If you’re a small business owner, you’ve probably heard about sales tax. Knowing how to collect, record and remit sales tax can be complicated, especially as your business grows. Keeping up with changing tax regulations can also be challenging. Paying sales tax for your small business is essential because failing to do so can result in fines and even jail time. This guide covers the basics of sales tax, how to stay compliant and what you can expect during an audit.

If you’re a small business owner, you’ve probably heard about sales tax. Knowing how to collect, record and remit sales tax can be complicated, especially as your business grows. Keeping up with changing tax regulations can also be challenging. Paying sales tax for your small business is essential because failing to do so can result in fines and even jail time. This guide covers the basics of sales tax, how to stay compliant and what you can expect during an audit.

Sales tax is a point of purchase tax that businesses charge customers who purchase certain goods or services within the borders of a taxing authority. This tax adds to the cost of the item or services and is included in the total price.

States and local municipalities govern sales tax, so the amount and type of sales tax varies from state to state. While buyers pay the tax, businesses are responsible for collecting and sending it to the correct government agency. Unless the item or service is specifically exempt, sales tax applies to cash transactions, credit sales, layaway sales, installment sales and sales that involve property exchanges and trade-ins.

If you own a small business, you must understand your tax obligations. When you set up your business, research to understand the taxes you must collect and pay the government. If you sell products in other states, it can get even more complex. Let’s look at how to do sales tax for a small business.

Start by determining whether sales tax applies to your state. Alaska, Montana, Delaware, Oregon and New Hampshire don’t have sales tax. However, local sales taxes in Alaska may impact your business. Instead of sales tax, Hawaii has a general excise tax (GET), which companies typically pass onto consumers. New Mexico has a gross receipts tax (GRT), which businesses also pass onto buyers, like sales tax.

Check if your products or services are exempt from sales tax. Your state may have a list of exempt products and services — for example, prescription drugs are exempt from sales tax in most states. As a business owner, you’re responsible for obtaining a valid certificate stating that specific goods or services you sell are eligible for tax exemption.

Some common taxable goods include:

Taxable services vary, but some of the most common services include:

You must determine the exact rate to add and whether it differs between products.

You’ll also need to consider if you have a sales tax nexus in another state. If your business has a presence or location in multiple states, you may have tax nexus. Sales tax nexus laws vary by state. Having a warehouse or employees in another state may result in having a nexus there.

Additionally, you will have an economic nexus for online sales if you earn above a sales threshold in a state you sell to. An economic nexus requires you to collect sales tax in that state.

Are you selling goods for resale? If a customer has a resale certificate, you don’t need to charge them sales tax.

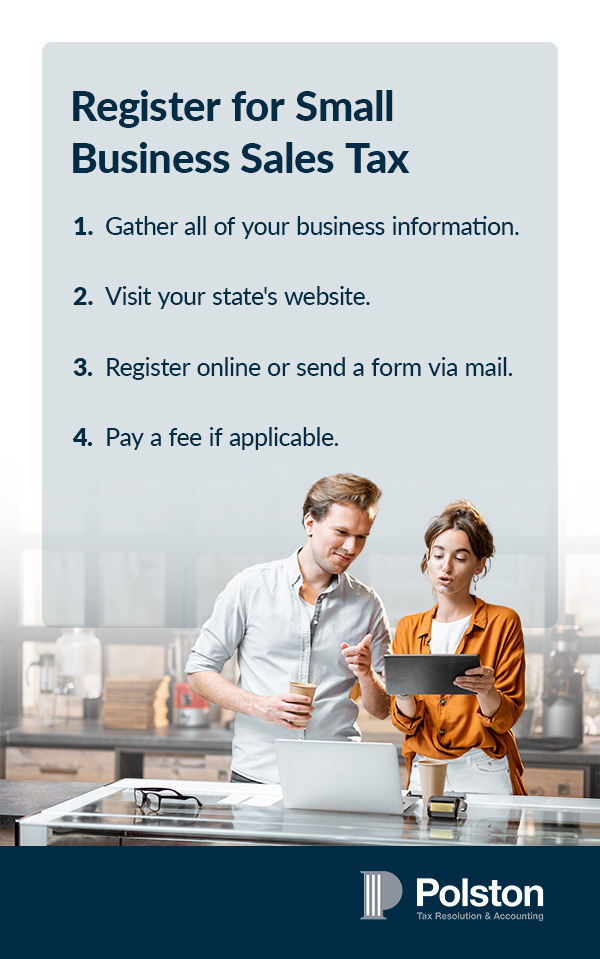

Before you can begin selling, you must register for a sales tax permit to legally collect tax from customers. Once you receive your sales tax permit, keep it safe because you’ll need it to remit and report sales tax to the state.

These are the steps you’ll need to follow to apply for your sales tax permit:

Before collecting sales tax, ensure you apply the correct rate to your goods or services. Each tax agency has its own rate. As a sales tax collector, you need to know what rate applies to your state or county. Remember to exclude exempt items, such as resale items.

Once you have your tax rates, you can include it in your prices. Multiply the price of the taxable item or service by the sales tax rate to determine how much sales tax you need to collect. Include the sales tax in a separate line on the receipt so your customers know what the extra charge is for.

After collecting sales tax from your customers, set it aside until it’s time to remit it to the applicable tax agency. Keeping a detailed record of the amount of tax that you owe the state can keep you from over or underpaying.

Using sales tax accounting, create a journal entry showing the total money you collect from a customer. This entry breaks down how much is for the sale and how much applies to sales tax. When you collect, you’ll record the journal entry as sales tax payable. Once you pay state sales tax, you can create an entry to show your sales tax as paid.

When it comes to paying your taxes, the process varies by state. Each tax agency has different rules for the following:

Due dates could be monthly, quarterly, semi-annually or annually. In many cases, how often you report and file sales tax depends on how long you have been running your business. The amount you collect can also determine the filing method you use.

Your state may still require you to file a return even if you didn’t collect any sales tax during a period. Failing to remit the sales tax you collect can result in a penalty of 1% to 30% of the tax you owe.

Collecting and reporting sales tax can be a complex process for business owners. These tips can help you develop a sound sales tax strategy and stay compliant with tax laws.

Many businesses make the mistake of assuming that what worked for them in the past will continue to work. This thinking often results in business penalties and fines. As your business grows, so will your tax obligations, making it more difficult to comply with tax rules. Some changes that may impact your tax obligations include:

By underestimating the complexity of sales tax, you can put your business at risk of a tax audit. To avoid compliance issues, assess whether your current system accurately addresses your sales tax obligations.

If your business has nexus in different states, you’ll need to ensure that the sales tax for each reflects the rules of each state. Review any changes on the taxability matrix for each state within which you do business to stay updated on regulation changes. You can also subscribe to the state’s “tax notice change” email list.

If your business has nexus in different states, you’ll need to ensure that the sales tax for each reflects the rules of each state. Review any changes on the taxability matrix for each state within which you do business to stay updated on regulation changes. You can also subscribe to the state’s “tax notice change” email list.

Linking exemption certificates to specific transactions can be challenging if your business manages many exempt products or services. Certificates also expire, resulting in you being liable for uncollected sales tax. To avoid these complexities, keep a clear audit trail for certifications. It’s also wise to stay updated on the exemption rules in each municipality or state you operate in and ensure you can present an exemption certificate summary report when needed.

Even businesses that do their best to collect and accurately record their sales tax fail to remit it correctly. Knowing where to file, what form to use and what to include in your returns can be complicated for business owners. Businesses that have nexus in different states need to keep track of deadlines, which forms to use in what state and the format requirements. Mishandling reporting can result in your business receiving a fine.

Review your filing schedule for each state and pay attention to changes. Find out if any states have implemented new e-filing or pre-payment requirements.

Sales tax holidays allow consumers to purchase goods and services sales tax-free. States specify which items or services are exempt on which days and for which consumers. These sales tax holidays occur randomly — ranging by the type of goods and services, time of year and over different periods. There’s also no consistency across states.

If you operate in states with sales tax holidays, you’ll need to track what products or services are exempt on which days.

Automation offers business many benefits — from inventory management to sales, it can give your business the flexibility, agility and efficiency it needs. The other option is to handle these processes manually, which can lead to errors in tax compliance. Automation can also help you leverage limited resources such as time and money without compromising productivity.

Identify your manual processes and consider which ones you can automate to lower costs and reduce your risk exposure.

Many companies try to collect, track, report and file their sales taxes on their own but face challenges in the process. Seeking a professional to manage your taxes can ensure you maximize deductions and file on time.

A sales tax audit occurs when a state agency suspects a business has understated its taxes. The audit is a means of determining whether you have collected and sent the correct amount of tax. An auditor reviews your financial documents to compare your sales revenue with the tax collections and checks the sales tax payable against the tax paid.

A sales tax audit occurs when a state agency suspects a business has understated its taxes. The audit is a means of determining whether you have collected and sent the correct amount of tax. An auditor reviews your financial documents to compare your sales revenue with the tax collections and checks the sales tax payable against the tax paid.

If your business has been selected for a tax audit, consider hiring a specialist who concentrates on local and state taxes. A specialist can help negotiate on your behalf with the tax agency and manage the auditor’s access to your business.

You’ll need to gather all of the documents necessary for the audit while also controlling the scope of information you provide to the auditor. Providing well-organized records that are easy to follow ensures a smooth process. The auditor will likely ask for additional documents throughout the process.

These additional strategies will ensure that the process runs smoothly:

Each state has a statute of limitations for a sales tax audit that specifies the period of transactions the auditor can look at. In most states, it’s three years from the return due date or the filing date — whichever comes later. The auditor can extend the statute of limitations if they believe the business understated its taxes by a certain percentage.

The statute of limitations won’t apply if your business commits fraud, tax evasion or gross negligence.

An auditor will review your financial records to uncover any non-compliance or fraud. Their goal is to increase the tax revenue for the municipality or state and impose penalties if your business owes taxes.

An auditor will perform the following duties:

The duration of the audit will depend on several factors, such as how big your company is and the complexity of the data.

If you have a small business, you likely have to register for sales tax. The regulations vary by state, so it’s essential to check what laws apply in your state and whether you need to apply sales tax to your products and services. Collecting, tracking and reporting your sales tax is complex, especially if you have nexus in other states. If you underpay your sales tax to the relevant agency, it can result in a sales tax audit, which can put pressure on your bottom line.

At Polston Tax, our sales tax representation services help guide and defend you throughout the tax audit process. Our professionals will take charge of your case and oversee it from beginning to end while negotiating the best outcome for your business. We’re here to help — contact us today or call Polston Tax at 844-841-9857.