $1,192.50 | $2,385.00 | $1,700.00 | $1,192.50 |

| 22% | $5,578.50 | $11,157.00 | $7,442.00 | $5,578.50 |

| 24% | $17,651.00 | $35,302.00 | $15,912.00 | $17,651.00 |

| 32% | $40,199.00 | $80,398.00 | $38,460.00 | $40,199.00 |

| 35% | $57,231.00 | $114,462.00 | $55,484.00 | $57,231.00 |

| 37% | $188,769.75 | $202,154.50 | $187,031.50 | $101,077.25 |

If you’re single and have earned $15,000, $11,925 of your income would be charged 10%, while $3,075 would be taxed at 12%. The resulting amount from the 12% tax rate would be added to $1,192.50.

Self-employed individuals need to look at the 1099 tax brackets to know their tax obligations. For 2025, the self-employment tax rate is 15.3%. This rate combines the 2.9% for Medicare and 12.4% Social Security. If your wages and tips total $176,100 or more, you don’t pay the 12.4% Social Security tax on the earnings above that amount.

If your compensation, wages or self-employment income exceeds certain thresholds, you must also pay an additional 0.9% Medicare tax on earnings over the threshold amount. Here are the thresholds:

| Filing Status | Threshold Amount |

|---|---|

| Single | $200,000 |

| Head of household | $200,000 |

| Married filing separately | $125,000 |

| Married filing jointly | $250,000 |

| Qualifying surviving spouse with a dependent child | $200,000 |

To prepare for the upcoming tax year, you should take note of the new tax bracket for 2026:

| Marginal Tax Rates | Single | Married Filing Jointly | Head of Household | Married Filing Separately |

|---|---|---|---|---|

| 10% | $0-$12,400 | $0-$24,800 | $0-$17,700 | $0-$12,400 |

| 12% | $12,401-$50,400 | $24,801-$100,800 | $17,701-$67,450 | $12,401-$50,400 |

| 22% | $50,401-$105,700 | $100,801-$211,400 | $67,451-$105,700 | $50,401-$105,700 |

| 24% | $105,701-$201,775 | $211,401-$403,550 | $105,701-$201,750 | $105,701-$201,775 |

| 32% | $201,776-$256,225 | $403,551-$512,450 | $201,751- $256,200 | $201,776-$256,225 |

| 35% | $256,226-$640,600 | $512,451-$768,700 | $256,201- $640,600 | $256,226-$384,350 |

| 37% | Over $640,600 | Over $768,700 | Over $640,600 | Over $384,350 |

The marginal tax rate amounts are added to the following:

| Marginal Tax Rates | Single | Married Filing Jointly | Head of Household | Married Filing Separately |

|---|---|---|---|---|

| 10% | $0 | $0 | $0 | $0 |

| 12% | $1,240.00 | $2,480.00 | $1,770.00 | $1,240.00 |

| 22% | $5,800.00 | $11,600.00 | $7,740.00 | $5,800.00 |

| 24% | $17,966.00 | $35,932.00 | $16,155.00 | $17,966.00 |

| 32% | $41,024.00 | $82,048.00 | $39,207.00 | $41,024.00 |

| 35% | $58,448.00 | $116,896.00 | $56,631.00 | $58,448.00 |

| 37% | $192,979.25 | $206,583.50 | $191,171.00 | $103,291.75 |

The self-employment tax rates for 2026 remain unchanged.

Tax deductions can lower your taxable income, while tax credits subtract dollar amounts from your tax bill. Notable deductions and credits for your 2025 income include:

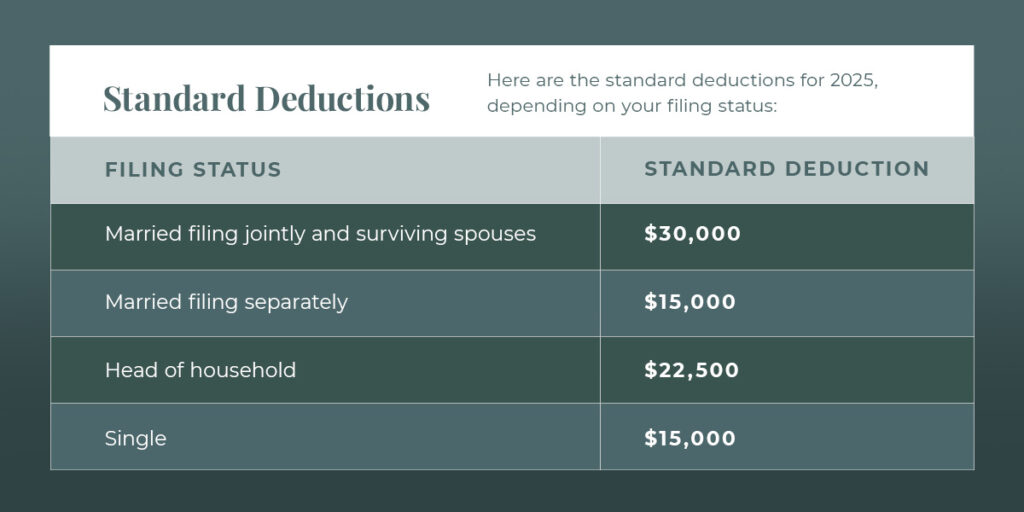

A standard deduction is a fixed amount you can subtract from your adjusted gross income to reduce your taxable income. Here are the standard deductions for 2025, depending on your filing status:

| Filing Status | Standard Deduction |

|---|---|

| Married filing jointly and surviving spouses | $30,000 |

| Married filing separately | $15,000 |

| Head of household | $22,500 |

| Single | $15,000 |

If you’re a dependent and have your own income, your standard deduction shouldn’t exceed the larger of $1,350 or $450 plus your earned income. With little to no income, you can still take a standard deduction of at least $1,350.

Additionally, if you’re age 65 or older, or if you are blind, you get an additional standard deduction, depending on your filing status:

An EITC is a refundable tax credit for low- to middle-income earners. It can help you offset taxes, depending on the number of children you have, your income, and your filing status. The credit phases out over a certain income threshold, and no credit is allowed above the completed phaseout amount. Here are the thresholds:

| Qualifying Children | Earned Income | Maximum Credit | Threshold Phaseout for Married Couples Filing Jointly | Completed Phaseout for Married Couples Filing Jointly | Threshold Phaseout for Other Filing Statuses | Completed Phaseout for Other Filing Statuses |

|---|---|---|---|---|---|---|

| One | $12,730 | $4,328 | $30,470 | $57,554 | $23,350 | $50,434 |

| Two | $17,880 | $7,152 | $30,470 | $64,430 | $23,350 | $57,310 |

| Three or more | $17,880 | $8,046 | $30,470 | $68,675 | $23,350 | $61,555 |

| None | $8,490 | $649 | $17,730 | $26,214 | $10,620 | $19,104 |

AMT ensures that taxpayers with high incomes pay a minimum tax amount, even with deductions or credits. Covered taxpayers must calculate taxes through the AMT and regular tax system, then pay whichever is higher. The exemption protects lower and middle-income earners from the AMT. Here are the thresholds for 2025:

| Filing Status | Exemption Amount | Excess Taxable Income | Threshold Phaseout | Complete Phaseout |

|---|---|---|---|---|

| Married filing jointly or surviving spouses | $137,000 | $239,100 | $1,252,700 | $1,800,700 |

| Single | $88,100 | $239,100 | $626,350 | $978,750 |

| Married filing separately | $68,500 | $119,550 | $626,350 | $900,350 |

Certain deductions and credits apply to businesses. The most notable ones for the 2026 tax season include:

Section 179 lets businesses deduct certain amounts for qualifying equipment purchases. In 2025, this amount can be up to $1,250,000, but decreases for purchases exceeding $3,130,000 during the tax year. Certain SUV purchases are also capped at $31,300.

Small business owners and self-employed individuals can deduct up to 20% of their QBI. Below a taxable income threshold, you can typically deduct the full 20%. Limitations start to apply within the threshold. Here are the QBI brackets for 2025:

| Filing Status | Threshold Amount | Phase-in Range |

|---|---|---|

| Married filing jointly | $394,600 | $494,600 |

| Married filing separately | $197,300 | $247,300 |

| Other filing statuses | $197,300 | $247,300 |

Energy-efficient commercial buildings in 2025 can claim a tax deduction, depending on the amount of energy they save. The deduction can range from $0.58-$1.16 per square foot, increasing by $0.02 for every percentage point of energy the structure saves above 25%.

Properties that meet additional requirements can get a higher deduction from $2.90-$5.81 per square foot, increasing by $0.12 for every percentage point of energy they save above 25%. The deduction ends for construction projects that will start past June 30, 2026.

The deadline for filing federal tax returns and paying taxes is April 15. If you request an extension, the last day for filing is October 15. Here’s how you can file your taxes accurately and smoothly:

The form you need depends on your income type:

| Form | Income Type |

|---|---|

| W-2 | Employee wages |

| 1099-B | Stock sales |

| 1099-DIV or 1099-INT | Dividends or earned interest over $10 |

| 1099-G | Unemployment benefits |

| 1099-K | Income from credit cards, prepaid cards, debit cards and third-party processors |

| 1099-MISC | Rental and miscellaneous income, except for self-employment income |

| 1099-NEC | Nonemployee compensation or self-employment income |

| 1099-R | IRA or retirement account distributions |

| 1099-SA | Health savings account distributions |

The most notable tax changes for the 2026 tax year include:

The standard deductions for 2026 were raised to the following, depending on your filing status:

| Filing Status | Standard Deduction |

|---|---|

| Married filing jointly | $32,200 |

| Married filing separately | $16,100 |

| Head of household | $24,150 |

| Single | $16,100 |

Deductions for dependents still cannot exceed the larger of $1,350 or $450 plus earned income. However, people who are blind or age 65 and older have an increased deduction of $1,650, which increases to $2,050 if unmarried and not a surviving spouse.

EITC for 2026 also gets updated rates, depending on your children, income and filing status:

| Qualifying Children | Earned Income | Maximum Credit | Threshold Phaseout for Married Couples Filing Jointly | Completed Phaseout for Married Couples Filing Jointly | Threshold Phaseout for Other Filing Statuses | Completed Phaseout for Other Filing Statuses |

|---|---|---|---|---|---|---|

| One | $13,020 | $4,427 | $31,160 | $58,863 | $23,890 | $51,593 |

| Two | $18,290 | $7,316 | $31,160 | $65,899 | $23,890 | $58,629 |

| Three or more | $18,290 | $8,231 | $31,160 | $70,244 | $23,890 | $62,974 |

| None | $8,680 | $664 | $18,140 | $26,820 | $10,860 | $19,540 |

AMT for tax year 2026 has also increased:

| Filing Status | Exemption Amount | Excess Taxable Income | Threshold Phaseout | Complete Phaseout |

|---|---|---|---|---|

| Married filing jointly | $140,200 | $244,500 | $1,000,000 | $1,280,400 |

| Single | $90,100 | $244,500 | $500,000 | $680,200 |

| Married filing separately | $70,100 | $122,250 | $500,000 | $640,200 |

Businesses can deduct larger amounts for qualified purchases in 2026 — up to $2,560,000. This deduction decreases for purchases more than $4,090,000 during the year. Certain SUVs are also capped at $32,000.

OBBBA amended QBI deductions, where self-employed individuals and business owners can now deduct at least $400 from their income, even if 20% of their QBI is less than the said amount. However, you need a minimum of $1,000 of QBI to qualify. These changes take effect after December 31, 2025. Here are the new thresholds:

| Filing Status | Threshold Amount | Phase-in Range |

|---|---|---|

| Married filing jointly | $403,500 | $553,500 |

| Married filing separately | $201,775 | $276,775 |

| Other filing statuses | $201,750 | $276,750 |

Before this deduction sunsets, businesses can get an increased standard deduction for reducing energy consumption in their properties. It starts at $0.59-$1.19 per square foot, increasing by $0.02 for every percentage point of energy they save above 25%. Certain properties can get $2.97 to $5.94 per square foot of deduction, increasing by $0.12 for every percentage point of energy they save above 25%.

This ultimate guide to the 2026 tax season details the important tax changes brought about by the OBBBA that impact your tax obligations for the coming years. Working with Polston Tax can make the entire process seamless compared to navigating the season on your own.

Since 2001, Polston Tax has been offering small businesses tax accounting and resolution services. We’ll help you determine which deductions, credits and exemptions apply to you, and identify potential tax strategies that can lower your tax obligations. To get started, contact us for a free consultation today.