Recent federal tax law changes from the One Big Beautiful Bill Act (OBBBA) impact state tax compliance for 2025 onwards. Some provisions automatically flow through state legislations, while other states need to update their conformance or decouple from the provision. How the new laws impact your tax obligations depends on your state. This article breaks down which states are adopting certain changes and what they mean for you.

The OBBBA, or the reconciliation bill, aims to reduce taxes, increase the statutory debt limit and update spending for federal programs. It made certain changes from the 2017 Tax Cut and Jobs Act (TCJA) permanent and added new tax rules for the short and long term. Some of the new tax laws take effect in 2025, which impacts tax filing in 2026. Most of the changes start in 2026, which impacts tax filing in 2027.

The most notable changes include:

Standard deduction changes at the federal level are:

| 2025 | |

|---|---|

| Single filing | $15,000 |

| Joint filing | $30,000 |

| Head of households | $22,500 |

The tax rate adjustments are:

Changes from the OBBBA affect state tax collection methods due to conformity with the Internal Revenue Code (IRC). Federal statutes and rulings are also more extensive than what states can produce, so states usually refer to the federal law for compliance requirements.

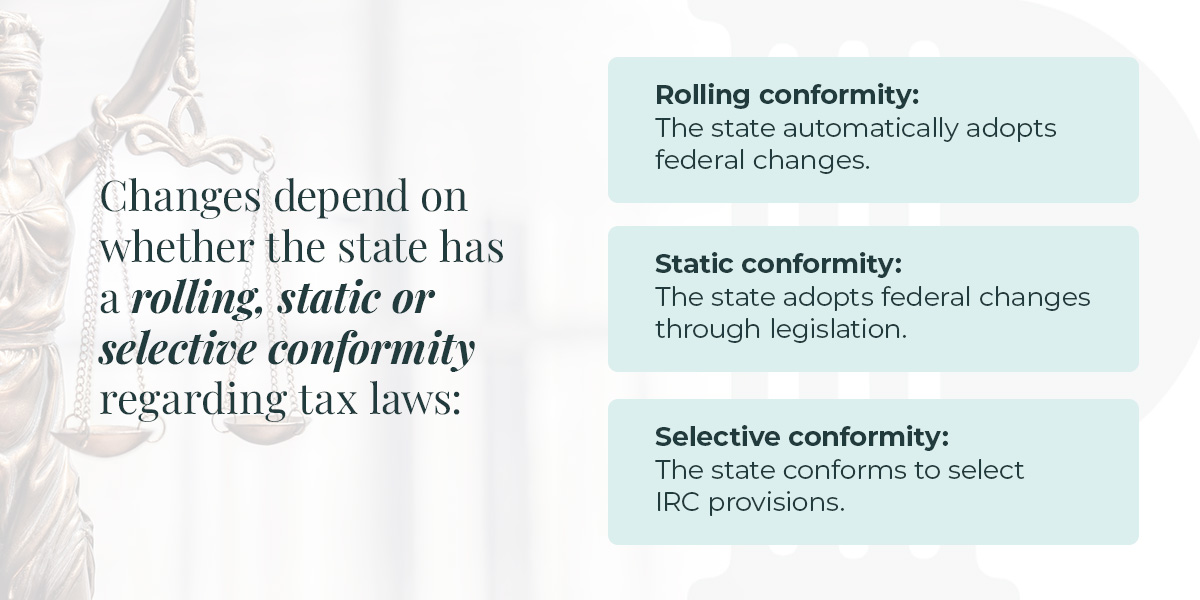

Additionally, federal tax code compliance reduces administrative burdens for each state. While states can decouple from federal provisions, they can also modify such provisions based on their specific situation. Changes depend on whether the state has a rolling, static or selective conformity regarding tax laws:

Some states don’t charge personal and corporate income tax.

Here’s how states comply with the federal law:

The most notable state-level tax enforcement changes include personal deductions and corporate tax changes.

Ten states and the District of Columbia conform to the federal standard deduction:

Additionally, most states use adjusted gross income (AGI) as a starting point when calculating individual income taxes, while others use the federal taxable income. States using the federal taxable income may apply the changes regarding personal and temporary deductions for qualified tips, overtime taxable income and car loan interest.

Some states may also increase their property tax deductions in line with the new state and local tax (SALT) deduction cap. Older adults also get an additional deduction to their previous standard deduction. Here’s what these changes mean for you:

Note that six states already have higher standard deductions for older adults and people who are blind. The new $6,000 deduction is a separate provision.

OBBBA brought multiple tax changes for businesses and corporations, most notably including:

At Polston Tax, we’ve been helping clients with their taxes since 2001. Whether you need to identify which deductions to make, resolve your unpaid taxes or improve your accounting processes, our experienced team can help you. Our team includes tax attorneys, case managers, accountants and tax preparers. We work with the IRS daily, so you can count on our myriad experiences to get you the optimal resolution for your needs.

OBBBA brings many changes that affect how states implement their tax laws. With advanced state audit trends on the rise, it’s even more essential that you remain compliant. If you’re experiencing difficulties with your unpaid taxes or need help with the complexities of the new tax laws, Polston Tax can work with you.

As a full-service tax and accounting firm, we can help you keep your personal and business taxes in shape while ensuring you don’t fall back into missing payments. Whether you’re looking to negotiate with the IRS, reduce penalties or opt for installment agreements, we can help. Schedule a free consultation today to get started.